US: Retail on the ropes

US retail sales have fallen for a third consecutive month as Covid-related restrictions and associated jobs losses dampen the consumer's willingness to spend. More stimulus cash may help boost sentiment and savings balances, but until the economy re-opens the spending situation won't improve meaningfully

3 in a row

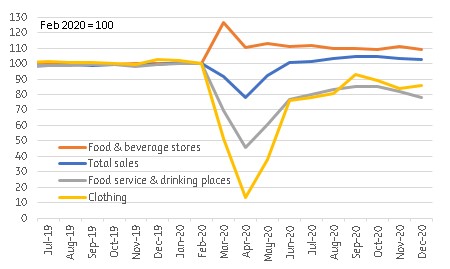

The December US retail sales report adds more evidence that the US economy is wobbling in the face of the latest wave in the pandemic. Total sales fell 0.7% in December versus expectations of a flat outcome while the figure for November was revised down to a -1.4% month-on-month reading from -1.1%. When you add in the -0.1% reading for October, it is now three consecutive monthly falls.

It is important to remember that this is a value figure so higher gasoline prices actually boosted the number – gasoline station sales rose 6.6%. Strip out this and other volatile items such as food service and autos and building supplies you get what is called the "control" group, which better maps broader consumer spending. It fell 1.9% MoM after a downwardly revised 1.1% fall in November and a 0.1% decline in October.

There was weakness throughout – electronics down 4.9%, food down & beverage fell 1.4%, department stores were down 3.8%, eating & drinking out down 4.5% and non-store down 5.8%. The only areas to see increases were gasoline (+6.6%) on those higher prices, clothing up 2.4%%, autos (up 1.9%) and health up 1.1%.

Sales will struggle until the economy re-opens

Stay-at-home orders in California, the US’ most populous state will have been a key factor while the closure of dine-in eating in New York and other cities will also have weighed on spending.

Another key reason for the drop is that people did less socialising this holiday season. If you weren’t meeting up with friends and family you probably weren’t going to buy as many gifts – and especially not emergency presents just in case your long lost uncle miraculously made an appearance. Less socializing also meant less "insurance" food purchases for the above reasons.

Yet another round of stimulus cheques are unlikely to meaningfully boost retail sales in the near-term. Most will be saved as the chart below shows – household savings as a proportion of GDP jumped 11 percentage points in the 12M to end 3Q20. It certainly gives households cash ammunition to go and spend when the re-opening happens, but that will require a massive ramping up of the vaccination effort to prevent what is likely to be a weak start to 2021.

Households cash, checking & savings deposits (% of GDP 1950-2020)

Download

Download snap