Asia in 2021: Ascendant

Fiscal and monetary policymakers have ripped up the rule book in Asia this year to battle the pandemic, but the strength of the recovery in 2021 will depend on how much Asian central banks push the boundaries in terms of unorthodox monetary policies, the nature of fiscal support rather than just the amount and the momentum for the semiconductor industry

Three main themes for Asia in 2021

Three issues most likely to dominate the outlook for Asia in 2021, excluding China are:

- The development of the semiconductor cycle

- The effectiveness of Covid-19 support measures

- Central banks drift towards unorthodox monetary policies

Semiconductor upcycle

Recent export and industrial production releases around the region have shown recovery from the depths of the pandemic. But the recovery has been uneven. Most industries are still struggling. The big exception to this is semiconductors and select electronic components.

This is of especial importance to the region’s semiconductor giants - South Korea and Taiwan. But there are few countries in Asia that are not tightly linked into the semi-conductors cycle. Increasingly Vietnam, Thailand and Malaysia have been taking market share from China in this sector, attracting new inward foreign direct investment as well as some relocations from China. Indonesia and India are the two least affected economies and will likely miss out on any upturn.

Gains of electronics market share from China

While the momentum for the semiconductor industry is currently strong, this is a notoriously fickle sector, prone to overinvestment and excess capacity, price plunges as well as gains. With relations between the US and China over technology hanging in the balance, backing a continued technology upswing is not without risks.

On the other hand, China’s push towards “new infra” and roll out of 5G could well provide a multi-year push for the sector, which would provide all of Asia with a considerable boost.

Effectiveness of fiscal support

The outlook for 2021 will be heavily tempered by how the pandemic evolves, possibility of a vaccine and potential return to more normal work and leisure practices.

But the difference between solid recoveries for some, and tepid and erratic recoveries for others, might be the scale and effectiveness of fiscal support measures put in place in 2020. All countries in Asia have provided considerable fiscal support measures, though there has been a considerable exaggeration of the scale of support in many instances, making a reliable comparison impossible.

What 2021 will show, is the effectiveness of these efforts in three important areas:

- Protecting the business sector, and maintaining the productive capacity of the economy

- Providing the same support/insurance, for the labour force

- Longer-term reform measures undertaken in some economies

While there is probably some overlap between the amounts set aside for fiscal spending and the strength of the recovery in 2021, the nature of that spending may well prove as important as the amounts.

Unorthodox central bank policies in Asia

As well as ripping up the rule books on fiscal policy during the crisis, monetary policy has also come under assault from central banks running out of traditional support tools.

The assumption has always been that emerging market economies would not be “allowed” negative real interest rates, and if so then certainly not quantitative easing and definitely not direct deficit financing.

But while fiscal policy easing has been less constrained during the pandemic, emerging market economies have still had to pay heed to the mood of rating agencies, and that has meant preserving some vestige of fiscal respectability, some have been pushed towards more monetary easing.

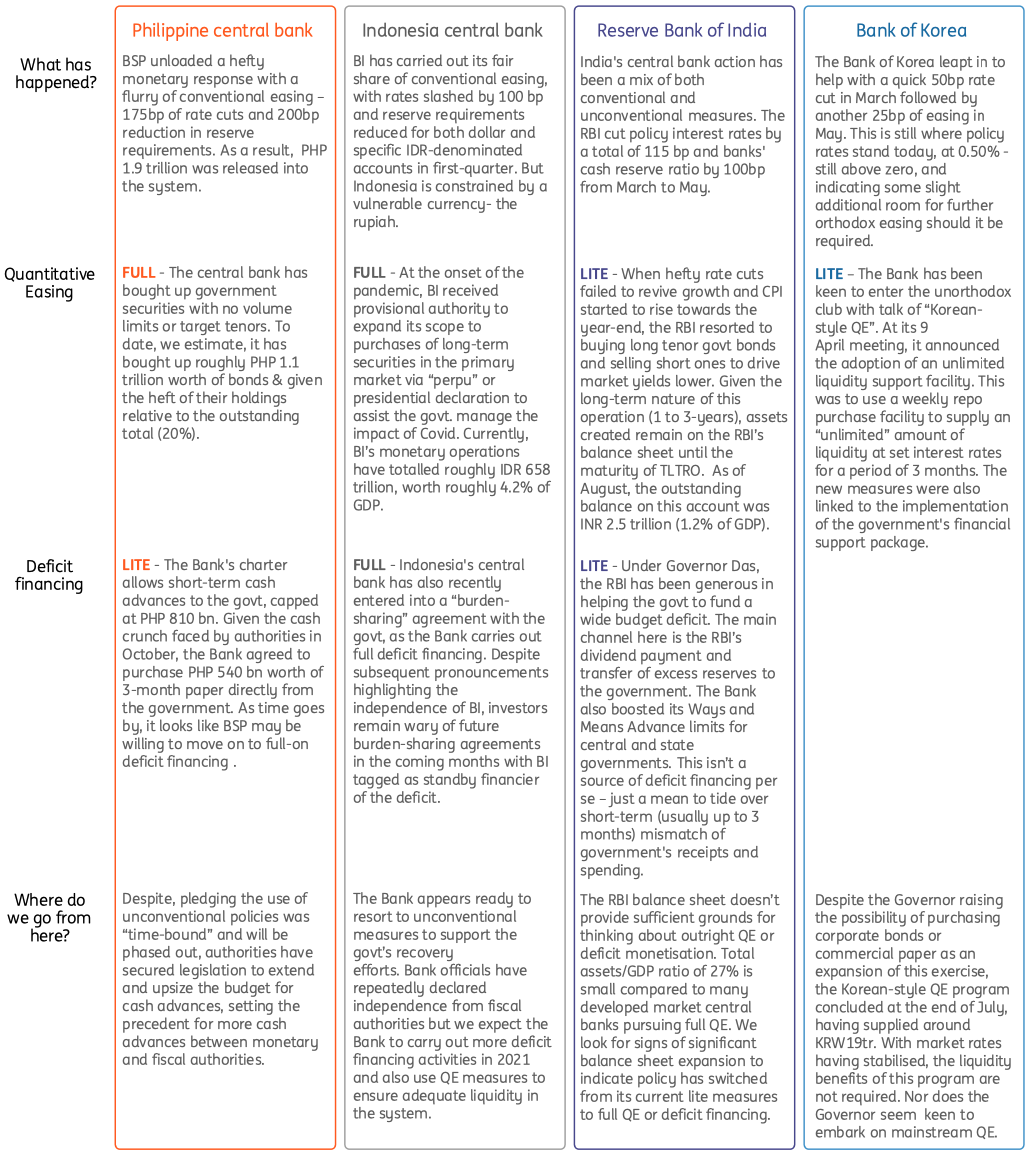

Asian central banks' conventional and unconventional policy easing during Covid-19 crisis

With negative real rates seemingly posing few problems, some governments have been emboldened to supplement their fiscal constraints with more imaginative monetary support – namely thinly-veiled direct deficit financing, or quasi-quantitative easing.

A number of economies have dabbled in this area, including South Korea, with their “Korean style” QE, and the Philippines, with some outright bond purchases in secondary markets. But perhaps most blatantly of all, Indonesia's central bank, is engaged in small-scale (currently) direct primary market financing “burden-sharing”, and the independence of the Bank is also being watered down.

Asia Pacific – unorthodox policy by country

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 November 2020

Good MornING Asia - 18 November 2020 This bundle contains 5 Articles