US: Production sectors continue to struggle, but China reopening offers some hope

Today’s US data has been disappointing with housing, manufacturing and construction data all hinting at challenging conditions. Housing and construction will continue to be a big headwind for growth, but at least the China reopening story offers some hope for US manufacturing to rebound

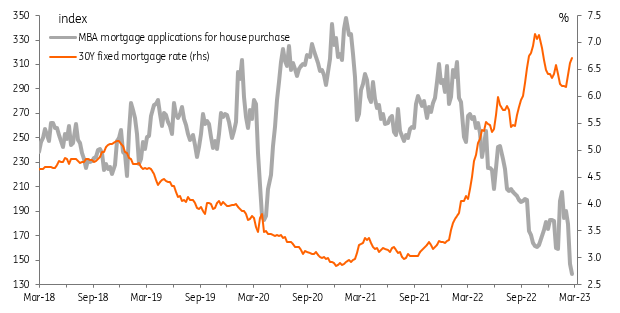

A rebound in mortgage rates depresses housing activity

The resurgence in US mortgage rates continued last week with the typical 30Y fixed rising to 6.71%, which on the $428,000 loan size averaged last week works out at a monthly mortgage payment of $2,767 per month. At the start of last year the typical mortgage rate was around 3.5% and on a $620,000 mortgage you would have been paying the same $2,767 per month.

This hit to affordability has led to mortgage applications plunging with yesterday’s S&P Case Shiller house price series reporting the sixth consecutive monthly fall in home prices. House price-to-income ratios remain above where they were in 2006 at the peak of the housing boom and to get us back to a long run average of 4.2 times for house price-to-incomes would imply prices need to fall by around 20% from here. Housing supply remains constrained so price falls are modest so far, implying this could be a long grind. However, should unemployment start to climb as a lagged response then the pace could rapidly gain momentum.

Mortgage applications for home purchase and typical 30Y fixed rate mortgage rate

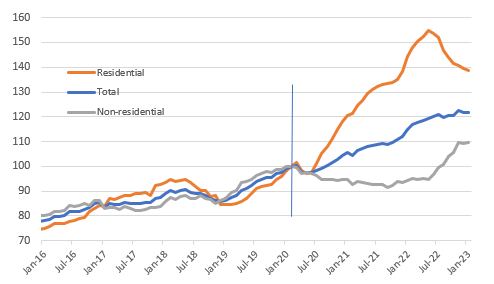

Construction will remain under pressure

Construction is responding though with residential construction spending falling for an eighth consecutive month in January. We had been hoping that warm weather would have provided a bit of a boost in that a lack of wintery weather would provide less disruption. We were wrong. Non-residential did rise, but not by enough to prevent total output falling 0.1% versus expectations of a 0.2% gain. Unfortunately, given the lack of buyer interest in the residential property market we expect construction activity to remain a drag on overall US economic growth.

Construction spending Feb 2020 = 100

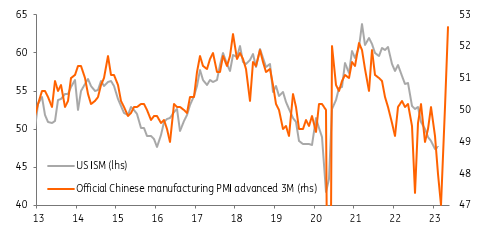

Manufacturing remains soft but China reopening provides opportunities

Rounding out the reports we have the February ISM manufacturing index. It rose from 47.4 to 47.7, so it remains below the break-even 50 level and undershot market forecasts of 48.0. The details showed employment falling back below 50, indicating job losses, while new orders, despite improving, also remain in contraction territory for a sixth consecutive month. This suggests that the sector will remain a drag on economic activity in the months ahead, but there is perhaps some light at the end of the tunnel.

US ISM manufacturing index versus Chinese PMI

The overnight surge in the Chinese PMI raised hopes the Chinese economy can bounce back strongly now that Covid containment measures have been scaled right back. If we do get a big big rebound in Asian growth that can help turn things around for US manufacturers. The chart above shows that historically the Chinese PMI tends to directionally lead the US ISM by 3-4 months. There has obviously been a lot of volatility in the Chinese PMI over the past year due to Covid measures, but perhaps the US sector is getting close to a bottom and we can gradually see some stabilisation in coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap