US: stability masks slowdown signals

4Q19 US GDP growth came in at 2.1%, the same as in 3Q, but the growth mix shows weakening consumer spending while business investment continues to languish. Trade stability may provide a better platform for 2020 growth, but coronavirus worries could undermine it

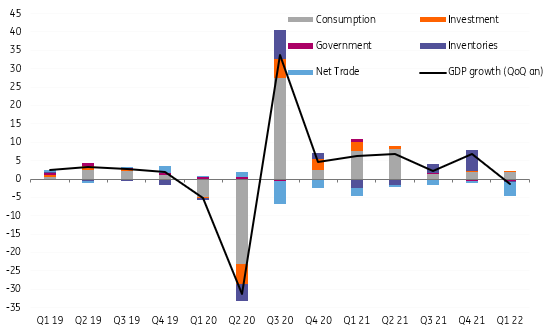

US 4Q GDP growth has come in broadly in line with expectations at 2.1% (consensus 2%). The details show slower consumer spending growth and weak business investment being offset by another strong residential investment figure, robust government spending and a plunge in imports resulting in a major contribution from net exports to the headline growth rate.

In fact, net trade contributed 1.5% of headline growth as the “will-they-won’t-they” debate over tariff hikes during the second half of the year led companies to slash imports at an 8.7% annualized rate in 4Q – remember the long lead times in shipping form overseas. This in turn contributed to a big reduction in inventories, which subtracted 1.1% from headline GDP growth. These components are likely to reverse course in the current quarter (December’s preliminary trade data gives us clear direction on this) and on balance become a headwind for GDP growth in 1Q20.

The concern surrounding business investment continues with non-residential fixed investment declining for the third consecutive quarter. Meanwhile, the slowdown in consumer spending growth was more marked than expected given the strength of sentiment, the strong jobs market and record stock prices.

US GDP growth with sector contributions (% annualised)

Looking ahead, it is far too early to say whether the coronavirus outbreak will have a dampening effect on US economic activity, but in an environment of already subdued global growth it certainly increases the downside risks. The US yield curve, which is flirting with inversion once again, highlights broader market fears that the virus and its human and economic threat could spread. The more that it does the more likely it starts to alter consumer and corporate behavior, thereby prompting policy action to mitigate the dangers.

In any case, we were already sub-consensus on US 2020 GDP growth, despite hopes that with US-China trade relations on a better footing this could provide a platform for stronger numbers. We certainly don’t see the agreement as transformational. Moreover, with the recent Deloitte’s CFO survey showing 97% of respondents thinking the US is either already in a downturn or will be at some point this year, we don’t have much confidence that US business leaders are about to start spending in a meaningful way. We are also cognizant of the fact that presidential elections typically make firms wary of putting money to work given the potential for significant regulatory/taxation changes.

We are also doubtful that strong consumer sentiment readings will translate into a sharp increase in consumer spending given wage growth has dropped back to 2.9% year on year, having flirted with the prospect of breaking above 4% early last year. Trade figures will also correct and are likely to be a drag on 1Q20 GDP as a minimum. We currently look for 1Q GDP growth of around 1.5%, with full year growth around 1.7%.