Energy price caps are appealing, but are not without risks

In this article our power market experts Gerben Hieminga and Nadège Tillier discuss the energy price cap recently proposed by the European Commission and detail the 10 things they will be monitoring closely in the run-up to, and after, the introduction of the cap

State of the Union introduces a price cap

On 14 September 2022, EU Commission President Ursula von der Leyen revealed in her State of the Union speech a set of proposals that could be put in place to mitigate the impact of high energy prices. The main points are:

- Joint gas storage: On average, natural gas storage capacity across Europe stands at 84%, and the goal is to reach maximum capacity in the coming months.

- Hydrogen: €3bn funds to facilitate hydrogen development in order to switch from a niche market to a mass market product.

- Energy savings: Member states are asked to reduce gas and electricity consumption by 10% with an additional 5% during peak hours.

- Taxes on fossil fuel companies: The EU will apply additional taxes to fossil fuel suppliers given that the current crisis partly fuels higher profits from surging oil and gas prices.

- Price cap on electricity: The EU proposes a €180/MWh day-ahead wholesale price cap for low-cost technologies. The scheme is expected to bring some €140bn in excess revenues that would be redistributed to the final energy consumers.

This article is about the price cap on electricity. In the run-up to the State of the Union speech, bold language was used to describe the way energy markets are currently functioning. According to the European Commission President, “The skyrocketing electricity prices are now exposing the limitations of our current electricity market design… We need a new market model for electricity that really functions and brings us back into balance”.

What price to cap?

It was not clear what a new market design would look like, but many politicians have called for price caps, albeit in many different forms. Some argued for a price cap on Russian gas, which is essentially a trade policy that would likely result in a full stop of gas deliveries by Russia to Europe. Others called for a price cap on all the gas that Europe imports, but that would limit the ability to import LNG and threaten our energy security as a result. Yet others called for a price cap on retail energy bills, like the ones that exist in the UK, but those could be a gamechanger for utilities and might trigger support schemes in order to keep delivering energy to households and businesses.

All these price caps, for good reason, did not make it to the final proposal. The proposal introduces a price cap on power generated by non-fossil fuels, in particular from solar panels, wind turbines, hydro power and nuclear power plants.

Capping the price of low-cost technologies

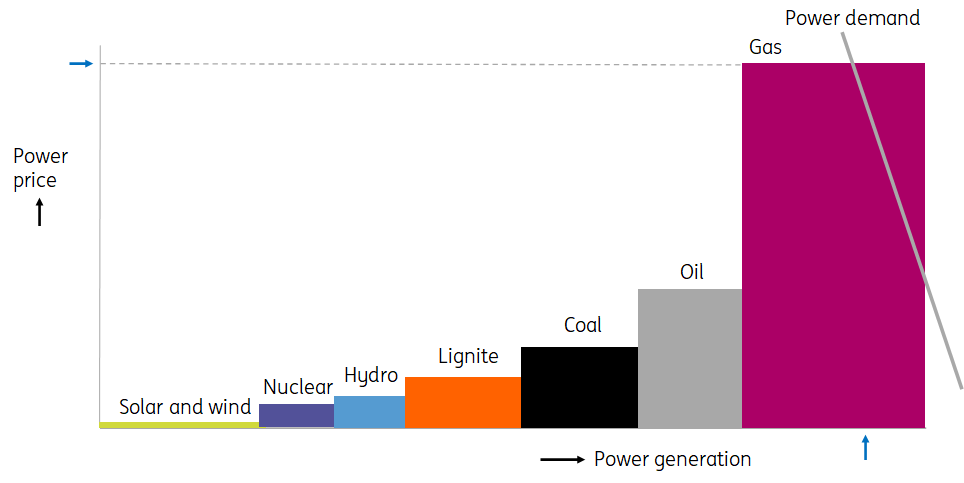

The proposal splits the merit order into two; one part for power generating technologies with low marginal costs (wind, solar, nuclear power and hydro power excluding coal) and a part for technologies with high costs (plants that run on coal, oil and gas excluding lignite). Once the wind is blowing, the sun is shining or a nuclear or hydro plant is running, it costs very little to produce an extra MWh of electricity. But coal- and gas-fired power plants and oil aggregates need to buy expensive fuel.

The merit order ensures that the cheapest technologies enter the market first but implies that the price is set by the most expensive technology to meet power demand. In the current market, those are the gas-fired power plants as gas prices have increased tenfold. What follows is an extreme high power price for all the technologies in the merit order. A price that meets a lot of resistance; why should technologies get a power price of hundreds of euros per megawatt hour (MWh), while they were already profitable at power prices between 50-100/MWh?

The working of the merit order: the power plant that meets demand sets the power price for all the technologies

The first-best solution to solve this problem and to bring down power prices is to reduce power demand to the extent that gas-fired power plants are no longer needed to meet demand. Unfortunately, this is not realistic in the short term as, on average, 23% of all the power in the European Union is generated with gas-fired power plants. And the shares vary considerably across Europe. It ranges from 42% to up to 65% in the Netherlands in the past ten years, while it ranges from 2% to just 8% in France.

Given that European nuclear output volumes are expected to remain far below average for some more months and that hydropower reserves remain depressed, gas power plants are expected to continue to set the average market price.

Setting the cap at €180/MWh

A second-best solution is now introduced by capping the power price for the low-cost technologies (solar, wind, nuclear and hydro power). The EU proposes a €180/MWh day-ahead wholesale price cap for these technologies. The market still clears at the high power price set by the gas plants, but utilities need to pay back the difference between the market price and the price cap to a fund. If the market clears at €400/MWh, utilities have to pay back €220/MWh, which is called the inframarginal price. So, in essence this proposal is not a price cap for end users, but a revenue cap for utilities with low marginal cost technologies (or inframarginal technologies) like wind, solar, hydro and nuclear plants.

The justification for this market intervention is that operators did not anticipate these revenues in their investment decisions and that they were profitable at power prices between €50-100/MWh. Governments also seek sources of funding to alleviate the burden of high energy prices for consumers. At a European level, this scheme is expected to generate up to €140bn that will be used to compensate households and business.

Note that Germany has proposed a technology-specific price cap instead of a general price cap of €180/MWh. It is still unclear if this will be adapted on a European level or that countries can chose their own method. The current EC proposal sets a maximum cap of €180/MWh, so technology-specific caps seem to be allowed if a revenue cap does not exceed €180/MWh.

The cap of €180/MWh is likely to fit most low-cost technologies, but not all projects

Unsubsidised life-cycle-costs of electric for solar, wind, nuclear and hydro power projects:

In the long run, the price from the merit order needs to be high enough to cover the full costs of power generating assets, not only the marginal costs. While the marginal costs cover the fuel costs, they don’t capture capital costs and operational costs.

The life-cycle-cost of electric (LCOE, or Levelized Cost of Electricity) is a measure of the average total electricity costs of an asset over its full life cycle. The proposed cap of €180/MWh is sufficient to cover most solar and wind projects without subsidies and even for some projects with battery storage attached. But the cap does not cover the full and unsubsidised costs of new nuclear and hydro projects. These tend to be very capital intensive and have a history of large budget overruns. This could pose a problem for the ‘nuclear renaissance’ that French President Macron recently called for.

The proposed cap only covers a small portion of the large and complex power market

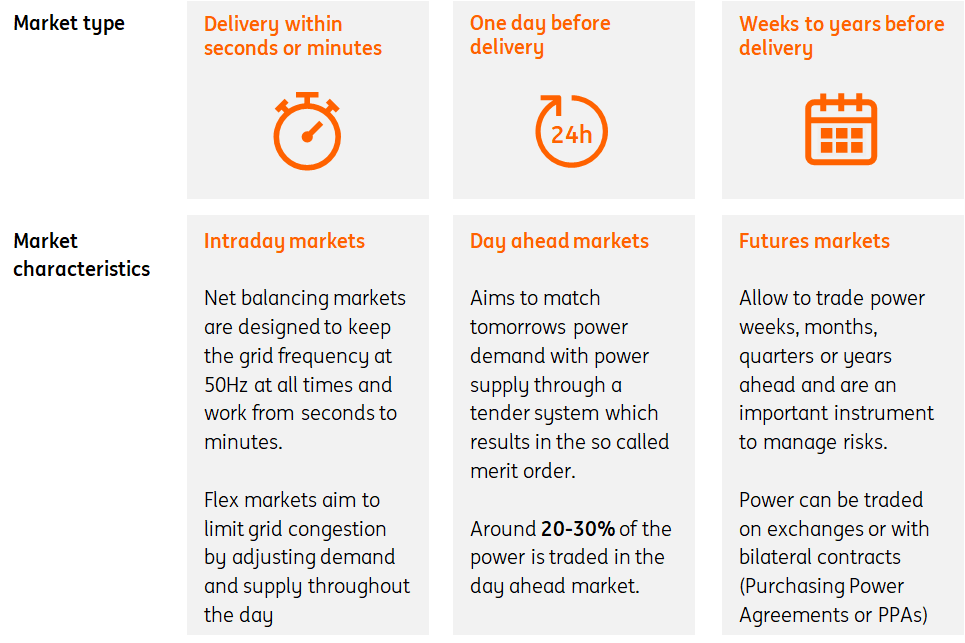

A single or one power market does not exist. In fact, power markets are multi-headed-beasts that consists of many segments which all serve a purpose to keep the physical complex power grids working. European power grids are among the most reliable grids in the world and power users, small to large, take it for granted that power is always available. In liberalised power markets this can only be done by a complex system of power markets, where vast amounts of power are traded within seconds and years in advance.

The proposed price cap only applies to the day-ahead-market

The power market is in fact a collection of many complex sub-markets:

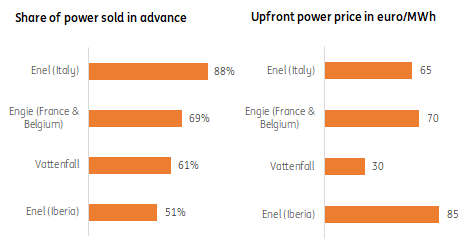

The proposed price cap only applies to the day-ahead-market on which approximately 20-30% of the power is traded. So, most of the power is not subject to the price cap. European power generators, for example, tend to pre-sell about 80% of their future power production in one-year ahead future contracts or through Power Purchase Agreements. Hence, most of their revenues won’t be impacted by the cap. Furthermore, supply is currently hedged at prices well below the cap (in the range of €30-85/MWh).

Utilities tend to pre-sell most of their power in future markets at prices lower than the cap

Share of power generation sold upfront through exchanges or purchasing power agreements and the average power price:

Potential drawbacks: 10 things we will be watching

Market intervention is bound to run into drawbacks, especially in markets as vast and complex as power markets. The wholesale market cap in the Spanish power market provides a case in point. Due to power leakages and increased power generation from gas-fired power plants, gas use in the months following the introduction of the cap went up not down.

These are the 10 things we will monitor closely in the run-up and after the introduction of the proposed price cap.

Power leakage

A price cap in the day-ahead-market might trigger generators of renewable assets to sell their power abroad, for example in non-EU markets like Britain and Norway. The power market in continental northwest Europe is well connected with these markets through the Britnet cable and North Sea Link. There were already plans for an EuroAfrica interconnector that connects Greece and Cyprus with Africa in a couple of years’ time. And this energy crisis is likely to speed up investment in new interconnectors.

Power demand

The market reform aims to redistribute revenues from high power prices, but the scheme could trigger an increase in power demand. For example, bakeries are switching from gas-fired ovens to ovens that run on power. And in some countries, there is a run on electric heaters as household try to save on gas.

The size of this feedback loop is hard to anticipate as it will depend on future gas and power prices. In any case, it remains to be seen to what extent the goal of lower power prices can be combined with the goal of power savings of 10% in overall demand and 5% in peak demand. Overall, savings tend to require high prices, while lower prices tend to increase demand.

Gas use in power sector

Northwestern European countries might need to generate more electricity with gas-fired power plants in case of sizable power increases and/or leakages. Hence gas use could go up instead, while this market design is intended to save gas and reduce the impact of high gas prices on the merit order.

Interference with longer-term power markets

Generators might shift from selling on the spot market (day-ahead-market) to longer-term markets. For example, by selling power above the cap of €180/MWh for months ahead through in the futures market or through a purchasing power agreement (PPA). Liquidity in the important day-ahead-market needs to be monitored closely in order to keep this important part of the power market functioning.

Interference with shorter term power markets (flex-market)

European power grids increasingly face congestion problems as the share of wind and solar power increases. Batteries can be a solution, both large scale batteries and homesize batteries. The big question is to what extent the €180/MWh revenue cap in the day-ahead-market is high enough to spur growth in battery capacity, for example by combining solar panels and wind turbines with batteries (so called co-location business models).

Profitability of energy providers

In an earlier report published in June 2022, we concluded that a price cap could be a game changer for European utilities and their profitability. As a result, utilities have been outspoken about their scepticism regarding price caps. Price caps are intended to minimise the windfall profits of utilities and to provide governments a revenue source to compensate households and companies for high energy bills. But they should not reduce the profitability of utilities as that will limit the much-needed and increasing amount of investments in the energy transition.

Implementation risk

The aim of this market intervention in the merit order of the day-ahead market is to provide short term relief in European power markets. Will it be implemented quickly enough to provide relief this winter? History is not supportive as previous energy market reforms took years to be implemented. In that respect, a timeline of a couple of months seems already ambitious but would mean that it is implemented at the end or after the winter period when energy prices are likely to be high. On the other hand, history also shows that policy interventions can implemented quite fast in a crisis.

Regulatory risk

As more renewables enter the power system, gas- and coal-fired power plants become increasingly important to act as a back-up. In Europe’s predominant energy-only-markets generators with gas- and coal-fired power plants are usually not paid to stand idle for the short term but important moments that the system needs them. Hence, the business case of investing in back-up power is built on high and flexible prices, albeit for short periods of time. This form of policy intervention introduces a regulatory risk for the business case: a risk of governments intervening when prices are high. This might make investors wary to provide finance for much needed back-up capacity.

Legal risk

Will this policy intervention trigger lawsuits and hold up in court? It is not uncommon that major changes in market design are taken to court or that parties will call for ‘force majeure’ under existing contracts. This is not something we can assess as economists, but it is likely that market players will reassess their legal risk premiums in the business case for renewables.

Cost of capital and investor return

If regulatory and legal risks are deemed sizable, investors will require a higher return on their investment for low carbon and/or fossil fuel power generation. This might impact the high ambitions by governments to solidify, extend and transform European power systems and grids. This energy crisis calls for an even faster speed of the energy transition. Utilities and investors are needed to invest billions of euros. They will only do so as long as the risk-return-profile is acceptable.

All in all, price caps sound appealing but in practice they are hard to implement and not without potential drawbacks. Since the State of the Union, we know the price cap aims at a specific segment of the power market, but yet many details have to be worked out. EU Energy ministers will meet again on 30 September, so more details are expected in the coming weeks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more