War overshadows Hungary’s record GDP growth

A minor revision to the fourth quarter GDP growth did not alter the 7.1% record-high Hungarian GDP growth in 2021. This hardly gives us any comfort in these dark times. Though we downgrade our 2022 forecast, the outlook is in constant flux

| 7.1% |

2021 real GDP growth (YoY)Flash estimate 7.1% |

| As expected | |

Statistical Office confirms 2021 record growth

In the fourth quarter of 2021, Hungarian GDP rose by 2.0% on a quarterly basis, according to the final release by the Statistical Office. This is only a minor downward revision compared to the flash estimate, and it does not change the narrative much. Hungary posted the highest GDP growth in the modern era of statistics (since 1995) with its 7.1% figure. This quick rebound follows a 4.7% decline in real GDP during the Covid-earmarked year of 2020. At the end of the fourth quarter of 2021, GDP was more than 3% above its pre-crisis level.

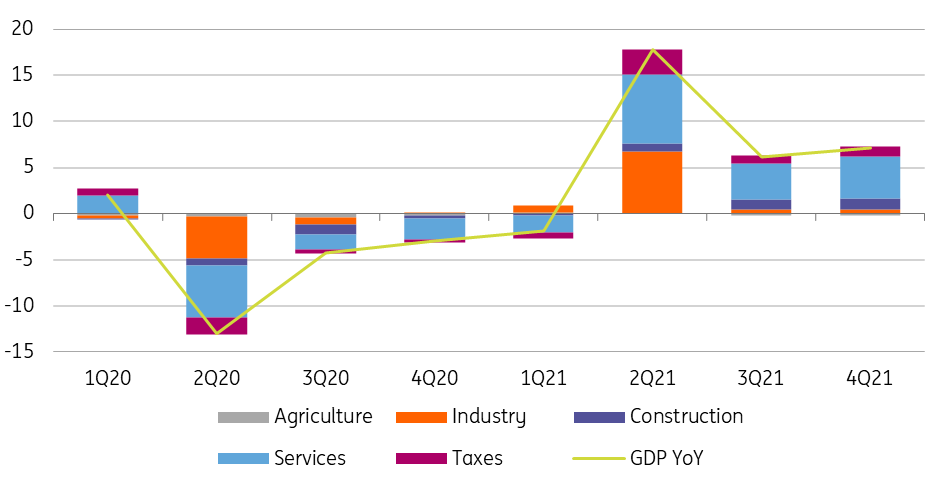

The flash estimate caused a significant upside surprise but with the details in our hand, we can see where this uptick came from. On the production side, agriculture held by the economic activity as expected, while the positive contribution of industry was moderate. In contrast, both construction and services had a stronger growth in value added and thus improved the fourth quarter GDP growth with a stronger impulse than we expected. But this made up half of the surprise, as the other half was related to the net taxes of products, adding 1.1 percentage points to the economic activity in the last quarter of 2021.

Contribution to GDP growth – production approach (% YoY)

Translating this to the expenditure side, government spending was up by almost 6% on a yearly basis in the fourth quarter. Other domestic factors were also spurring the growth (household consumption and investment activity), so domestic demand elevated GDP growth by roughly 6.4ppt. Despite the demand-driven economic activity, exports were able to outperform imports, thus the net export contribution was positive again after being a huge drag on growth in the third quarter.

Contribution to GDP growth – expenditure approach (% YoY)

Over 2021 as a whole, the growth structure was quite balanced despite the several challenges provided by the waves of coronavirus and the shortages in the economy. The main driver of growth was the rebounding services sector (3.6ppt), while industry added another 1.9ppt to 2021 economic activity (the majority coming during the second quarter rebound). Construction fuelled both by public and private spending contributed to the record performance as well (0.7ppt).

Despite strong fundamentals, the war makes us downgrade the outlook

The year 2022 started well for the Hungarian economy based on surveys and big data. According to the central bank’s weekly GDP tracker, the economy showed an above 7% year-on-year growth during the first month. This could have been on par with our 6.2% GDP forecast in 2022.

Unfortunately, this rosy outlook is now shattered with the war in our Eastern neighbour. The February soft indicators – which were still pointing upwards – did not take into account the latest geopolitical developments, which will clearly impact the Hungarian economic outlook. The effects on growth are practically invaluable as the situation is changing not day-by-day, but on an hourly basis. In this respect, our downgraded GDP outlook needs to be taken with a pinch of salt as the forecast is in constant flux.

The negative channels are mainly related to confidence, dampening the propensity to consume and investment activity both of households and corporates. Supply shocks are rising again as Ukrainian manufacturers are unable to produce for understandable reasons. One of Hungary’s most important producers, Audi, has already announced that it is facing parts shortages, which will lead to a shutdown soon. Probably more of the same will follow soon.

ING's GDP growth forecast – Hungary

On the other hand, the refugee crisis could have a positive impact on both private and public consumption in the very short term, somewhat counterbalancing the first round of negative effects. In all, we cut our 2022 GDP forecast by 1ppt to 5.2% YoY. This can be seen as an interim forecast now, as this outlook could turn to a quite optimistic one fairly quickly. But despite the mounting downside risks, we are not yet ready to talk about the chances of stagflation in Hungary. For the time being, we do not foresee a recession.

Inflation forecast moves up as well

Inflation is also becoming more and more of an economic issue with the soaring energy and commodity prices. These are adding to the wage pressure created by the labour shortage and the 20% minimum wage growth. The icing on the cake is the forint being under constant pressure, reaching new record-high levels on a daily basis versus both EUR and USD. Against this backdrop and despite the government’s inflation shield measures, we raise our CPI outlook up to 7.4% YoY in 2022, followed by a 4.5% average price increase next year. The risks are clearly tilted to the upside.

Download

Download snap