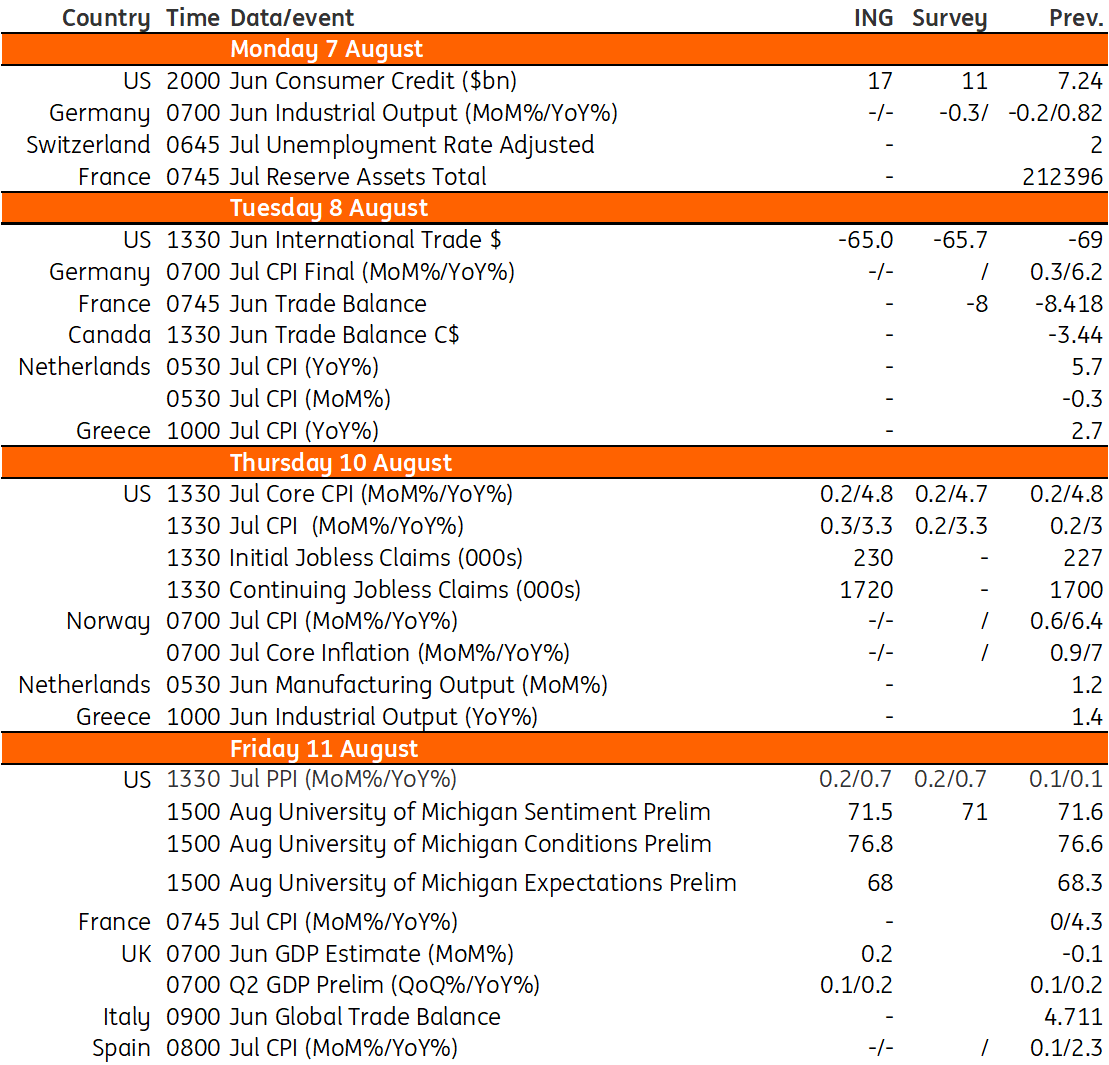

Key events in developed markets next week

All eyes will be on the US next week with inflation being the main theme as CPI and PPI are both released. In the UK, the economy appears to be stagnating with GDP set to show a modest increase in the second quarter

US: Inflation the main theme with CPI and PPI both released

Inflation is the main theme for next week with CPI and PPI both released in the US. Unfortunately, there is a little bit of upside risk for year-on-year figures after their recent slowdown, but this reflects falling energy costs last summer dropping out of the annual comparison. However, the Federal Reserve will be focused on the month-on-month readings which we are hopeful will come in at 0.2%MoM for headline and core for both CPI and PPI. This is what we need to see consistently to bring inflation back to the 2% target, and the Fed can take comfort that inflation pressures are softening, reducing the need for further interest rate increases.

The move higher in Treasury yields only adds to our conviction that the Fed won’t need to hike interest rates further. We are approaching 4.2% for the 10Y Treasury yield in the wake of the Fitch downgrade and the Treasury funding announcement, and it could go higher over the next week as the extra bond supply hits the market. This, coupled with the stronger dollar and rising market volatility, is tightening monetary conditions and will put up mortgage rates and corporate borrowing costs.

The Federal Reserve Senior Loan Officer Opinion survey shows a further tightening of lending conditions, which in combination with higher interest rates, will be toxic for bank lending. This is going to be a major headwind for economic activity – hence our view that recession risks cannot be ignored.

UK: GDP set to show modest increase in the second quarter

Last month’s GDP data showed that the King’s Coronation and the extra bank holiday did very little to change the monthly GDP reading, contrary to previous royal events that resulted in a temporary dip in activity. That means overall second-quarter GDP is likely to come in marginally positive, and confirms that the economy is more-or-less stagnant right now.

All of this is of limited consequence for the Bank of England, which has been very clear that it is looking at services inflation and wage growth and not a lot else. We are doubtful that either of these figures will have staged enough of a turnaround by September to enable the BoE to pause its hiking cycle at the next meeting. A rate hike is therefore the base case, but by November we think that services inflation in particular will have shown signs of improvement. We, therefore, suspect we’ll get one more hike, marking the top of the cycle.

Key events in developed markets next week

Download

Download article4 August 2023

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more