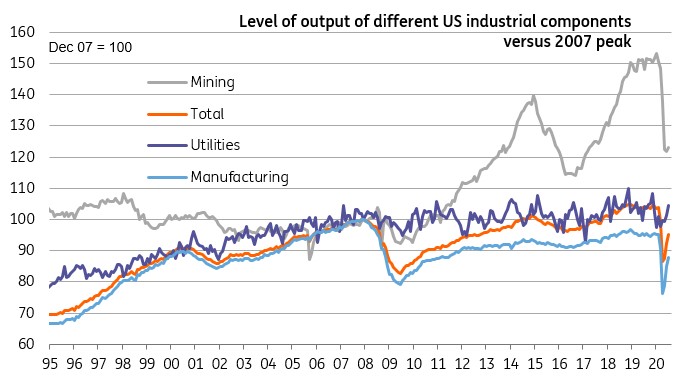

US manufacturing’s long road to recovery

Manufacturing continues to bounce as factories re-open, but this story is fading and with output still 8.2% below the December level, the strains are clear. The oil and gas sector remains in dire state with the threat of job losses lingering over the whole industrial sector

US industrial production came in exactly in line with market expectations, rising 3% month-on-month.

Manufacturing was up 3.4%, led by autos (+28.3%) with ex-autos posting a 1.6% gain. Utilities rose 3.3% as hotter than usual weather led to more electricity demand with AC units staying on longer and working harder. Rounding out the details, mining rose 0.8% although oil and gas drilling fell another 8% to leave that component 71.5% down YoY.

Level of industrial activity

Overall it is a decent outcome, but we caution that manufacturing output is still more than 8% lower than the most recent high in December.

The scope for further large gains on factory re-opening appears limited so additional gains will be determined much more by underlying economic fundamentals. Based on the high-frequency consumer sector data there is evidence of a plateauing in the recovery and it will be hard for the manufacturing sector to buck that trend.

In any case with capacity utilisation at relatively low levels (70.6% versus an average of 78% through 2019) corporate profitability remains under pressure which will constrain business appetite for investment and creating jobs.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap