China: Revising our USD/CNY forecast

Exchange rate reform has shown that USD/CNY can be quite volatile, which is why we are revising our USD/CNY forecasts. In this note, we discuss the progress in liberalisation efforts and the prospects for interest rate reform in 2021

Exchange rate liberalisation is in charge

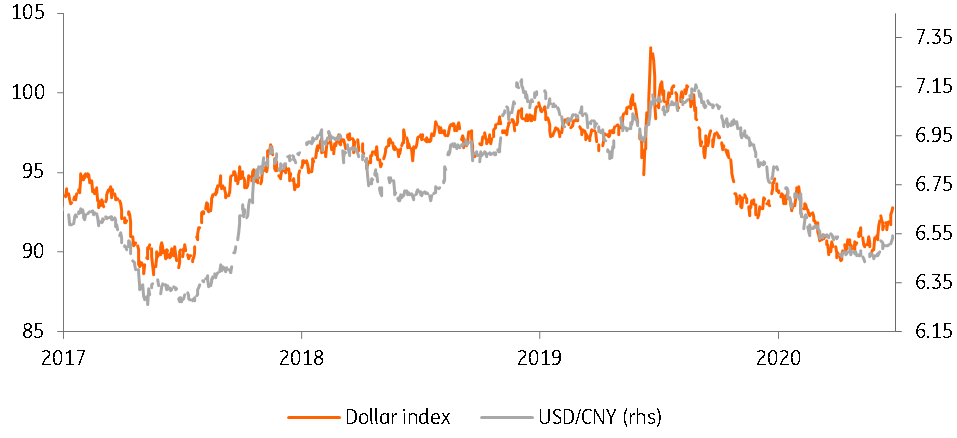

Since October 2020, China's central bank, PBoC, has liberalised the exchange rate by fading out the counter-cyclical factor in the daily fixing mechanism. Though the daily fixing exchange rate is still announced in the morning of every trading day in Mainland China, the transparency of the fixing has increased. The market has since become used to the USD/CNY fixing following the direction and momentum of the dollar index, which reflects changes in market information.

In making this change, the PBoC and the market face higher yuan volatility. This risk is not only taken by the market but by the central bank as well. When there is unexpected news or data that hints at either much bigger capital inflows or outflows, moves in USD/CNY will be particularly unpredictable.

If the central bank has a contingent plan for this lack of predictability and/or believes that cross border capital flows are fairly stable in China, it is unlikely to be too concerned about this risk.

For now, the latter is true. The capital account in China is still not fully open although it has opened a lot within the past few years. One example is to allow foreigners to invest in China’s bond market, which indeed attracts capital outflows, and these are fairly stable investments.

USD/CNY is increasingly correlated with the dollar index

Interest rate reform is coming

What we are looking for in 2021 is interest rate reform. Though banks have now adopted the Loan Prime Rate as the benchmark interest rate for longer-term loans, the market is not yet sensitive enough to reflect all of the risk, including credit, interest and liquidity, in the interest rates that link to the benchmark interest rate. Short-term loans face a similar situation.

We, therefore, expect the PBoC to guide banks further in quoting interest rates to clients. These clients not only include big corporate clients but also small retail borrowers. In fact, regulators are clamping down on online platforms similar to “peer-helping” lending platforms that target small retail borrowers. We believe that regulators will put more emphasis on both the legality of lending and the sensitivity of interest rates to the risks incurred in such lending.

The main domestic factor which could affect the yuan

The government has deepened deleveraging reform in the real estate sector. This is, in fact, good news because those 'too big to fail' real estate developers are now being closely monitored by the central government for how they use their borrowings under the category of "working capital". Real estate developers should no longer be able to use the loophole of "working capital" to bid for land. This will speed up the deleveraging process.

To be sure, there is a risk of deleveraging too fast, which could squeeze some weak developers into bond and loan defaults. But the number of such cases should be small, and they shouldn't be the biggest developers.

This domestic factor could affect USD/CNY if there is bad news from the sector.

Revising USD/CNY forecast

As USD/CNY is now increasingly reactive to the dollar index, and Covid is yet to be under control in the US and Europe, we are revising our forecast of USD/CNY to 6.30 from 6.20 by the end of 2021. We may further revise the forecast if the dollar strengthens.

Download

Download article

5 April 2021

Good MornING Asia - 5 April 2021 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).