US: Manufacturing producing the goods

The US manufacturing sector remains in very good health despite a modest decline in the headline ISM index. Construction is performing even more strongly, led by activity surrounding the booming housing market. However rising price pressures are also evident, which will keep the markets' inflation hawks wary

ISM dips, but remains firm

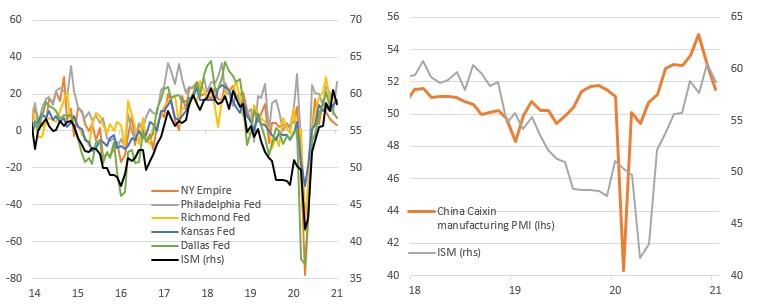

The January ISM headline manufacturing index dipped to 58.7 from 60.5, which was slightly worse than the consensus prediction of 60.0, but the fall is consistent based on the regional manufacturing indices and the decline in the Chinese PMI seen recently. Nonetheless, this is still a very strong figure by historical standards with the headline balance remaining above the 6M moving average of 57.8.

Regional surveys, the Chinese PMI and the ISM have all softened

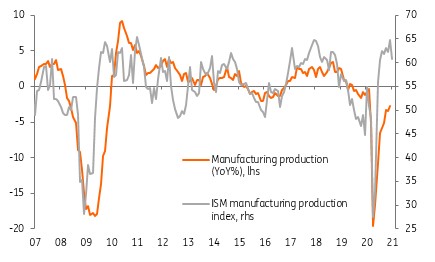

Both new orders and output are at very strong levels of 61.1 and 60.7, respectively, relative to the 50 break-even level. At the same time inventories remain very low at 33.1. Given a strengthening economy we would expect to see companies wanting to rebuild their inventory levels towards historical norms so this should indicate that both the orders and output components will remain strong in the months ahead.

Business optimism was also underlined by the fact that the employment component rose to 52.6, the best reading since June 2019, so it looks as though the manufacturing sector will be contributing positively to overall economic activity in the first quarter.

ISM output & manufacturing production growth - more upside to come

More evidence of inflation pressures

There will be some caution at the Federal Reserve though given the sharp increase in the prices paid component to its highest level since April 2011. This reflects input costs, particularly commodity and energy related, which have been grinding higher for several months now. Coming after last Friday’s surprise increase in the personal consumer expenditure deflator and the employment cost index, it could be interpreted as a sign that inflation pressures are becoming a broader issue for the economy.

While we think it is too early to be especially concerned, we do predict that headline inflation will rise above 3% and core inflation above 2.5% in coming quarters as price levels in a vibrant re-opened economy contrast starkly with twelve months before when the stresses of the pandemic saw companies slashing prices to generate demand and cash flow.

For now the Federal Reserve continues to tell us that they don’t think they will raise interest rates before 2024, but we feel that this will be increasingly difficult to reconcile with the data. 2023 looks increasingly like the starting point for higher US interest rates.

Construction boom

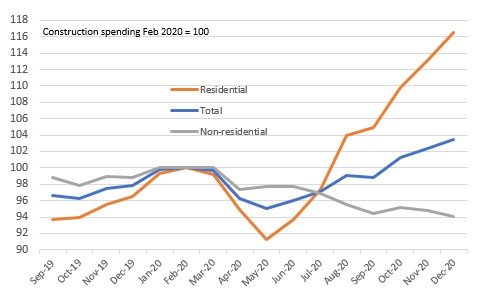

Meanwhile, construction grew 1% month-on-month in December and November's figure was revised up to show 1.1% MoM growth. A very strong set of figures, led by residential construction given the booming housing market.

Levels of US construction activity

Residential home construction is now up 16.5% on the previous peak seen in February 2020 and is up 28% from the low in May. It is all really in single home construction with six consecutive MoM increases in excess of 4.5%! Apartment construction is much weaker, but is at least positive. Meanwhile, non-residential construction is down 6% from the February peak and will remain lackluster given working from home. Government construction is also going to remain under pressure given state and local government budgets, but with more stimulus proposed that could turn around more quickly than the office sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap