Energy Outlook 2023: European utilities are resilient but not immune to crises

European utilities will continue to be driven by opposing forces in 2023. The recent financial distress of a few strongly dependent on Russian gas supply is concerning. Nevertheless, the reality is that most fared very well this year and will continue to do so in the next

European utility sector operating profits set to rise again

2021 was marked by a number of bankruptcies among European electricity and gas providers, all of whom had different business and earnings models. The victims were primarily pure energy resellers with low capitalisation and they didn't have the necessary cash to acquire power and gas volumes at high prices on the wholesale markets. 2022 saw far fewer bankruptcies in the sector. Despite a complex operating environment, the European utilities sector recorded strong revenues and operating profit growth.

For the full year 2023, the sector is expected to record an average operating profit (EBITDA) growth of 6%, a performance relatively in line with 2022.

| 6% |

Average EBITDA growth expected for the European utility sector in 2023 |

Supported by past investments, higher power prices and inflation-linked remuneration on grids, the European utility sector is set to post another EBITDA growth in 2023. At a sector level, we forecast a 6% EBITDA increase in 2023.

- Integrated utilities

At a sub-segment level, for integrated utilities (operating grids and power plants) the growth should approach 7%. While price caps and taxes on windfall profits could mildly impact the results of some European utilities, integrated utilities should again benefit from their geographically diverse exposure to regions such as Latin America and the United States where the current energy crisis has been less severe.

Large investment programmes will also continue to spur future cash flow generation due to asset expansion. And the data published by utilities communicating their power price hedging strategies show that the electricity volumes they will deliver in 2023 have been sold at higher prices than those locked in 2021 by an average of 25%.

- Network utilities

For pure network utilities, the growth will be more limited due to their regulated revenue caps. We expect the sub-sector’s EBITDA to increase by around 3% on higher tariff correction for inflation as well as growing regulated asset bases. In a few countries, the regulator will also allow for a shorter timing concerning the recouping of certain costs. As distributing or transmitting energy along networks requires power usage, higher power prices have had a negative impact on the operating results of grid companies.

On top of this, certain players have suffered from higher power leakages due to increased flows coming from renewables. While utilities have been very active in upgrading their networks, they continue to face limitations.

European utility sector: average EBITDA

YoY change (%)

Liquidity issues still in the background

The volatility of commodity prices, namely natural gas and power requires European utilities to have extra liquidity available to meet margin call requirements. The needed additional cash collaterals have created a difficult environment where most utilities need to extend and increase credit lines or loans all at the same time.

With banks having limited room to increase their available capital, finding liquidity on the market has become a challenge. While natural gas prices appear to be coming down from their highs, volatility might be difficult to keep under control, especially once stored LNG stocks are depleted and will need to be replaced from February onwards. We would expect the EU proposal for a new TTF gas wholesale market mechanism as well as governments’ liquidity support plans to increase stability.

As of today, Germany has earmarked a budget of €68bn available to utilities needing extra liquidity to meet margin call requirements. The United Kingdom is willing to dedicate €46bn and Sweden €23bn. Finland and France have thus far both evaluated liquidity needs at €10bn.

EU proposals to tackle the energy crisis should not be disruptive

From September 2022 onwards, the European Commission has worked on different actions that could be adopted to mitigate the impact of high energy prices.

- Energy savings

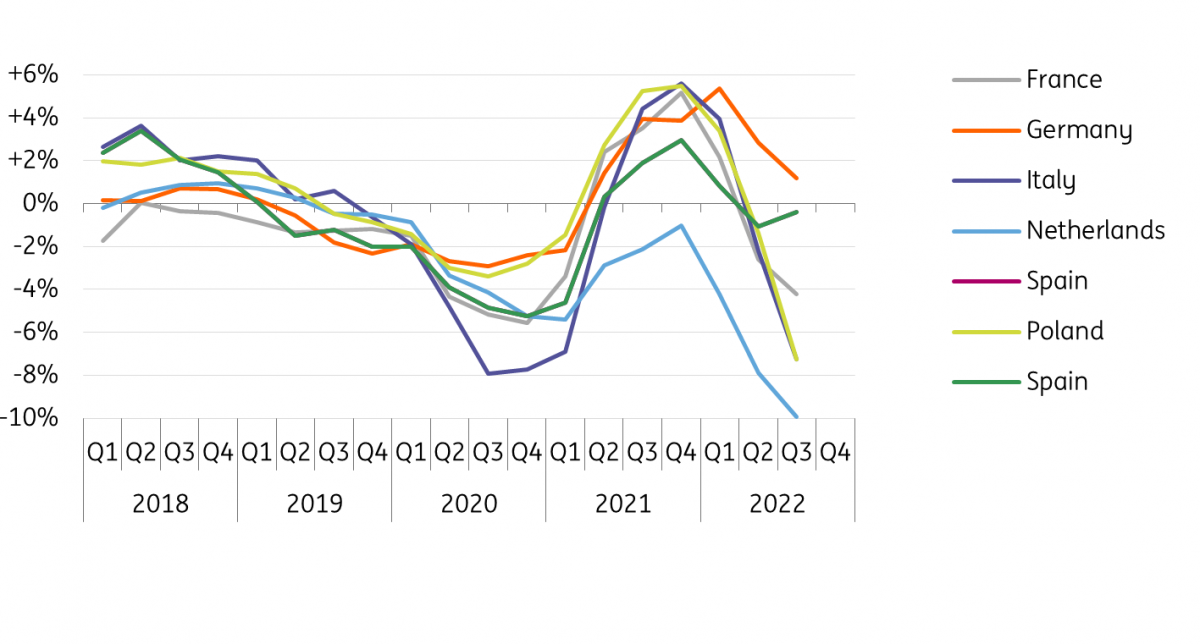

Member states are being asked to reduce gas demand by 15% and electricity consumption by 10% with an additional 5% during peak hours compared to long-term averages. According to ENTSO-E statistics, a decline in power demand started at the end of 2021. The Netherlands led the way in reducing electricity consumption the most by the end of the third quarter of 2022, seeing a -10% drop. Poland was not far behind with -7.5%, and France at 4%. The Netherlands has also reduced gas consumption by 30% as households lower their thermostats and industries substitute energy sources or even curtail production where high gas usage makes production unprofitable.

Year on year growth in electricity demand

4-quarters moving average

Power proposals

- Price cap on electricity: The EU proposes a €180/MWh day-ahead wholesale price cap for low-cost technologies. The scheme is expected to bring some €140bn in excess revenues that would be redistributed to the final energy consumers. The biggest European power producers will not be much impacted by the measure. As seen above, European integrated utilities do sell forward large amounts of future production at fixed prices. Despite being higher than those sold forward a year ago, pre-sold prices for 2023 remain below €100/MWh.

- Joint gas storage: as of today, about 85% of gas storage capacity across Europe is filled. In the future, the EU Commission would like to establish a joint LNG capacity purchasing system and targets for gas storage levels.

- Taxes on fossil fuel companies: EU members will apply additional taxes to fossil fuel suppliers given that the current crisis partly fuels higher profits from surging oil and gas prices. A number of countries have already announced their taxation plans with Italy, for instance, applying a 50% tax on windfall profits on some 7,000 energy providers from 2023 onwards.

- Hydrogen: €3bn funds to facilitate hydrogen development in order to switch from a niche market to a mass market product.

- A price cap on wholesale natural gas has been debated for a long time, with EU members voicing concerns about a mechanism and price level that could threaten the security of supply.

Government support schemes for consumers are rather positive

Government support and subside schemes help utilities too. They allow companies to keep bad debt under control. Parts of the announced support schemes are expected to be financed by caps and tax systems that will bring financial proceeds to governments.

In its latest roadmap for measures concerning energy inflation, the European Union is proposing a €40bn programme to which EU country members can apply in order to support their national consumers.

Government support and subsidy schemes help utilities too

A significant number of EU members have announced their own support schemes to help consumers - both households and companies - to pay their energy bills. Risking criticism from other European countries, Germany announced it would make as much as €265bn in subsidies available. Between September 2021 and the end of November 2022, the United Kingdom communicated a total cumulative budget of €97bn and France €69bn. As far as Italy is concerned, the country will dedicate as much as €91bn on a cumulative basis as the government recently announced an additional package worth €35bn, partially financed by taxes on energy firms’ windfall profits.

The size of support varies greatly between countries

Cumulative budgets announced by EU governments to shield consumers and enterprises from rising energy prices (€bn)

Capital expenditure continues to boost growth prospects

Utilities are at the heart of the energy transition theme, and the path from fossil fuel power generation to clean electricity production requires large investment plans. This applies to both power generation assets and grids that need upgrades and extensions to support the growing power flows from renewables.

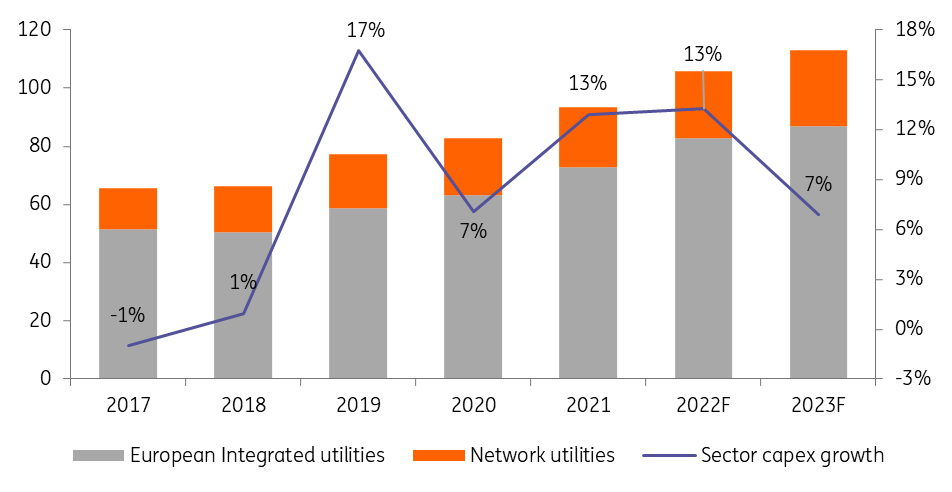

Capital expenditure programmes

2017-2023F (€bn) and YoY change (%)

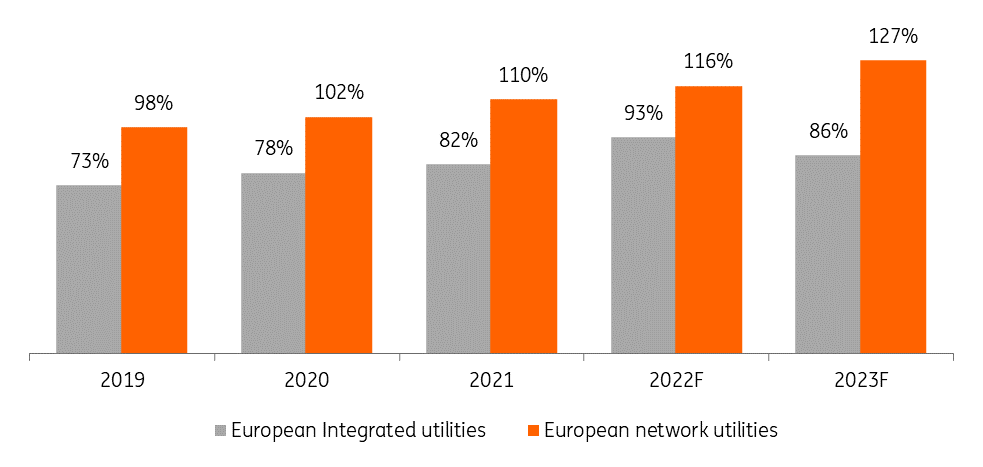

While these large investments are an important growth driver for the sector, they are also a concern for utilities’ financial health. This is particularly true for pure network players whose funds generated by operations do not cover capital expenditure needs. The 15 main European grid utilities will see investments surpassing forecasted funds from operation by more than 20% in 2023. This situation, which we've seen since 2020, pushes transmission and distribution utilities to recourse to additional debt, adding pressure on leverage metrics.

Expenditure to Funds from Operations

European integrated and network utilities

Rising funding costs should stabilise

With substantial capital expenditure programmes, and we'll look at that shortly, the European utilities' sector is an important debt issuer industry. We forecast European utilities to issue €50bn in new bonds in 2023 corresponding to €30bn of bond refinancing and €20bn of new bonds to partly finance capital expenditure needs.

Favourable market conditions

Market conditions have been very favourable for utilities and corporates in general, with average bond yields between 0.5% and 1.1% in the period 2019-2021. Utilities took advantage during this time to approach the credit market more often. High inflation along with the actions of the European Central Bank to deal with the new economic environment resulted in a sharp increase in yields. Year-to-date, the average € bond yield paid by utility issuers in 2022 is 2.64% with average yields towards 1.2% in the first few months of the year and 3.5% in the last three months of 2022.

The European Central Bank announced another rate hike on 15 December with a deposit rate going from 1.5% to 2%. This should lead to higher yields paid by corporates to issue new debt. However, our ING rates strategists believe a recession over the winter still looks very likely. The challenged European global economic outlook should result in rates tightening again, allowing corporates and utilities to print new bonds at lower yields in 2023.

Average € 7Y German Bund and € Utilities bond issuance yields (%)

80% of bonds issued by utilities will be sustainable bonds in 2023

Issuers and investors alike are embracing Environmental, Social and Governance (ESG) notions into core financing or investment philosophies. As the pressure from societies, governments, activists and regulators accelerate, there is a bigger push for ESG bond issuance.

| 80% |

of € bonds issued by utilities in 2023 will be sustainable bonds |

We forecast €100bn of the expected total corporate €270bn bond issuance in 2023 to be ESG issuance. The percentage of ESG bond supply relative to overall € corporate supply is growing year on year. We expect this to jump to 40% in 2023, up from 35% in 2022. For utilities, out of the €50bn of new bond issuance in 2023, we forecast €40bn will be made in sustainable bonds, representing 80% of utilities’ bond issuance. This ratio was 75% in 2022. Green bonds will remain the preferred format for the sector.

Download

Download article

20 December 2022

Energy outlook 2023: From power to utilities to renewables This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more