Industrial Metals Monthly: Uncertainty the watchword during LME Week

Our monthly report looks at the performance of iron ore, copper, aluminium and other industrial metals, as well as their outlook for the rest of the year

Bearish sentiment intensifies during LME Week

As LME Week, the metals industry’s biggest annual gathering, is coming to an end, bearish sentiment takes the lead as we look towards the final quarter of another turbulent year. A weak macroeconomic environment, geopolitical risks and a growing sense of uncertainty have dominated discussions this year. China’s economic slowdown, fears of a higher-for-longer interest rates environment, weak global manufacturing and looming supply surpluses amid rising LME inventories remain the key risks ahead.

China’s real estate worries deepen

China’s official gauge of manufacturing activity only just returned to growth for the first time in six months, at 50.2, in September. However, all things related to the property market continue to struggle. Stimulus measures introduced over the last couple of months are yet to have a meaningful impact on metals demand. Additional measures might be necessary to boost demand for industrial metals.

Renewed concerns over the fate of China Evergrande have surfaced following the detention of its chairman. And there are still questions looming over the economy’s largest developer, Country Garden, after it warned that it might not be able to meet repayments on offshore debt.

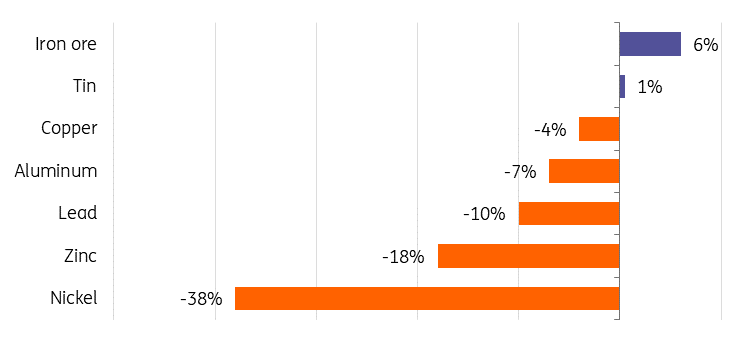

A slump in China’s property market has been a major headwind to metals demand this year, with the LMEX Index of six metals down around 10% this year. During Golden Week in early October, which is typically a prime time for property developers, home sales declined from last year.

A continued slowdown in China’s property sector remains the main threat to metals demand looking ahead.

LMEX Index has tumbled 10% since the start of 2023

We believe the short-term outlook remains bearish for metals demand and we do not foresee a substantial recovery before next year. Metals prices should continue to trade under pressure in the fourth quarter with the only upside risk being if Chinese demand recovers faster than anticipated. Prices are likely to remain volatile through the quarter as markets will continue to react to macro drivers.

China’s manufacturing sector slowly returns to expansion

US interest rates reaching peak

US consumer price inflation for September rose slightly faster than the consensus forecast, pushing the dollar and Treasury yields higher.

Meanwhile, US payrolls surged in September, underscoring the strength seen in economic activity over the summer backing the Fed's argument on the need for interest rates to stay higher for longer.

The market pricing around the possibility of a rate hike by December has increased marginally, but our US economist doubts it will happen. Fed officials have been emphasising the importance of the increase in Treasury yields as a factor that will tighten financial conditions and reduce the need for another rate hike.

Our US economist believes that monetary policy is restrictive enough and doesn’t think that the Fed will hike again.

Elevated rates have been a drag on industrial metals consumption. Looking forward to 2023 and further into 2024, the possibility of US Fed continuing to raise rates and other major economies continuing with monetary tightening, remains the key uncertainty for metals markets.

If US rates stay higher for longer, this would lead to a stronger US dollar and weaker investor sentiment, which in turn would translate to lower metals prices.

LME warehouse stocks pile up

Weak demand for industrial metals amid China’s slow economic recovery and a slowdown in manufacturing globally is translating into rising inventories in LME-registered warehouses, the market of last resort. However, they remain low by historical standards. We believe low inventories fuel the possibility for spot prices to rise rapidly if consumption picks up sooner than expected.

LME metals inventories (thousand tonnes)

For copper, global LME stocks now stand at 179,675 tonnes as of 11 October, up more than 100% from 88,550 tonnes at the start of 2023, and the highest it has been since October 2021. LME copper stocks have been rising for the past few months and have more than tripled since July.

For zinc, LME warehouse stocks have risen to 89,050 tonnes, up more than 190% from 30,475 tonnes in January. Zinc inventories reached their peak this year at the end of August at 153,975 tonnes.

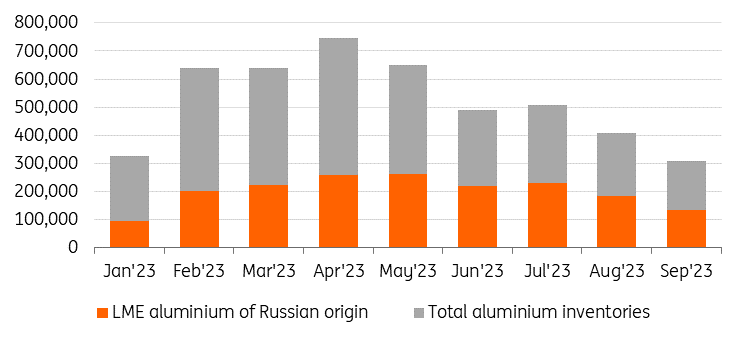

Aluminium stocks in LME warehouses have also been rising. They are currently at 492,650 tonnes, up 10% from 447,250 tonnes at the beginning of the year. And as LME inventories continue to rise, a lack of brand variety is adding to concerns for the aluminium market. About 76% of aluminium in the LME’s warehouses was of Russian origin at the end of September, up from less than 10% before the start of the war in Ukraine. This is the highest level for at least a decade. However, the share of the Russian metal declined from 81% at the end of August. India is the other major source of LME aluminium stocks.

| 76% |

share of Russian aluminium in LME sheds |

There are no sanctions on buying Russian material but some European buyers have been self-sanctioning since Russia’s invasion on Ukraine, leading to fears that LME warehouses could be used as a dumping ground for unwanted Russian metals, leading to a disconnect between LME and actual traded prices.

Russian metal continues to dominate LME stocks

Meanwhile, spot metals prices on the LME have been trading at a big discount to futures – a market condition known as contango, indicating that supply is exceeding demand in the spot market.

For aluminium, that discount is the biggest since 2008, while copper’s contango is the widest in over two decades, which could indicate more material is on the way to LME warehouses.

ING forecasts

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more