US: Slow slide in jobless claims

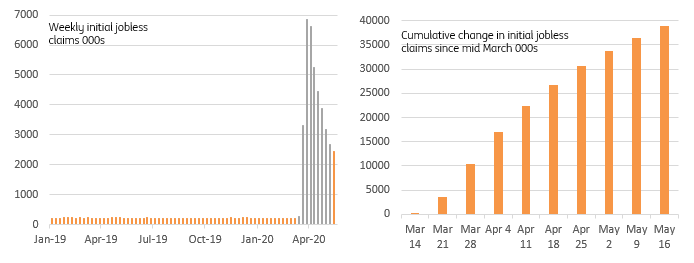

US initial jobless claims dropped for the seventh straight week, but remain painfully high at 2.44 million. As the economy gradually re-opens this decline should continue, but social distancing constraints, consumer anxiety and squeezed household incomes mean unemployment won't drop anywhere as quickly as it spiked

| 38.9 |

Cumulative new jobless claims over past 9 weeksmillion |

Lay-offs remain painfully high

Initial jobless claims for the week of 16 May slowed broadly as expected to 2.438mn (from the previous week's figure of 2.69mn), while there were some favourable downward revisions to the recent history. Nonetheless, the cumulative running total of 38.9mn initial claims underlines the economic devastation resulting from lockdown measures.

The rate of decline in weekly initial jobless claims is proving to be more glacial than we would have thought likely a few weeks ago

The US states that reported ahead of time, including Arizona and Pennsylvania, had suggested the rate of decline in new jobless claims was not improving anywhere near as quickly as hoped, but big falls in Georgia, New Jersey and Kentucky and modest falls elsewhere brought some relief. Unfortunately, Washington, New York and California continue to post increases.

Nonetheless, the rate of decline in weekly initial jobless claims is proving to be more glacial than we would have thought likely a few weeks ago. It is possible that some businesses that had continued paying staff in the hope of a swift re-opening process now recognise that social distancing constraints mean that business will not return to “normal” quickly. This means that only now are they adjusting their workforce for the new environment. If this is correct then jobless claims may post only modest declines for a good few more weeks.

Weekly Initial jobless claims and cumulative weekly totals since lockdowns started

Continuing claims are picking up

Moreover, continuing claims picked up more than hoped to 25.1mn. This is obviously below the 38.9mn running total for initial claims and the gap between the two is somewhat odd. There are some clear factors in play such as the fact that there is an extra week lag in the data (week of 9 May for continuing claims, rather than the 16th for initial claims), while not everyone will qualify for unemployment benefits and there may well be the case of double-counting on initial claims as people try to register both online and by phone.

That said, we suspect it is more to do with backlogs between filing and receiving benefits due to overwhelmed government benefit teams.

New unwelcome records for the labour market

It is clear that because of social distancing constraints, consumer anxiety relating to the virus and household incomes feeling the strain with tens of millions of Americans out of work, unemployment will not drop anywhere as quickly as it spiked.

What is remarkable is the fact that just 51.3% of 16-65 year-olds received a wage in April

In April the unemployment rate hit 14.7%, but perhaps an even more remarkable fact is that just 51.3% of 16-65 year-olds received a wage – around a third of working-age Americans not included within the labour force (students, early retirement, sick, homemakers, carers).

Given the trend in jobless claims, unemployment will be around 20% in May with just 46-47% of working-age Americans earning a wage.