South Korea: Industrial production temporarily rebounded in January

Monthly activity data showed that weak growth continued this quarter. Although industrial production rebounded for the first time in seven months in January, weak February exports and manufacturing PMI data suggest production activity slumped again in February

| 2.9% |

Industrial Production%MoM sa |

| Higher than expected | |

Industrial production rose unexpectedly in January

*Statistics Korea has changed the base year of industrial production data from 2015 to 2020, thus the historical time series was updated accordingly.

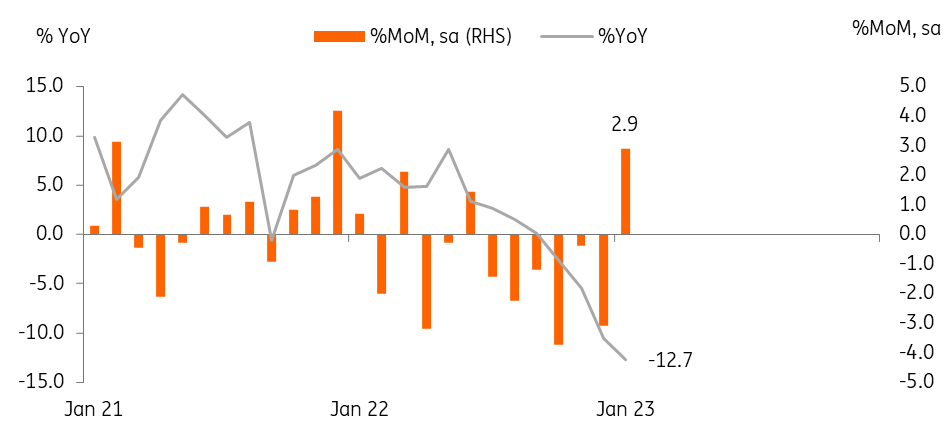

Manufacturing and mining IP rebounded 2.9% month-on-month (seasonally adjusted) in January, the first rise in seven months. The main factors were a large one-off increase (111.0%) in mobile phones & camera modules and a decent rise in automobiles (9.6%). In the first half of the year, we believe automobile production will continue to outperform, particularly when it comes to electric vehicles, hybrids, and batteries, but sluggish semiconductors (-5.7% in January) are expected to hamper production and investment. Supporting our view, the manufacturing PMI continued to contract, staying below the neutral 50-level for five consecutive months in February (48.5) with falling new orders for eight months.

IP rebounded for the first time in seven months in January

Exports declined in February

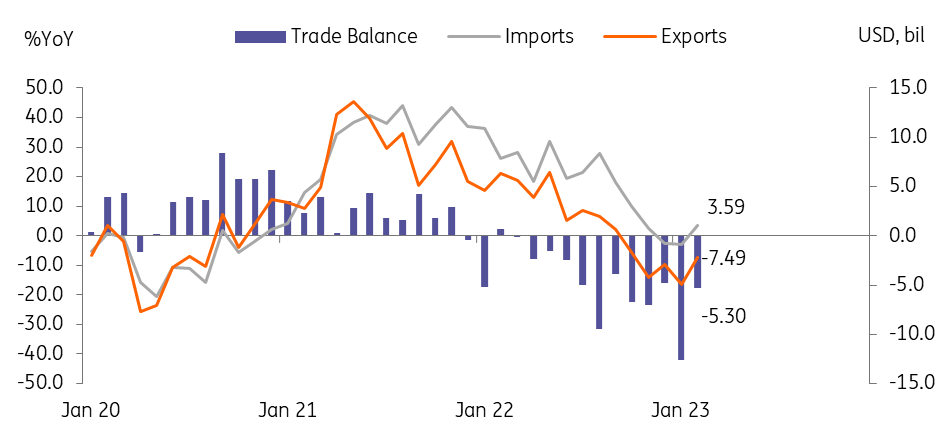

In addition, weak February exports yesterday signalled that the pick-up in January's industrial production may be only temporary. Exports fell 7.5% year-on-year (vs -16.6% in January) supported by favourable calendar effects ( +2 more working days compared to the previous year). Details showed that semiconductor exports plunged 43% while automobiles rose sharply by 47%. Thus, we believe that the deviation between semiconductors and autos will continue for a while. Also, exports to China declined by 24% amid falling semiconductors and construction-related machinery. We expect exports to China to rebound only in the second half of the year along with China's real estate market and global IT demand recovery.

Weak February exports suggest IP softened in February

Retail sales and investment declined in January

Retail sales declined 2.1% month-on-month (seasonally adjusted) for three months in a row as reopening effects dissipated and higher interest rates and deleveraging of household debt dragged down consumption. Facility investment also fell 1.4% MoM sa. Transportation-related investment increased but was offset by the decline in chip manufacturing equipment. Taking the recent export, production, and PMI data together, we expect GDP in the current quarter to contract (-0.2% quarter-on-quarter, sa) with growing downside risks.

BoK watch

Next week, we will have Feburary's CPI data. We expect CPI inflation to edge down to 4.9% YoY (vs 5.2% in January). If inflation continues to decelerate in the coming months and more visible signs of recession grow, then the Bank of Korea will likely stay put in April. However, the BoK will also need to consider how the Federal Reserve's rate hikes impact the domestic economy. Thus, the BoK will maintain its hawkish tone even if it does not raise the policy rate.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap