FX: too soon for Plaza 2.0

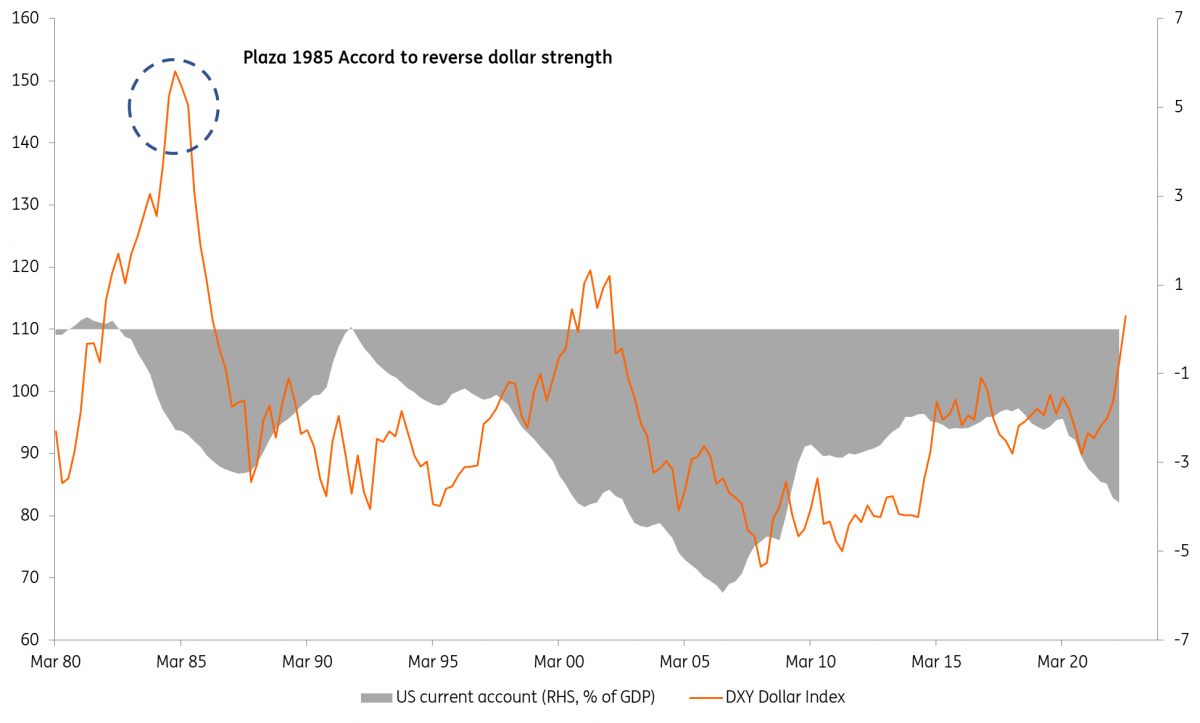

Volatility has picked up sharply in FX markets as the strong dollar pressure tests financial market vulnerabilities around the world. Some are saying that policymakers need to produce a new Plaza agreement to deliver an orderly reversal of the dollar. Until the Fed feels its work in fighting inflation is done, don't bet on a Plaza 2.0

FX Volatility back to its March 2020 highs

Driven by the wild swings in debt and rates markets, FX volatility is back to its March 2020 highs. At the heart of the story remains the strong dollar and how trading partners are reacting. Japan has already started its first FX intervention campaign since 1998 in support of the yen. Around US$20bn has been sold so far and this looks part of what could be a multi-month, if not multi-quarter campaign to fight USD/JPY strength. Chinese authorities may well be selling dollars above CNY7.20 as well.

Arguably the collapse in GBP/USD could be partly blamed on tight US financial conditions caused by the strong dollar, even if UK authorities lit the fire for sterling’s drop. This is leading some commentators to argue in favour of another Plaza agreement. This was a 1985 deal agreed by G5 nations (in the Plaza hotel in New York) for an orderly reversal in the dollar. Focus could build on the next release of a G20 Communique on 12 October.

We think it is too early for a Plaza 2.0 agreement – largely because the Fed is still sounding so hawkish. The success of the 1985 Plaza agreement was very much driven by consistent monetary policy considerations. At the time, coordinated FX intervention to sell dollars was backed up by a Fed prepared to cut rates (the policy rate was halved from 1984-1986) and the Bank of Japan to hike.

Arguably today the BoJ is a little more likely to hike than the Fed to cut – but both still seem distant prospects. Indeed, we continue to think it dangerous to try picking a top in the dollar as the Fed continues to tighten the screws and take US real rates further into positive territory. Not until the Fed is prepared to declare its work done – most forcefully through a dovish adjustment in its Dot Plots – should we be thinking about a top in the dollar. We suspect that is a story for March, if not June 2023.

What does this mean for EUR/USD? Three quarters of negative growth in the eurozone into 2Q23 and a still hawkish Fed is a bearish cocktail for EUR/USD. This pair is not particularly cheap and a pick-up in gas prices this winter will keep the eurozone trade balance under pressure. This could see EUR/USD falling towards the lower end of a 0.90-0.95 range over the next three to six months before a potential turnaround in 2Q23 if the Fed is more dovish and both the US and the eurozone exit recession.

Q: Are we ready for another Plaza Accord? A: Not yet

Sterling to remain challenged

The UK’s government experiment with unfunded tax cuts ended poorly in the form of emergency bond market intervention from the Bank of England and a fiscal policy U-turn. Making the budget numbers add up will remain a challenge for the UK government this autumn and winter. That probably means a risk premium should stay in the pound, which will already be vulnerable to a difficult external environment.

Failure by policymakers to win over a sceptical gilt market with the late November budget update could easily see sterling sink back to the lows – especially against the strong dollar. And as we have discussed recently, do not expect emergency BoE rate hikes or FX intervention in support of the pound. UK authorities tried that in 1992 and it did not end well either.

Tags

FXDownload

Download article6 October 2022

ING’s October Monthly: bracing for a tough winter This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more