FX: Bounce back

Early year tension in the Middle East has failed to dampen bullish sentiment in FX markets. Assuming no severe escalation, pro-risk currencies should continue to make modest gains and the dollar should stay supported against the euro and Japanese yen

Energy dependencies exposed

Global equity markets rallied over 10% in the fourth quarter as investors welcomed the US-China trade truce and the pre-emptive easing put in place by both the Federal Reserve and the European Central Bank. Away from the gyrations of the British pound, the currencies that benefited the most were generally those of economies most open to trade (EUR under-performed here) and the commodity producers.

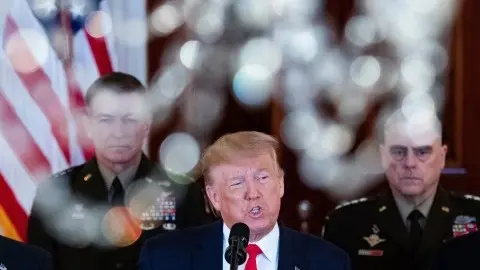

Events in the Middle East have served to undermine some of the confidence in the recovery and saw those pro-risk currencies hand back gains. Currencies hanging onto their gains have been the net oil exporters, especially the likes of the Colombian peso, Russian rouble and Mexican peso in the emerging market space.

FX performance against the dollar since equities started rallying in Oct 2019, oil exporters hold gains

FX markets and oil prices

Tension in the Middle East has naturally focused attention on oil shocks and the FX markets. In theory, terms of trade and positive income shocks should benefit the oil exporters at the expense of the importers. Below we highlight the net oil balance as a percentage of GDP for G20 countries.

Academic literature on the impact of oil shocks on the FX markets is quite mixed but of the published papers we do like a 2012 ECB paper, which concludes that oil demand, rather than supply shocks are bigger drivers of the FX market. A bullish re-assessment of global demand helped commodity producers late last year and unless we see a significant setback to the global growth view this year, we expect commodity currencies to stay well supported.

For EUR/USD, there is no correlation with energy prices. However, we do suspect that an oil supply shock would be slightly EUR/USD negative on the basis of i) the US having superior energy dependence to the eurozone and ii) the pass-through of higher oil prices into CPI is twice as powerful in the US as it is in Germany, perhaps keeping short-end USD money market rates supported.

Oil balances as % of GDP (2018 data)

Equities will play an increasing role in FX

After healthy gains in 2019, we expect equity markets to play an increasingly important role in determining FX rates this year. Corrections in the MSCI World Index were very mild in 2019 (not exceeding 6%) and one has to look back to late 2018 for a 10%+ correction.

Surveys showing that fund managers are finally underweight cash suggest equity markets may be exposed to larger corrections this year. FX markets show a clear spectrum of positive and negative betas on changes in global equity prices and investors should probably add a little more yen and Swiss franc to portfolios this year. As we discussed last year, the euro’s emerging role as a funding currency means that the EUR/USD is now starting to show a negative beta to changes in the equity market.

FX betas to daily changes in the MSCI World Equity Index

Election year

It is probably a little early to be saying this, but it seems that a simple narrative is emerging where good US data is seen as good news for President Trump’s election campaign and also seen as good news for the dollar. The recent narrowing in the November 2019 monthly US trade deficit is a case in point. On that subject, the market may start to take note of the race for the Democratic nomination – perhaps into Super Tuesday in March – with a special interest in whether Elizabeth Warren or Bernie Sanders are selected, as these candidates are seen as negative for the dollar should they make it to the White House.

In terms of dollar performance in a US Presidential election year, the chart below looks at the last eight cycles. It is a bit messy, but there are certainly no big dollar bear trends there and it seems that the dollar, compared to the start of the election year, only ended marginally lower on election day in two of the eight cycles. That ties in with our view of the DXY this year, looking for a modest 2-3% decline rather than anything more severe. Please see a more detailed discussion on this subject in our 2020 FX Outlook.

In practice, this means that both EUR/USD and USD/JPY will be confined to relatively narrow ranges of 1.10-1.15 and 105-110, respectively. The jury remains out on sterling this year, but we suspect volatility levels will be a little lower, and GBP can end the year a little higher, if Prime Minister Boris Johnson can secure some kind of trade agreement before the transition period ends in December 2020.

How does the dollar perform in a US election year?

Download

Download article

10 January 2020

January Economic Update: Turbulent twenties This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more