US retail - back on top

US monthly retail sales have more than fully recovered from the crisis with the value of spending above that of February. However, maintaining those levels may be more challenging as fiscal support wanes and structural adjustments start emerging

Retail fully rebounds

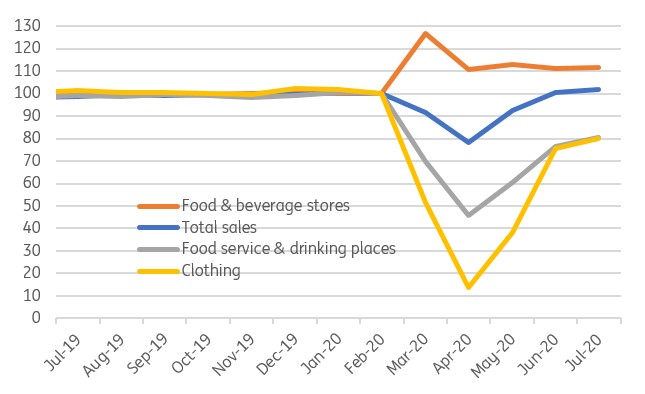

Headline retail sales for July rose 1.2% month-on-month versus the 2.1% consensus expectation, but the June figure was revised up to 8.4% MoM growth from 7.5% so in US dollar spending terms it is broadly in line. In fact the dollar value of spending is now 1.6% above the pre-crisis level of February.

The "control group" which excludes some of the more volatile components like gasoline, building materials and autos (and has a better match with broader consumer spending trends) was actually better than hoped, rising 1.4% (cons 0.8%) with the June figure revised up four-tenths of a percent. The details show electronics continue to do well, rising another 22.9%, but it is clear from all the categories that the pent-up demand effect that boosted activity as we emerged from our homes is now waning.

Level of US retail sales - February 2020 =100

Phase 2 challenges emerge

We are more nervous about the second phase of the recovery. Consumer confidence fell back in July and likely stayed low in early August as the rising number of Covid-19 cases and renewed containment measures heighted both health concerns and worries about the economy. Employment growth appears to have stalled since July based on high frequency data from Homebase, a payroll tracking company, while the lack of progress on a new fiscal package and the scaling back of unemployment benefits is squeezing incomes for 30 million or so recipients.

These factors appear to be contributing to a stalling in credit and debit card transactions since the beginning of July - down just over 2% based on evidence from wwwtracktherecovery.org. Consequently, we see the risk of a drop in the August retail sales report that will be published on 16 September. This would add to evidence seen in other data of a plateauing in the recovery after a vigorous rebound through May, June and early July.

Credit and debit card transaction (www.tracktherecovery.org)

More help is needed

As such calls for further fiscal and monetary policy support are likely to grow. Last week’s Presidential Executive Orders will provide some help, but more assistance for business and consumers will likely be required to ensure the positive economic momentum continues. Upward moves in Treasuries also needs to be watched carefully in case it translates into higher borrowing costs and we wouldn’t be surprised to see the Federal Reserve stepping up its asset purchases in coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap