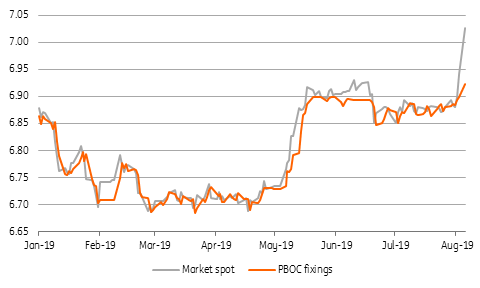

USD/CNY pushes above 7.0

The People's Bank of China fixed the renminbi at 6.9225 today, up from 6.8996 on Friday in what they suggest is a response to the latest round of tariffs from the US. Markets have immediately taken the spot rate above the psychological 7.0 rate

7-broken - what now?

Today's fixing at 6.9225 was up from 6.8996 last Friday and a little more than had been expected from models looking at market swings in the basket of currencies against which the CNY is managed. Markets have immediately taken the spot USD/CNY rate above 7.0. With that level now broken, the key question is what now?

We, like most of the consensus, have been reluctant to forecast a 7+ figure for USD/CNY, at least whilst trade negotiations were ongoing, assuming that this would immediately lead to the breakdown of talks. So it is probably fair to assume that today's move was a deliberate decision, and part of what we imagine will be a concerted series of steps aimed at pushing back at the latest US tariffs. For more on this, see the note Iris Pang published last Friday.

Absent from that list was any currency action. It appears the Chinese authorities no longer see the need to limit the tools at their disposal and that the currency is now also considered part of the arsenal to be drawn upon.

The PBoC's website explicitly links the weaker fixing to the latest US tariffs, saying "Affected by unilateralism and trade protectionism measures and the imposition of tariff increases on China, the RMB has depreciated against the US dollar today, breaking through 7 yuan, but the renminbi continues to be stable and strong against a basket of currencies" (translated from original).

The website goes on to intimate that a move back below 7.0 is quite possible and suggests that not too much should be read into this currency movement.

China Spot FX rate vs Fixing

7.0 a psychological hurdle only

With 7.0 now broken as a resistance level, a number of analysts are looking to set new forecast levels for the currency - with figures of 7.2 and 7.3 widely mentioned. In time, these may indeed be plausible levels, though the arguments against excessive weakening remain - namely, that it is likely to be damaging to the value of risk assets, such as Chinese stocks. Also, that it could result in more efforts to get currency offshore, which could tighten market liquidity and result in further economic weakness.

Moreover, we don't believe the currency is a strong transmission channel for the effective stimulus of the economy, so given the non-negligible costs of depreciation, a meaningful depreciation is not a clear choice for the Chinese authorities.

Of course, what today's move does do, by taking away the USD/CNY 7.0 hurdle, is provide much greater room for the PBoC if it does decide that the currency has to be part of the response to the latest round of the trade war.

But we're not leaping to any conclusions and will take our time in considering if this is more of a gesture of defiance (today's fixing was only 0.33% weaker than last Friday's fix) or the beginnings of a concerted currency move. The next few days fixing levels will provide some useful information.

Download

Download snap9 August 2019

Are we headed for a currency war? This bundle contains {bundle_entries}{/bundle_entries} articles