Dutch healthcare continues to see substantial growth despite capacity limitations

A less tight labour market and declining absenteeism will make the chronic staff shortage in the Dutch healthcare sector slightly less acute this year. While the need for healthcare continues to grow due to population growth and ageing, waiting times for patients remain long

Demand for healthcare continues to rise

The number of patients treated by Dutch hospitals reached pre-pandemic levels in 2023. In fact, private clinics are now treating around 30% more patients than in 2019. However, reaching the old production levels is not enough to substantially reduce waiting times. With an average of more than eight weeks, patients now have to wait a slightly shorter amount of time for treatment in the hospital, but this figure is still above the acceptable maximum standard of seven weeks. Capacity shortages are also still extensive in mental health care and long-term care. Healthcare demand is growing structurally, driven by population growth and ageing, and is therefore higher in 2024 than in 2019. In addition, postponement of treatments during the pandemic also keeps waiting times high.

Growth in healthcare workers insufficient for keeping up with demand

An increasing share of the Dutch working population works in healthcare. While the labour market share was still 1 in 8 employed people in 2001, it has increased rapidly in subsequent years. The share has been fairly stable over the past three years at almost 1 in 6. However, the labour market has become structurally tighter and competition with other sectors has therefore become fiercer. The number of healthcare vacancies is still very high, while the personnel demand in most other sectors is proportionately even greater. At 44 (vacancies per 1,000 jobs), the vacancy rate in healthcare is still below the national average of 46.

Number of healthcare vacancies remains very high

Number of vacancies in the Dutch healthcare sector, in thousands

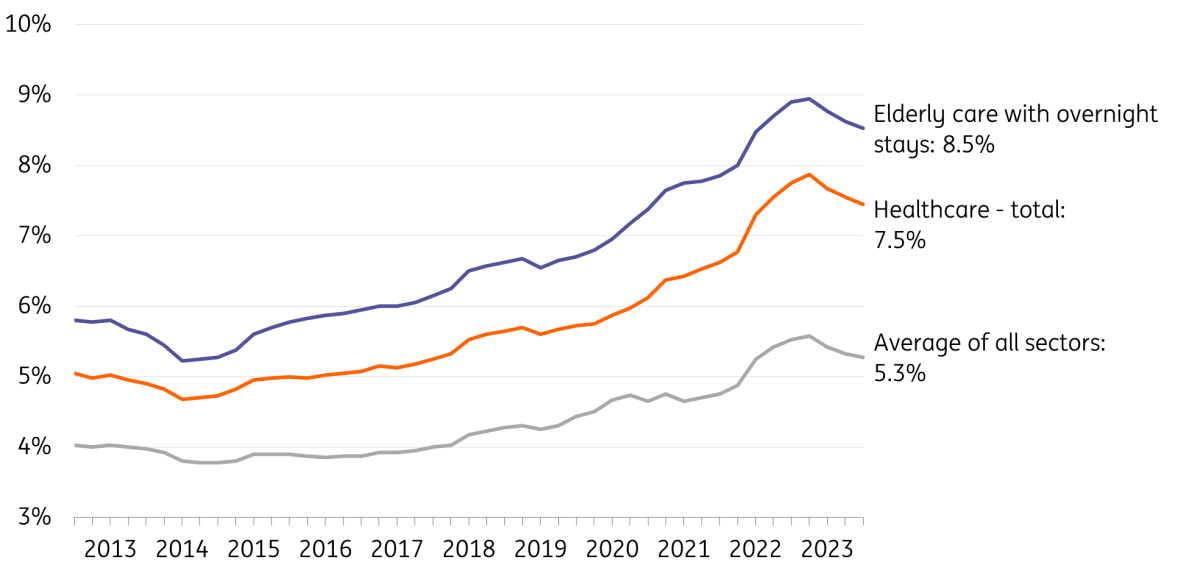

Absenteeism shows a decline but remains very high

Staff absenteeism due to illness has shown a clear turnaround in recent quarters. Thanks to three consecutive quarters of decline, absenteeism is 0.4 percentage points lower, on an average of 7.5% for the entire sector. However, this is still well above the national average for all sectors (5.3%). In elderly care with overnight stays, absenteeism is as high as 8.5%.

A reduction to pre-pandemic levels could save almost half of the vacancies

With a reduction of 1.8 percentage points, absenteeism would return to pre-Covid levels. This would mean that approximately 30,000 fewer employees would have to be hired, in turn meaning that almost half of the number of vacancies could be filled. Unfortunately, due to the high workload and the large number of long-term sick people – partly due to long Covid – this is easier said than done. Reducing the workload by reducing or automating administrative tasks and by limiting false self-employment offers a solution. The latter ensures that permanent staff do not have to work a disproportionate number of night and weekend shifts or have to perform more administrative work for a lower wage.

Absenteeism has peaked, but is still very high

Sickness absence percentage per quarter*

Healthcare volumes to grow slightly faster in 2024

The staff shortage is slowing down the growth in healthcare volume. Growth may be higher in 2024 (+2.5% compared to +2.0% in 2023) due to a slightly increasing unemployment and a further decrease in staff absenteeism. Both developments have a positive effect on the available healthcare supply.

On the other hand, the budgetary room for growth of hospitals will be increasingly limited in the coming years on the basis of the national integrated care agreement (IZA). It is doubtful whether this agreement will keep expenditure developments in check, though. The policy plans of most political parties hardly reflect cost awareness. The two largest parties, PVV and GroenLinks-PvdA, both predominantly opt for expenditure-increasing measures. In December, a majority in parliament agreed to abolish the healthcare deductible as quickly as possible, which could increase collective expenditure by around €6 billion.

Poor financial results for healthcare providers in 2022

Annual accounts show that the combined result (before taxes) of providers in the four largest healthcare sectors decreased by 39% in 2022. More than a quarter of healthcare institutions suffered losses, almost twice as many as in 2021. In addition to the one-off effect of the disappearance of Covid support measures, more structural cost increases also contributed to this. The tight labour market and high absenteeism are causing a continued increase in hiring costs, which amounted to no less than 18% in 2022. In addition, healthcare institutions also have to deal with sharply increased costs of energy, materials and medicines. The (maximum) compensation rates and budgets are adjusted annually based on inflation and wage cost increases, but this compensation takes place with a delay and is sometimes incomplete.

Significantly more loss-making healthcare providers

% of providers with a negative result before taxes, 4 largest healthcare sectors

Trends continued into 2023, with profit margins will set to remain very thin in 2024

As a result, margins of many healthcare institutions were also under pressure in 2023. Hospitals are the only ones of the four largest healthcare sectors to see stabilisation, mainly due to slower rising costs of hired staff. Mental health care, disability care and elderly care had a relatively difficult time due to the introduction of a new financing system and the lapsed compensation for real estate vacancy. Some improvement is expected to occur in 2024 due to a broader labour market, lower absenteeism and lower inflation, but the margins remain very thin.

National health care expenditures are rising rapidly

After very moderate growth between 2013 and 2017 (an average of +1.4% per year), healthcare expenditure has risen sharply again by almost 5.5% over the past five years, partly due to the pandemic. Price increases are likely to continue to drive up healthcare expenditure significantly in the coming years. New medicines and especially high collective labour agreement wage increases contribute to this. Personnel in care for the disabled will receive an additional 13% in wages in two years. In elderly care, this will be 10% to 14% and in hospitals, most employees will earn 15% more.

In a sector where around 70% of operating costs consist of personnel costs, this means significantly higher national healthcare expenditure and additional margin pressure for healthcare institutions. The government contribution to labour cost development (OVA) follows the average wage increase and will increase by more than 6% this year. An increase of almost 5% has been provisionally set for 2024. This means that the contribution does not (yet) fully cover the wage cost increase.

Expenditure growth has increased significantly

Average annual growth rate of national health expenditure, over five-year periods

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more