FX markets: It seems like the euro is always stuck in second gear

Recovery trades in the FX market have been slowed by the pincer movement of a delayed European recovery on the one hand and by early Fed tightening expectations on the other. We still think there is scope for EUR/USD to recover later this year, but the window of opportunity is closing

Europe’s slow roll-out weighs on the EUR

While the ECB may be delighted that the trade-weighted euro is now down 2.5% from its highs at the start of the year, it will be less happy about the reason for that decline. Undoubtedly the soft euro has been driven by a re-assessment of eurozone growth prospects as leaders struggle to control the Covid-19 crisis.

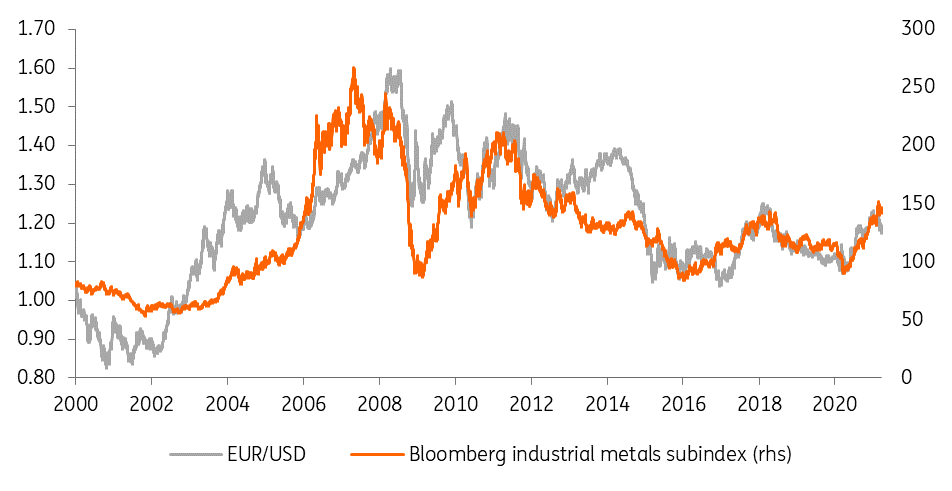

The fact that Europe will be contributing less to the global recovery in 2021 has also taken its toll on commodity prices, where reflationary trends have stalled in March. Industrial metal and oil prices are roughly 5-8% off their February highs. Yet the global demand story is expected to hold up – the eurozone recovery is delayed, not derailed after all – and should keep commodities bid and the dollar offered as we move through 2Q.

We are cutting our EUR/USD forecast

While the first quarter of this year was never going to be the break-out quarter for the euro-dollar rally, events in Europe suggest EUR/USD gains will be harder to come by this year. Accordingly, we are cutting our 2Q21 EUR/USD forecast to 1.22 from 1.25 and now doubt that the 1.30 level will be seen later this year.

Let’s not forget, however, that the Fed’s experiment with deeply negative real rates and what aggressive US fiscal policy means for the nation’s twin deficits will continue to be the dollar’s Achilles heel. Also, FX positioning is now much better balanced than the heavily short dollar positions witnessed at the start of the year.

EUR/USD versus Industrial Metals: The rally is not over

Commodity currencies continue to be favoured

Commodity currencies have held up quite well this year despite the recent correction in commodity prices. Driving some of that out-performance is the understanding that the positive income shock of the terms of trade gains enjoyed by these countries over recent quarters bring local central banks closer to exiting emergency measures of support.

In the G10 space, the Bank of Canada is already one of the first central banks to slow asset purchases and may even announce plans to shrink its balance sheet in late April. And Norges Bank may be raising interest rates as early as 4Q21. These central banks should therefore be most tolerant of currency strength. The Canadian Dollar should also benefit from the strong pick-up in US domestic demand as the year progresses.

What would trigger a u-turn on our bearish dollar view?

Doubts are certainly emerging in the minds of investors about the underlying path for the dollar. We would change our bearish dollar view if the Fed decides that policy is just too loose and allowed expectations to build that Fed tightening would be a matter for 2022, not 2023 as currently priced.

A flip to bearish flattening from bearish steepening of the US yield curve as the Fed moved to withdraw the punchbowl of cheap liquidity would likely see the dollar rally. Neither of these is our forecast for 2021.

Tags

FXDownload

Download article

1 April 2021

April Economic Update: Bigger things than the Suez ship are still firmly stuck in the mud This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more