US: Manufacturing muddies the waters

After a remarkably strong retail sales report, a much softer-than-expected industrial production release underscores the strains that the pandemic continues to place on the economy

Manufacturing miss

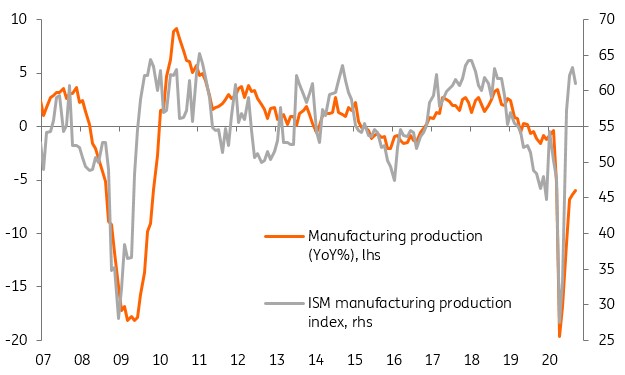

We had been hoping for a decent industrial production report to follow on from the knockout retail sales figures, but it hasn’t happened. While manufacturing surveys continue to point to rapid growth, the Federal Reserve has calculated that US industrial production fell 0.6% month-on-month with manufacturing output falling 0.3%. The market expectations were for a 0.5% gain for IP and a 0.6% increase for manufacturing.

The disappointment stems from the auto sector – despite the robust gains in car sales we saw just over an hour ago. Auto output fell 4% MoM (vehicles down 7.3%, car parts down 1.3%) in September after falling 4.3% in August, so maybe producers may be worried that the recent sales boom is not sustainable and are wary of building up too much inventory. Outside of the auto sector manufacturing output was flat. Defence and Space was the biggest positive, rising 2.1% MoM.

Manufacturing output underperforms the surveys

Overall activity still robust

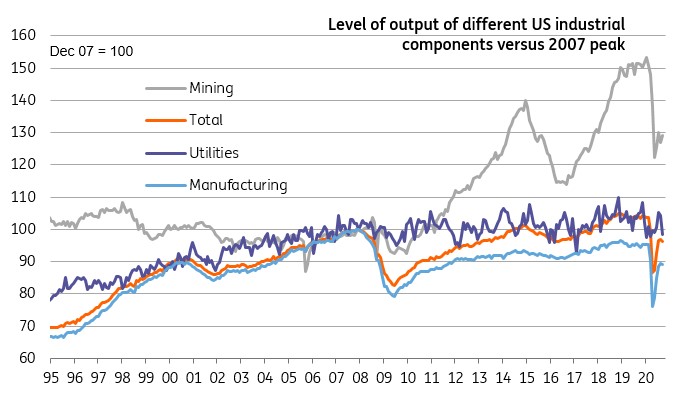

Utilities output fell 5.6% MoM as cooler weather returned in September – remember that August was hot with air conditioning units running overtime most of the month. Mining was up 1.7% MoM. In terms of the levels of activity, manufacturing is still 6.3% down on February, mining is down 14.4%, utilities are down 2.5%, leaving total industry output 7.1% lower than before the pandemic started to bite the economy.

The one consolation is that consumer spending is nearly 70% of the economy and manufacturing is only 10% so on balance the US is still well ahead. We continue to forecast 3Q GDP growth of 34.5% annualized due to the re-opening rebound with 4Q GDP likely to grow a more modest 4.5%.

Levels of output for different industrial components

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

16 October 2020

US hero, rates moving to zero This bundle contains 6 Articles