EU Summit – Market preview: The “bumps” are in the price

The bar for positive market impacts of the EU Summit this weekend is not too high, as there is little hope for a quick agreement among investors. If our base case – progress towards a compromise, but more time needed – materialises, we could see EUR/USD push towards 1.15, and the 10Y BTP-Bund spread pressure the 160bp level

Our base case: Some progress, but more time needed

As discussed in detail in our economics team’s note: “EU summit preview: Is the impossible within reach?”, several different scenarios appear on the cards ahead of the EU Summit starting tomorrow.

Pressures from the so-called “Frugal Four” (Austria, Denmark, Netherlands and Sweden) around the size of the fund, disbursement process, conditionality and the grants/loans mix appears to have taken the original Franco-German proposal off the table. Still, intense bilateral talks and the mediation efforts of German Chancellor Merkel have helped create some room for compromise.

Our economics team thinks that such compromise may consist in something close to a €600bn 50/50 loans/grants fund, with annual reviews to determine the loans/grants mix depending on compliance with some conditions.

Still, with many sticky points (and not only those raised by the “Frugal Four”) still to be addressed, we do not see an agreement being reached as the base case ahead of this EU summit. Instead, we expect some progress towards a compromise being made, but some time for more negotiations is still required. This should allow a consolidation of the notion that the EU Recovery Fund will eventually come into existence – without having to be materially resized first. We therefore deem less likely that the negotiations will break up.

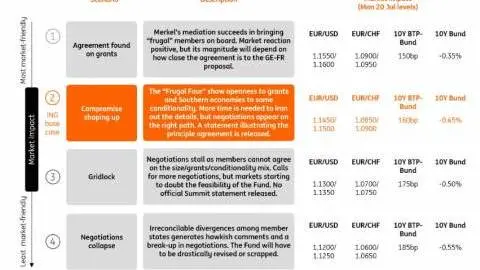

Four scenarios for FX and rates

The chart below shows four different outcomes of the EU Council meeting, ranked from most to least market-friendly. On the right-hand side are displayed our estimations for the levels of EUR, Bunds and BTPs as markets re-open on Monday. We discuss our views on FX and rates in detail in the sections below.

EUR: The bar for a surprise is not too high

EUR/USD is currently trading around the 1.14 level, not far from its 2020-highs. While the pair has been benefiting from hopes surrounding the EU Recovery Fund, its rally has largely been a function of a generalized USD weakness as risk sentiment has improved. In fact, we are of the view that the EUR is not pricing in a quick and seamless agreement on the Fund, nor that its final shape will be the one proposed by the European Commission (nor of the French-German proposal).

The resilience of EUR to a number of pessimistic comments – from the “Frugal Four” in the past couple of months and from Hungary (for instance) more recently – could be a case in point. While some optimism around the eventual realization of the Fund appears there, EUR seems to be fully pricing in the “bumps” of the negotiations.

In light of this, we expect that there is still room for the EUR to benefit from progress being made at the EU Summit this weekend, and the prospect of more negotiations should not scare EUR bulls. After all, the main factor driving EUR/USD higher in the coming months remains a weak-dollar environment. The simple notion that progress is being made on the EU Recovery Fund should be enough to maintain a benign environment for the common currency, which could unlock more upside in the pair.

Barring negative events hitting global sentiment next weekend, we could see EUR/USD push to the upper-half of the 1.14/1.15 range on Monday if our base case (scenario 2 above) materialises. EUR/CHF could make a decisive leap into the 1.08 region, also helped by a shrinking BPT-Bund spread, as we discuss in the rates section below.

Rates: Cash is king

We view the EU Recovery Fund as acting on interest rates markets through two channels. The most straightforward one is the net monetary benefit (disbursement minus contribution, or net contribution) for each member state. In the absence of any certainty about either the size, allocation, timing, or nature (loans vs grants) of the disbursements, it is hard to reach a definitive conclusion.

The European Commission’s proposal does offer an illustrative guide of the allocation key between member states however. Since the funds will in all likelihood be approved in the first three years of the Multiannual Financial Framework (MFF), we compared this net contribution to member states’ GDP and to their 2019-21 net borrowing.

There are a lot of caveats to this analysis. Firstly, we should stress here that the EC proposal is probably a best case scenario in terms of size. It is also likely that disbursements will be spread over the whole MFF, so 7 years, rather than just 3 years. Finally, the financial benefit of loans is mitigated by the fact that these need to be repaid out of a member state’s budget in subsequent years.

Greece and Portugal debt issuance could shrink

On both measures, the beneficiaries are the same: Greece (net benefit of 17.8% of GDP, and of 279% of 2019-21 net borrowing needs) and Portugal (9.5%, 121%) top the list. The upshot for both countries is that, taken as such, the EC proposal would cover a significant portion of their financing needs in the coming years. Depending on how the states choose to use the funds, for additional spending or as a replacement for market funding, this could imply a sharp drop in debt issuance for both sovereigns.

EU recovery fund net benefit vs GDP and vs net borrowing needs

The second group of beneficiaries, Spain (6.6%, 36%) and Italy (3.2%, 18%) could also see a reduction of borrowing needs in financial markets. The magnitude and timing being uncertain, we expect their sovereign debt markets will find it hard to see this as a game-changer, however. This is particularly true as we are comparing the net benefit with deficits. In countries like Italy, gross borrowing needs, to refinance maturing debt, far exceeds deficits.

A symbolic gesture

The second way an agreement could impact the rates markets is as a signal that more financial integration in the Eurozone is back on the agenda. In three out of the four scenarios we identified above, the agreement of an EU Recovery Fund is a matter of when rather than if, so we see that signal as a high likelihood event.

As we have shown above, the EU Recovery Fund should only be a complete backstop for the finances of small peripheral economies. For larger ones, it is more of a token of good faith. It remains that an agreement would be a milestone in the long-term process of financial integration.

Eurozone breakup risk premium in Bund has already reduced

In our view, some of the benefits of the EU Recovery Fund, namely a reduction in the Eurozone break-up risk, has already been priced in EUR rates markets. One prime example is the fact that Bund yields have failed to revisit their March lows despite the ECB adding to its QE programme in June. For comparison, US Treasury and Gilt yields have remained at or close to their all-time lows.

The upshot: tighter peripheral spreads

The case for a strong market reaction in peripheral debt is clearer to us. If heavy Italian or Spanish debt issuance will continue in the coming years, we think the combined impact of ECB purchases in the near term, and EU financial support in the medium term, amounts to a license for investors to buy peripheral bonds.

Room for tightening: Eurozone sovereign spreads

In case of a swift agreement, we could see the 10Y Italy-German spread reaching our 150bp target this summer. In the event of a more protracted process, this target would likely only be reached towards the end of the year. In both cases, the carry benefit of peripheral debt, and lower prospective volatility thanks to the ECB intervention, make it a superior alternative to core bonds, in our view.

Download

Download article

17 July 2020

Covid-19: Europe to the rescue this weekend? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more