Akbank: Challenges ahead

After years of solid growth, there are signs the Turkish bank has its work cut out to maintain its impressive metrics

Turkish lender Akbank reported strong 1Q18 earnings, beating consensus with net profit of TRY1.7bn, up 17% YoY. Its main profit drivers were loan growth and improved margins. However, while the NPL ratio declined, the Group II Loan ratio almost doubled QoQ to 10.2%. The TRY loans/deposits ratios rose further to 144%, although the headline 104% ratio was solid and unchanged. The Tier 1 ratio was a respectable 13.6%, modestly down QoQ on dividend payments and currency weakness.

Results highlights

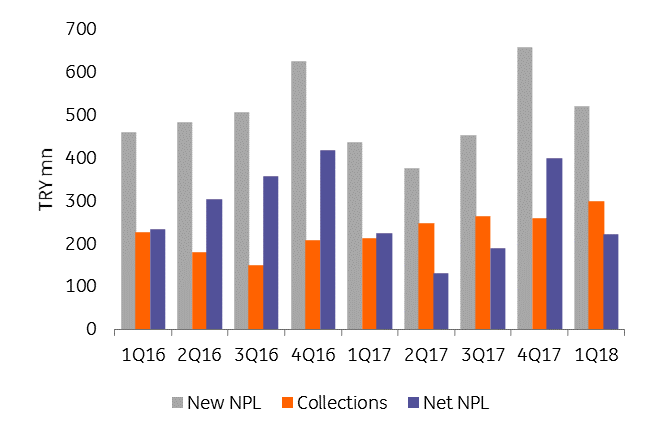

- Akbank asset quality showed mixed trends. While the NPL ratio declined, the Group II Loan ratio almost doubled QoQ to 10.2%, which would have been 7.1% but for the Otas loan. However, gross NPL inflows of TRY522m came off the highs of 4Q17, while the net number was a much more manageable TRY 223mn as collections improved.

- The cost of risk is still very low at 42bp (or 24bp under IFRS 9). The total coverage ratio remains ample at 154%, while capitalisation is also solid (Tier 1 ratio: 13.6%, one of the strongest in the sector and up 20bp YoY, though down 60bp QoQ).

- We note that loan growth was concentrated in Commercial and Other Business banking as well as higher-risk GPLs, while the modest growth in FX loans (+5%) meant that loan growth was 18% YoY (in line with deposit growth).

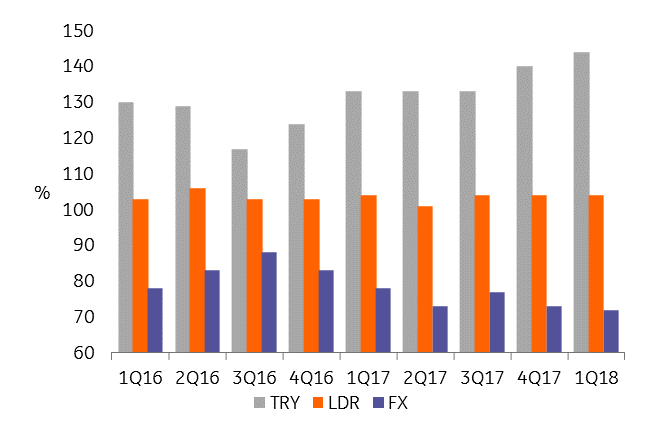

- We also note that the TRY loans/deposits ratio has risen from 133% to 144% since 1Q17. This has undone much of the previous good work undertaken to rebalance the funding position, though it somewhat inevitable as the economy moves away from reliance on FX loans while depositors simultaneously seek shelter in USD deposits. The Credit Guarantee Fund (CGF) accelerated this phenomenon in 2017. A corresponding drop in the FX ratio to a very strong 72% left the headline number little changed at a healthy 104%. FX deposits grew 3% QoQ and now comprise 56% of total deposits, while TRY deposits were flat.

Earnings in detail

- Akbank reported a 16.7% YoY increase in 1Q18 net profits to TRY1.7bn. Net interest income rose 30.2% YoY to TRY 3.3bn as loan volumes improved 17.8% (still benefiting from the pre-CGF comparison) and 4.6% QoQ. NIM was flat on the year (after swaps) at 3.54%, but fell back 30bp YoY as higher funding and swap costs bit (a function of the dollarization of the Turkish deposit base, higher wholesale funding costs and higher CBRT liquidity charges). Moving on from NII, Fees & Commissions enjoyed another solid year, rising 19.1% to TRY810m, while the adjusted cost/income ratio remained extremely competitive at just 34.8%.

- Asset quality was more mixed. The headline NPL ratio fell back slightly from 2.1% to 2.0% QoQ as NPL inflows slowed from TRY400m to TRY223m QoQ (see chart). The bank, therefore, remains comfortably ahead of the sector average of 2.9%. The cost of risk also remained low, falling from 49bp in 4Q17 to just 24bp in 1Q18, due mainly to the impact of IFRS 9, without which it would have remained stickier at 42bp. However, in a sign that the benign backdrop for Turkish asset quality metrics is changing as growth slows and the currency remains under pressure, the Group II loans ratio increased significantly from 5.4% in 2017 to 10.2% in 1Q18 (or from 2.4% to 7.1%, excluding the $1.7bn Otas exposure). While we are not surprised that the Group II loans are rising following the headlines concerning Yildiz and Dogus Holding (AKBNK has confirmed that its loan to Yildiz is included in the Group II loans category), the deterioration in this ratio is startling. AKBNK, as a significant lender to large corporates, is likely to be affected if more large businesses attempt to restructure their loans.

We expect to see this trend appearing in GARAN and ISCTR’s numbers too, as they are also major lenders to the Turkish large corporate sector.

New NPLs and Recoveries

-

Turning to liquidity and capitalisation, the loans/deposits ratio was maintained at a strong level of 104% (sector average: 120%), while the bank unsurprisingly showed more stretched liquidity metrics in TRY than in FX, which is a feature common to the sector. Not only have TRY deposits been declining as depositors switch to USD, but the demand for TRY loans has increased as a result of the CGF. In Akbank’s case, the loans/deposits ratio in TRY was 144% (up from 133% a year ago and from 140% in Q4), while in FX it is 73% (down from 78% in 1Q17). TRY deposits were flat QoQ, while FX deposits rose 3% in USD terms, showing that Turkish depositors have still not regained confidence in their currency. Meanwhile, the Tier 1 ratio rose 20bp YoY to 13.6%, one of the strongest numbers in the sector, although this was 60bp weaker QoQ. The annual comparison was boosted by the fact that CGF loans attract a 0% risk weighting, while current lending has reverted to the usual rules. Weaker TRY and dividend payments also played a part. Total CAR stood at a healthy 15.6%. We expect the bank to expand its capital base in the coming quarters now that dividend payments are out of the way. Organic capital generation is in the region of 60bp per quarter.

-

As for the loan book, we find it interesting to look at the main growth areas, which helps us to identify the segments in which the bank sees the greatest opportunities. Akbank’s lending numbers show a clear preference for riskier, more profitable lending (smaller businesses over large corporates, GPLs over mortgages), though that could also reflect the slowdown in the housing market and demand for credit from the large firms. We use QoQ numbers to avoid the CGF distortion visible in YoY figures. The headline 5% QoQ overall growth of the book to TRY 223bn masks the divergence between loan classes. While TRY denominated loans grew by 3%, their FX counterparts rose just 2% in USD terms due to lack of demand. Within the TRY book, Business Banking loans increased 4% (Corporate +2%, Commercial +5%, Other Business +6%), while Retail loans rose by just 1% (Consumer +2%, boosted by 6% growth in the unsecured lending book, offset by Mortgages -3% and Credit Cards -2%). By contrast, within the FX bucket, Corporate loan growth of 1% was augmented by a 5% increase in Commercial loans. Business loans accounted for 79% of AKBNK’s total loan book; little changed YoY.

Loans/Deposits Ratio

- We note that Akbank’s assets and liabilities remain reasonably well matched by currency, although the lack of TRY funding remains a concern. On the asset side, FX securities comprised 53% of the total, while FX loans accounted for 39% of total loans. Meanwhile, FX deposits made up 56% of total deposits, up from the recent low of 47% at end-3Q16, as re-dollarisation continued.

For 2018, Akbank is assuming GDP growth of around 4.5% and CPI inflation of about 9.0%.

Loans and deposits should both grow at 13-15% (1Q18 annualised result: +19%, matching deposit growth), one percentage point faster than the sector. The bank expects NIM to fall back slightly to 3.5%, the loans/deposits ratio to remain anchored below 105% and NPLs to be stable at 2.1%.

If this guidance pans out, it will mark a year of relative stability following the turbulence the sector has experienced since 2016.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).