Dutch construction faces sharp decline in 2024

The construction of new homes in the Netherlands is under pressure due to higher interest rates and falling house prices. Those at the beginning of the value chain, such as project developers and producers of concrete and bricks, are seeing a significant decline in demand already

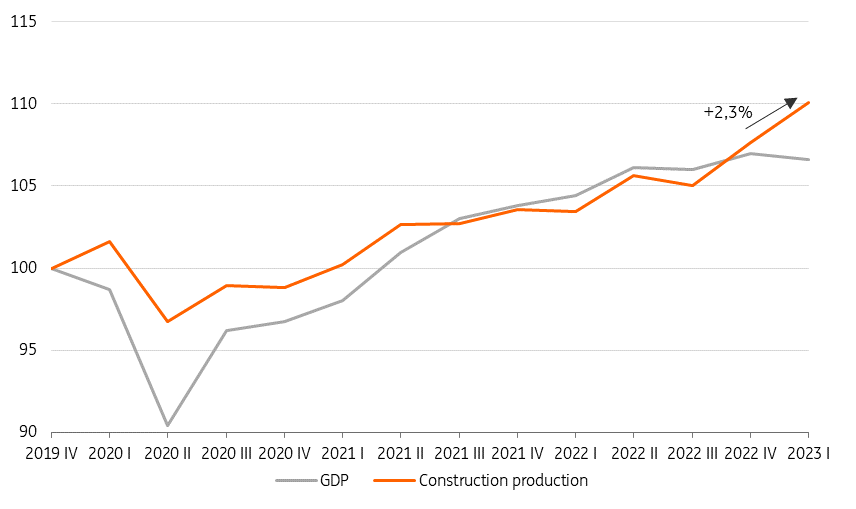

Construction production expected to grow by 0.5% in 2023

We expect Dutch construction volumes to experience slight growth of 0.5% this year. A small contraction was previously anticipated. However, unexpectedly high growth in the first quarter of this year has led to the possibility of ending 2023 with a small increase.

Contraction of 2.5% expected in 2024

The high growth in energy-saving measures in the installation industry is likely to decline due to falling energy prices, thereby removing this support pillar for the entire construction industry. Moreover, the late cyclical nature of the sector will start to take effect in the months ahead. Signs of cooling are already evident at the beginning of the construction value chain, with a visible contraction in project development and the production of building materials such as concrete, cement, and bricks. This trend will continue further down the supply chain. As a result, we expect a contraction of 2.5% in Dutch construction output next year, the largest decline since 2013.

Construction continued to grow in early 2023

In the first quarter of 2023, Dutch construction production continued to grow by 2.3% compared to the fourth quarter of 2022. Even then, the construction sector showed significant growth of 2.5%. This is significantly better than the overall Dutch economy, which contracted by 0.3% in the first quarter of this year.

Construction production continued to grow in early 2023

Volume development Dutch construction output (valued added index Q4 2019= 100)

Demand for energy-saving activities has peaked

The sustained high growth in the construction industry was mainly driven by energy-saving measures. Higher energy prices led to a huge uptick in demand for energy-saving construction work, including the installation of (hybrid) heat pumps, the placement of solar panels and insulation works. As a result, installation companies experienced an almost 20% increase in revenues in the first quarter. However, interest in energy-saving measures seems to have tailed off now that energy prices have significantly dropped. While demand is still relatively high, the rapid growth seems to have subsided. As a result, this pillar of support, which counterbalanced declining new construction production, is diminishing.

Issues in the new construction chain are already being felt

New housing projects are affected by the declining housing market due to factors such as higher interest rates, high construction costs, a shortage of building land and often complex project development. This all puts pressure on construction volume and is already evident at the front end of the value chain. The number of building permits has decreased and project developers’ revenues are also declining.

Turnover is declining in the project development sector

Monthly turnover development 2015=100 12-month moving average up to and including May 2023

Production of building materials such as concrete, cement and bricks has fallen by 20%

Production in the building material industry is also contracting. In May, the volume was 20% lower than a year earlier, after a 9% decline in volumes in the first quarter. Contractors are ordering fewer building materials such as concrete, cement and bricks. These materials are primarily used in new housing construction projects. Further down the value chain, there is still revenue growth, such as in the building completion and finishing sector, which includes plasterers, painters, and carpenters. Some of these activities are also common in renovations, but in the long run, the work in these sectors will decrease as ongoing new projects diminish.

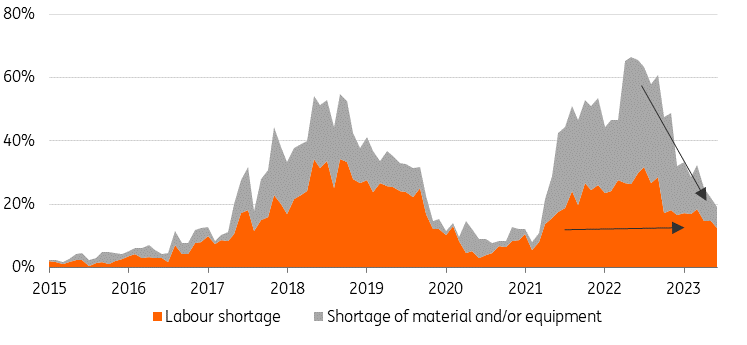

Structural staff shortages, but few builders with material shortages

% Dutch builders with production restrictions due to: (SA and up to and including June 2023)

Persistent labour shortages

Many construction companies still report production hindrances due to labour shortages, although this has decreased. Previously, urgent labour shortages were reported by 25% of construction entrepreneurs, but in June this was only the case for 13%. The number of companies expecting to hire new employees has also significantly decreased to 4%. Construction companies are likely preparing for reduced activities in 2024.

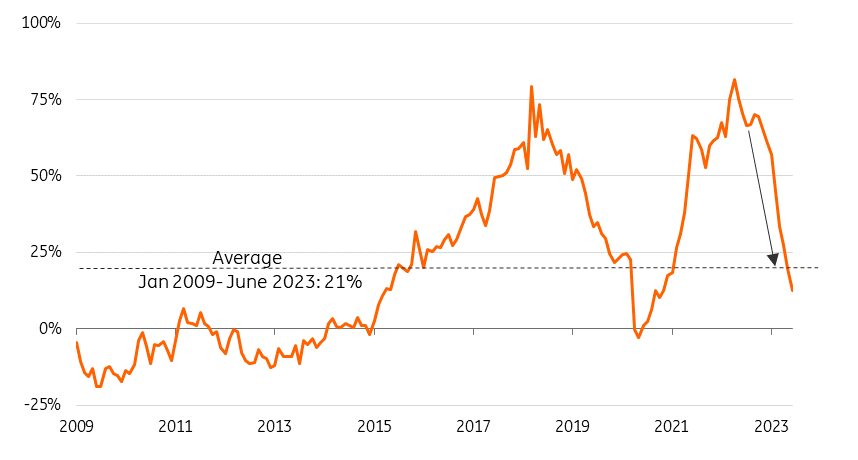

The number of builders that want to raise prices has fallen enormously

% of Dutch builders that expect to increase sales prices (balance pos. -/- neg. answers, SA, up to and including Jun 2023

Shortages of materials and price increases have almost disappeared

Material shortages have significantly decreased in the past six months, as international supply chains have resumed following the Covid-19 crisis. The supply of building materials, especially technical components, has also improved, reducing production hindrances caused by materials that cannot be delivered (on time). As the scarcity of building materials diminishes, price increases are less pronounced. Additionally, declining demand in certain segments puts pressure on prices.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more