Russia: Economy contracts modestly in 2020, but challenges to recovery remain

Russian GDP dropped by 3.1% in 2020, faring relatively well thanks to budget support, small services segment, and lack of prior overheating. However, with fixed investments and household income at multi-year lows, and limited room for further stimulus, GDP recovery beyond the base effect would be a challenge. We reiterate our 2.5% GDP forecast for 2021

| -3.1% |

2020 GDP, % YoYvs. 2.0% growth in 2019 |

| Better than expected | |

Lack of prior overheating, small services sector, and support to real estate cushioned the blow in 2020

The drop in GDP, according to the official first estimate, comes after 2.0% growth in 2019. This decline is only slightly worse than our -3.0% expectations, but is better than market expectations of -3.5% to -4.0%. The State statistics service (Rosstat) has also provided the structure of annual GDP by usage and production, which generally confirms our initial take on the reasons for the Russian economy's defensive performance in 2020. We have the following observations and takeaways.

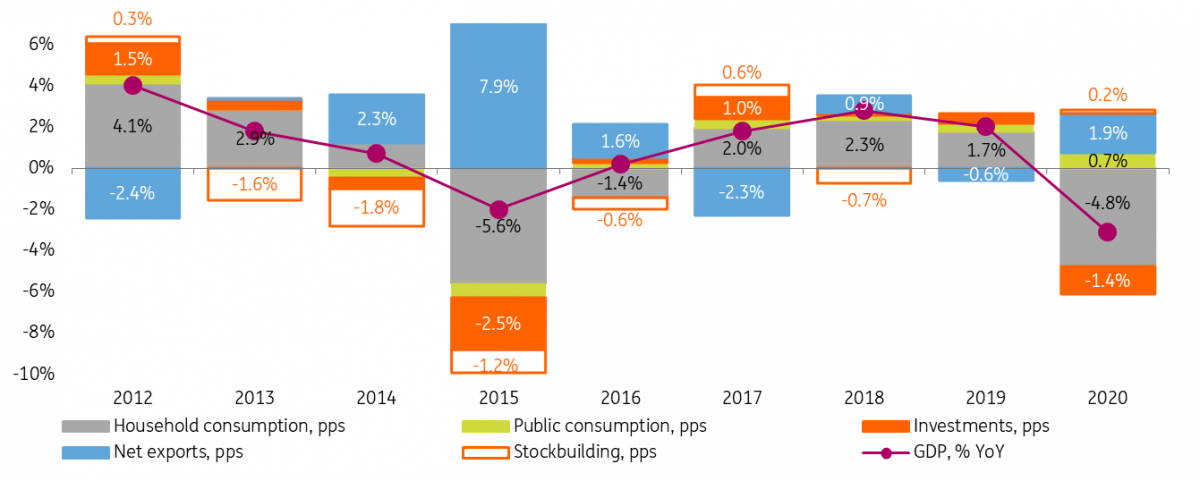

- Looking at the GDP by usage (Figure 1), it appears that lack of destocking was one of the supporting factors, unlike in 2015 and 2009. This was largely due to the fact that prior to 2020 the overall GDP growth rate was within 2%, and there were no accumulation of inventories. In other words, the lack of positive expectations before 2020 helped dampen the blow of the sudden stop.

- Another support factor (which may have partially contributed to prevent destocking) was increased budget support, as state consumption increased by a historical high of 4% in 2020 in real terms, making a positive 0.7 percentage point contribution to GDP dynamics and partially offsetting the negative effect of the 8.6% year-on-year drop in household consumption.

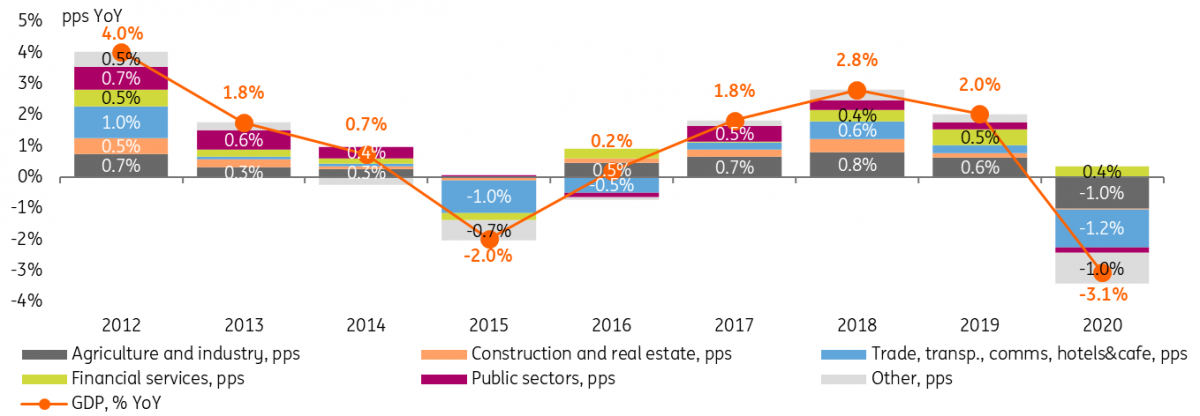

- GDP structure by production (Figure 2) illustrates the small share of services in Russia. For example, hotels and restaurants, the sector most hit by the lockdowns, dropped 24.1% YoY, but given its miniscule 0.7% share in the overall GDP, the negative contribution of that sector to GDP dynamics was limited to 0.2ppt. Overall, the combined negative contribution of the contraction in trade, transportation, telecoms, hospitality, and catering was only 1.2ppt in 2020.

- In addition, we note the stable positive contribution from the financial sector and lack of any drop in construction and real estate. Those appear to be related to increased interest of households to real estate, which in turn was a result of redustribution of savings by the high net worth segment and subsidized mortgage for the rest. To remind, while overall retail lending decelerated in 2020, the mortgage segment growth accelerated from 17% in 2019 to around 20% in 2020.

- Industrial sectors have also fared relatively well, with manufacturing output staying flat (with all the abovementioned factors likely preventing a decline), and the entire drop in industrial output assured by the 10.2% YoY drop in commodity extraction amid OPEC+ restrictions on output. The latter contributed a negative 1.0ppt to the GDP growth dynamics in 2020.

Figure 1: No destocking and state demand dampened the blow in 2020

Figure 2: Small services sector, and reliance on mortgages helped too

Recovery challenged by weak investment and household income amid limited room for fiscal support

The defensive performance of the Russian economy during the pandemic does not, however, guarantee a robust recovery afterwards. We see at least a couple of challenges:

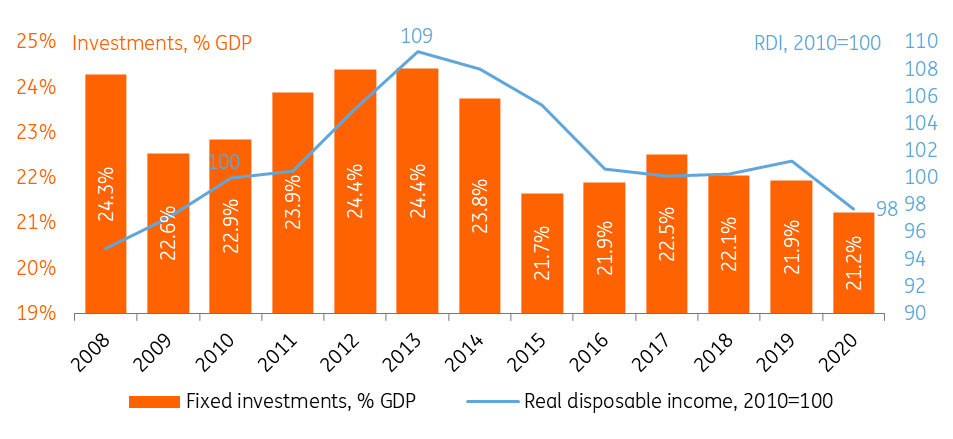

- Fixed investment trend appears under persistent pressure, as following the 6.2% YoY drop in 2020, its level is now 21.2% of GDP, the lowest reading since 2007 and far below the 25% of GDP previously targeted by the government. A material increase in invesment demand would require expectations of a long-term consumer recovery, however at least in the near term consumers are downbeat as a result of weak income, which slid over 10% since 2013 and is now lower than 10 years ago (Figure 3).

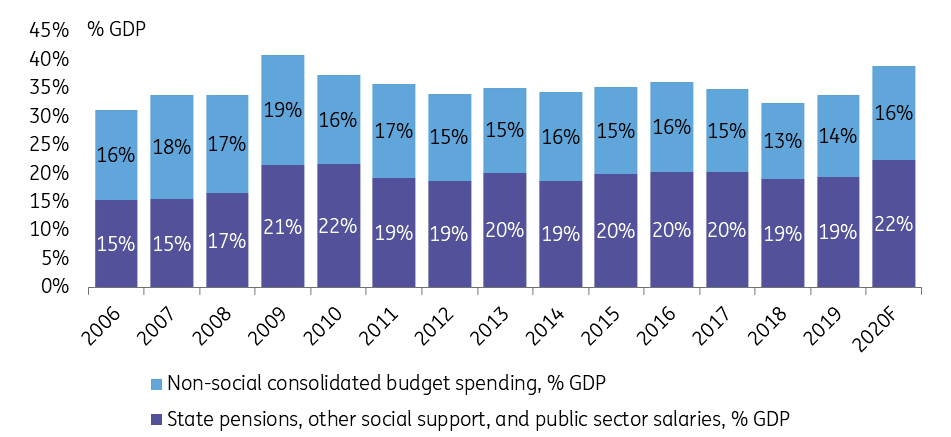

- Meanwhile, the government's ability to boost investment and consumer demand with conventional tools seems to be largely exhausted as following the 4% GDP fiscal support package disbursed in 2020, the level of overall consolidated expenditures is already at elevated levels close to 40% of GDP in our estimates, driven by both socially-focused and other spending (Figure 4). We believe that with budget breakeven Urals at a high US$74/bbl level (US$83/bbl net of one-off proceeds in 2020) the fiscal room for extra spending is limited to the 1% GDP spending backlog passed over from the previous years. This means that more subtle measures aimed at improvement in the mood in the private sector would be required to assure growth beyond the base effect this year.

Figure 3: Weak income and investment trend since 2014 remains a challenge

Figure 4: Budget spending already close to historical high

Maintaining our below-consensus expectations for 2021

Weak investment and household income trends and the lack of easy economic policy tools to address them make us skeptical of Russia's ability to post a recovery beyond the base effect in 2021, in line with a number emerging market and commodity peers. We therefore reiterate or below-consensus 2.5% growth expectations for 2021.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap