Rates in 2021: Far from risk free

This is it! The final year for Libor, at least for the US, the UK and some others. Euribor continues, but the rest need to get ready for 'risk-free' rates. The transition will be helped by flat central bank rates, but expect volatility in longer dates. The bias will be steeper and higher for market rates, assuming the Covid-19 threat diminishes

A yield of at least 1% on the US 10yr should be a structural thing for 2021

The recent vaccine moment vindicates a move of the US 10yr to 1%, where it has a so-called 1-handle. It's a key level, as it brings us back to the notion of describing yield in percentage rates rather than in basis points. It is also foreign territory to the 10yr German rate at -50bp. Deviating from that is something to be strived towards. While negative rates have served the purpose of providing ultra-low financing conditions, they are also not a desired outcome.

We see 2021 as a year in which the spread between the German and the US 10yr widens back towards 175bp. And this is important for eurozone yields, as higher US yields can help to pull eurozone ones up too; which is a good thing as higher yields usually mean better things in terms of underlying macro circumstances. We don't see this as being a consequence of more supply. That might come. But for now the dominant pull on market yields is a reflationary 2021.

We'll see this in the shape of the curve too; it should steepen. Watch the US curve here more than the eurozone one, as the latter has a strange front end that can go as deeply negative as it likes it seems, bringing long end rates with it. The US curve is more anchored at zero. When it stretches steeper, it means something. Our target is for it to be in the 100-125bp range as a theme for 2021, with the 10yr trading between 1% to 1.25%. The German 10yr likely stays in -50bp territory, but at least is shown the way by the US, especially if the US manages a break above 1.25%.

A picture of reflation, a mini reflation so far, but better than the deflation discounted in mid-2019

Why is Libor so low and where is it heading to in 2021

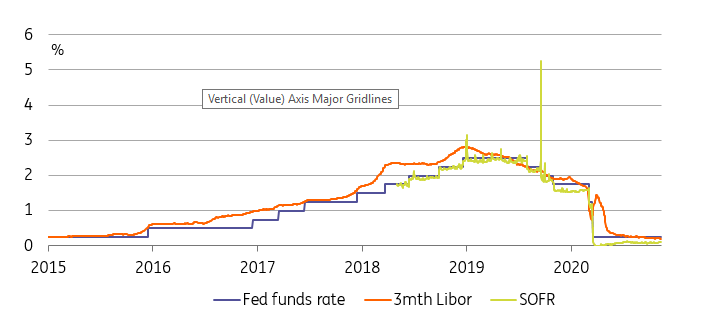

Libor will live out its final days in market centres through 2021, but it is strutting through 2020 with quite a bit of attitude. One of the issues with Libor is the implied bank risk that it contains, which proved exceptionally volatile during crises (most notably through the great financial one). But as we head towards the end of the year, Libor is on the floor. USD Libor at 20bp is some 5bp below the Fed funds ceiling. There's not much-implied bank credit risk there.

The likelihood in 2021 is that this changes. We think that USD Libor should be some 10bp higher than it is currently, and we'd assert similar for Ibors in most other centres. For example, remarkably, 3mth Euribor is currently flat to the ultra-safe ECB's deposit rate. While this can be rationalised on account of advantageous bank funding conditions, it still looks anomalous.

So while central banks may not do an awful lot in 2021 in terms of policy changes, we would expect to see Ibor rates drift higher from current levels. An ancillary rationale here centres on the likelihood that risk attributed to banks and the system ratchet higher again, especially as default risk gets re-elevated. The end of Covid-19 is clearly positive, but it also means the Band-Aids come off, in many cases, leaving ghastly unhealed wounds that will result in numerous uncomfortable shutdown stories, even as economies begin to structurally rebound.

Why risk free rates are the future, and what to expect in 2021

Actually, there is no such thing as a risk-free rate. All rates have risk. The transition here is from Libor, which contains a bank credit risk, to overnight rates that minimise both credit and counterparty risk. The transition must happen in 2021, as there (likely) will be no, for example, USD Libor in 2022. Initial resistance to change has morphed to inertia, as players await first movers. And there has not been huge movement so far, to say the least. One Federal Reserve spokesperson likened the process to herding cats; very apt.

Down in the dumps, but at least steady for transition

Still today the vast majority of derivatives trades are set with reference to Libor, and not to the new replacement 'risk-free' rates. Many are awaiting a build-up in volumes before switching. We expect to see a material build in such volumes through 2Q 2021, and we view it as being a simultaneous process, as volume in all product builds at the same time. This is vital. Such a build in volumes would allow for derivatives referencing risk-free rates to begin to dominate Libor. While not a flick of a switch, we do feel that transition to the use of the new rates can be swift, happening over a matter of weeks.

That, in turn, would facilitate the mapping out of term rates in the USD risk-free rate in particular e.g. a 3mth rates rate in advance (and not in arrears). A decent rump of players in the loans market globally is calling for this as a must-have. We expect term rates to be in place by early 3Q 2021, and this is a critical call for a smooth transition. The other issue is how to deal with the legacy Libor product and especially loans. Here, bi-lateral conversations will have to be had, effectively on suitable spreads that translate from Libor to risk-free rates. There are traded market spreads that can help as a reference, but they move. Not easy. Also not easy as Libor is so low now that the market spread is below average, which makes the discussion that bit more complicated.

And we have not even touched on different methodologies to be used in derivative versus loans. It's really very messy; get ready for it as best you can.

Download

Download article17 November 2020

Global Macro Outlook 2021: The darkness before the dawn This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more