Hong Kong: Is proximity to China still an advantage?

Hong Kong has benefited from its geographical proximity to Mainland China for a long time, but that's no longer the case for all sectors. Asset-related sectors continue to leverage this advantage a lot better than tourism and the re-export sectors

Fourth quarter growth should improve, but expect it to come down in 2018

Fourth quarter GDP figures will be released tomorrow (28th March), and we are still looking for growth of the Hong Kong economy albeit slightly slower from the 3.6% year-on-year in the third quarter and the overall 3.8% in 2017.

Better growth could come from consumption and investment in private and public construction. However, we believe growth will continue to slow to 3.5% in 2018 and also in the future due to changes in the economic and financial relationship with Mainland China.

Economic structure in Hong Kong is changing

Re-export and tourism sectors no longer benefiting from proximity to China

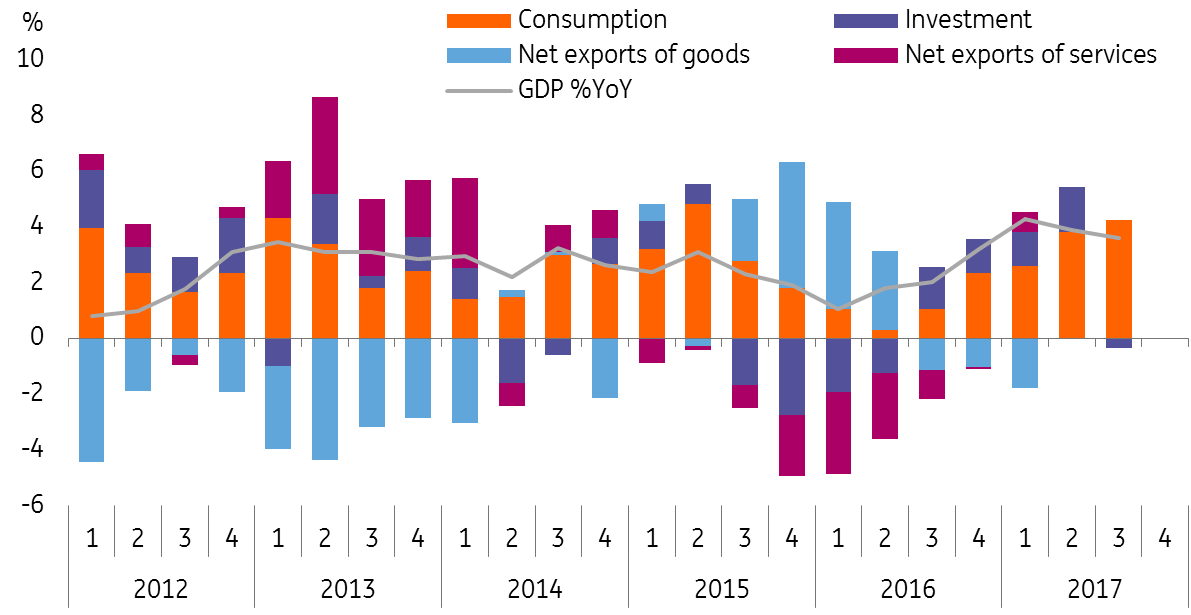

Hong Kong's GDP components show us that so far, consumption has been the key contributor in 2017. This is very different from the past when net exports of goods played an important role, just as much as consumption. When net exports of goods began to decline in 2016, the economy placed its hope on the net export of services, which was largely tourism.

But 3Q17 told a mere consumption story for Hong Kong, which makes us question if Hong Kong is still leveraging its geographical proximity advantage with Mainland China.

In the past, Hong Kong offered port services to Mainland as Hong Kong is a free port, and located right next to it. But, as the Mainland has developed its own port with better facilities, this means Hong Kong is losing its advantage as a re-export centre for Mainland China.

Tourism is another sector Hong Kong has been pinning its hopes to - as in the past it has been responsible for pushing up retail shop rentals among the world's highest. This has also changed as Mainland tourists prefer long haul travel for their long holidays, and Hong Kong has become a short break location.

The retail sector has felt the change with short-haul tourists usually spending less, and that reflects in the small contribution of net export of services in Hong Kong GDP.

Investment has been moved by private constructions

Property and financial sectors benefit from China money

The way that Hong Kong taps China's opportunities become increasingly involved in China's "going-out" money. For example, Chinese corporates' offshore headquarters are likely to be located in Hong Kong, which has pushed up office prices in the past two years.

Sure, Mainland investors are also interested in Hong Kong's residential properties, which has led to an average of 14% increase in home price in 2017. Moreover, the Hang Seng Index increased 35.99% in 2017, and all of these have led to higher asset prices in Hong Kong in 2017.

Hibor has been reluctant to follow Libor even under the HKD linked exchange rate system

The case of ample liquidity in Hong Kong

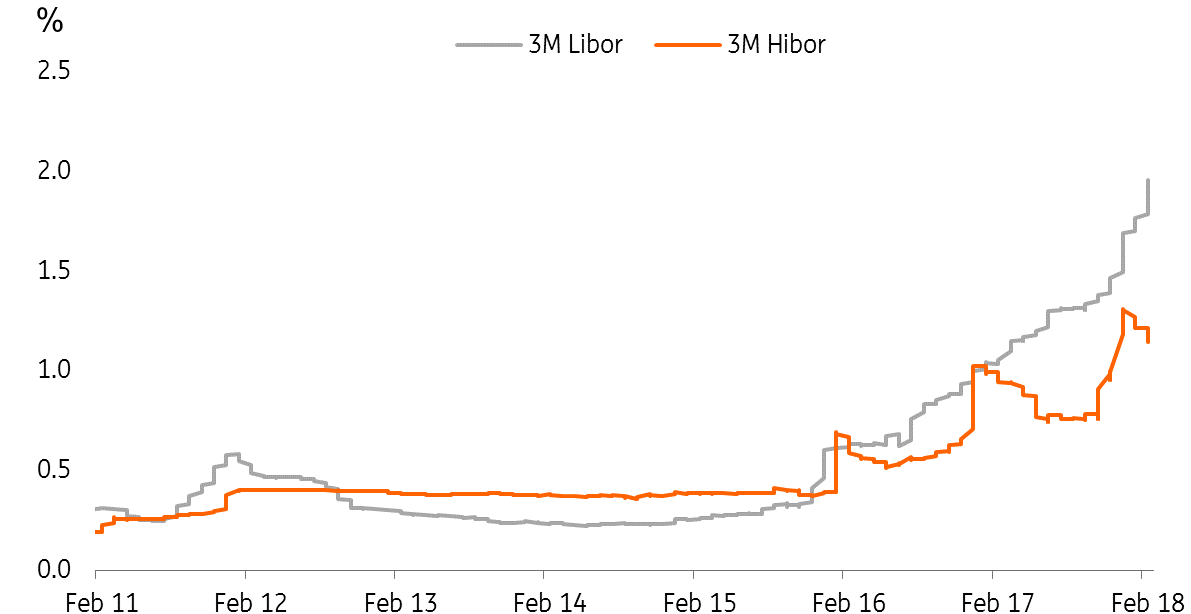

Part of the reason that Hong Kong's short-term interest rates (Hibor) have not followed Libor is that Hong Kong has too much liquidity. It's not difficult to understand that the money comes from Mainland China as cross-border businesses between the two have continued to increase.

We continue to believe that the abundant liquidity position will not change in 2018, and therefore Hibor would only follow Libor temporarily when the Fed raises interest rates. We are likely to see Hibor fall between each Fed's rate hike.

And before USD/HKD touches the upper bound of 7.85, HKD will continue to be weak as the HKMA would buy HKD when it touches 7.85.

What could change in 2018?

Our baseline scenario remains that the current ample liquidity in Hong Kong will continue in 2018.

The risk of tighter liquidity in Hong Kong could come from increasing regulations about money leaving China, but the risk is not high. As the yuan continues to strengthen, there will be more money inflow into China; this will give room for capital outflows as Chinese regulators need not worry about the risk of capital flee.

Download

Download article

28 February 2018

Good MornING Asia - 28 February 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).