EU summit preview: Is the impossible within reach?

EU leaders are edging closer to a deal on a recovery fund. A lot is still at stake at the coming EU summit, but a deal does seem to be within reach

The lines between European capitals are very busy these days. In the run up to the European Summit on Friday and Saturday, several bilateral meetings between the key players have received media attention. However, very little has actually been said after these meetings.

Angela Merkel seems highly determined to bring the European Recovery Fund to life

In our view, probably the most important news of recent days and meetings is that Angela Merkel seems highly determined to bring the European Recovery Fund to life. She leaves very little doubt that this time around she really wants to do serious business and put her (and Germany’s) entire political weight behind it.

Admittedly, there are still many open issues and some observers have cast doubt about the feasibility of any deal at all. We remain more optimistic. European leaders have come already a long way on some very sensitive issues. The fact that there now is broad agreement about support for the worst-hit countries in the crisis and that there should be European borrowing from the market is already an enormous game-changer. It was only in October last year that plans for a eurozone budget had been negotiated down to a meagre €17 billion fund for competitiveness and convergence as part of the multiannual budget 2021-2027. This weekend, there is a fighting chance that an agreement will be reached on an EU recovery fund that holds many multiples of that.

Don’t forget that European leaders never hammer out any single detail of a deal. For this weekend, a political agreement on the basic principles of a European Recovery Fund is still feasible, although the final stamp of approval may need another round of negotiating as it will involve lots of horse-trading, including the negotiations on the European budget. A deal now would be huge, but any sign of further progress on the remaining contested issues would also still be positive.

What are the make-it or break-it points on the table this weekend?

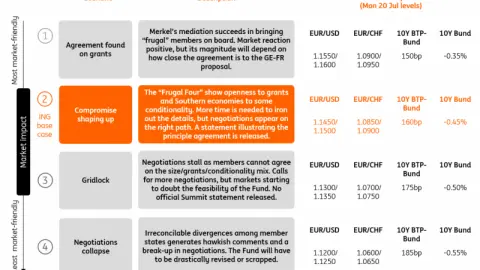

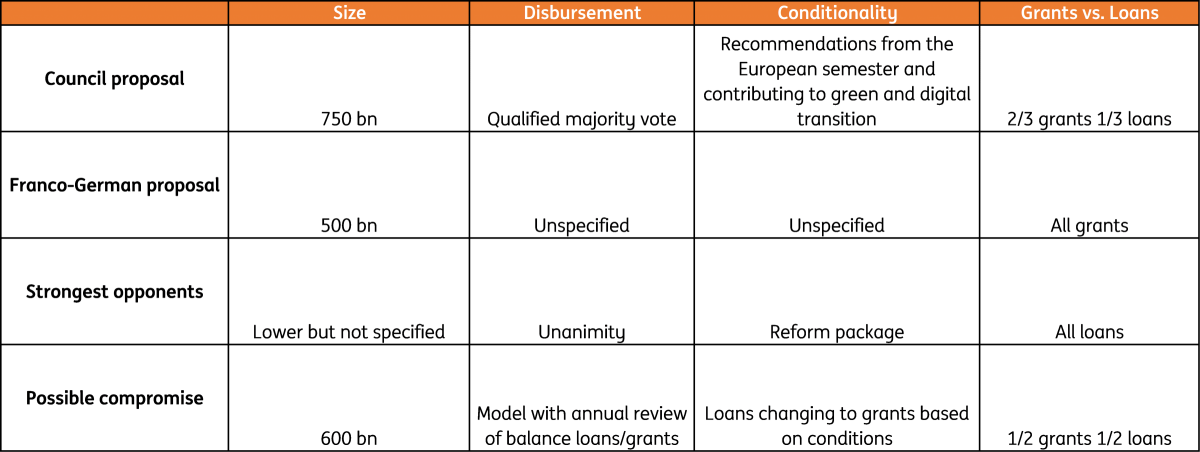

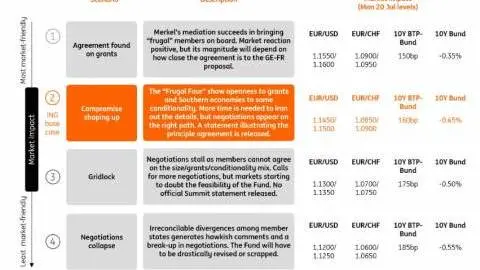

The European Commission plan for a €750bn recovery fund has been amended somewhat by the European Council, but overall the proposal that is now up for negotiation is roughly similar to the Commission plan. As is well-known at this point: the main opponents of the plan are Netherlands, Denmark, Sweden and Austria (Frugal Four) who are in general cautious on burden sharing. At the same time, remember that the initial French-German proposal foresaw a €500bn fund of grants only. Judging from the rounds of top-level tête-à-têtes this week, the main issues on the table now are size, conditionality, grants versus loans and control over disbursement.

• Size: the main opponents want the fund to be smaller than what is currently on the table. No amount was specified in the counter-proposal of the Frugal Four, but they do consider the €750bn amount unfounded. France and Germany had presented a 500bn euro fund, which would be exclusively grants. A possible compromise could be around €600bn with a mix of grants and loans.

• Disbursement process: According to the European Council’s proposal, each disbursement should require a qualified majority vote. The European Commission had proposed a qualified majority vote to block disbursements, while the Frugal Four would like to see unanimity. Probably included in the ratio for unanimity is the proposal of national parliament approvals. However, this does not seem to stand a serious chance at the moment. It is hard to find middle ground here and this could be given to the Frugal Four as a sweetener.

• Conditionality: This may be the most difficult nut to crack at the moment, although there are several possible compromises with regards to conditionality. The current proposal of the council suggests an assessment of the plans according to consistency with the country-specific recommendations of the European semester, digital and green transition and economic potential and job creation. The opponents would like to see reform plans tied to the disbursement along the lines of the troika workings during the euro crisis. A possible compromise could be a model where the disbursement of the fund starts with grants to maintain the speed of disbursement and annual reviews would determine the mix between grants and loans based on reform conditions. Another possible compromise would be a model where disbursements from the fund start as loans but are turned into grants if conditions are met.

• Grants versus loans: This has been an ongoing discussion since the start. In the counter proposal by the Frugal Four, only loans were mentioned as the opposition to grants is large and Dutch PM Rutte has indicated that grants are a possibility under strict conditions. This is clearly a balance which provides wiggle room for a compromise. However, Angela Merkel this week said that a significant change would not make sense. In our view, this could be negotiated down to a fifty-fifty mix. At a size of €600bn, this would still allow for a sizable amount of grants.

What would constitute success at the summit?

The above does look like a lot of work is still to be done over the weekend with a lot of possible outcomes still imaginable. If an agreement on basic principles of a deal is found though, it is hard to imagine one that wouldn’t be considered a historical success. It would mark a new step in terms of burden-sharing with the purest form of Eurobonds seen so far. Only if the size of the fund would be minimised this could be seen as disappointing, but would after some time still be perceived as a new step in terms of European integration.

Financial markets have responded positively in the run-up to a possible agreement

That would be received very positively by financial markets, which have already responded positively in the run-up to a possible agreement. In terms of real economic impact, the devil would be in the details, but the proposals floating now would generate significant stimulus in some of the countries most vulnerable to a longer economic slump.

If no deal is reached at the summit, this is not necessarily a disappointment. It is well possible that more negotiations are needed over the summer, so this does not necessarily mean that a deal is out of reach. Signs of concern would be a postponed decision to a new summit at a later date without a statement on progress. That would suggest that there is much more to be done, especially if no new date is immediately put forward. This lowers the chances of an ambitious result and could make deadlines for the multi-annual budget more challenging.

A possible compromise in our view could include a graduation of grants and loans, starting with grants in the first year and then have an annual review of and for the right balance between grants and loans. As stated above, any kind of political deal this weekend would be seen as a success. However, Angela Merkel’s comments this week that settling for a deal could take until the end of the summer was a clear warning against too much optimism.

Download

Download article

17 July 2020

Covid-19: Europe to the rescue this weekend? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more