US: Manufacturing meltdown

The headline ISM manufacturing index fell only modestly, but this reflects quirks in the index calculation. Ignore it. The important details are simply horrible

| 41.5 |

ISM headline index |

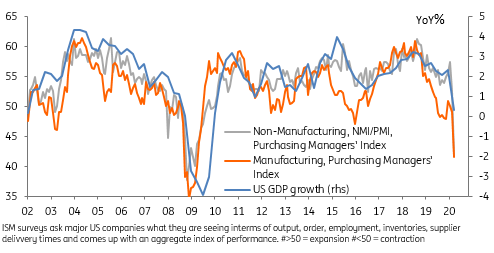

The ISM manufacturing index has dropped to 41.5 in April from 49.1 in March, but this doesn’t tell us the true story. It is driven entirely by the fact supplier deliveries surged to 76.5. All the important components – production, new orders and employment collapsed and are consistent with a deeper contraction than during the Global Financial Crisis a little over a decade ago. Production is at an all time low in a survey that goes back to the 1940s.

In normal times rising supplier delivery times are interpreted as a positive signal - huge levels of demand that businesses can't meet so supplier delivery times are extended. The component therefore boosts headline ISM. However, today, the rise in supplier delivery times is because everyone is restricting output so supply chains break down. This is obviously very bad, yet the survey doesn’t account for this and so it boosts headline ISM.

As can be seen in the chart below, the regional surveys are consistent with an ISM at around 30 – not 41.5. The production, employment and new orders are all clustered around 27.1-27.5, which as the right hand chart shows, is consistent with manufacturing output falling close to 20%YoY.

ISM headline lags regional surveys. The production index shows the true picture

Manufacturers are caught between a rock and a hard place. What started off as initially as a supplier related problem – output restricted by the fact Asia supply chains shutdown – quickly morphed into a demand issue as those shutdowns spread to Europe and the US. The foreign supply issue will start to ease as China re-opens, but the domesrtic one won't and there is no end in sight for the demand drop.

With revenues under immense pressure firms are increasingly looking to cut costs, which means more bad news for the jobs market. The ISM employment component has only been lower once – in June 1949 – which underlines the immense strain the sector is under. So far, the 30 million or so jobs lost have been concentrated in retail, travel and hospitality but the pain is clearly spreading. Next week’s unemployment rate figure will probably come in around 16%, but May’s will almost certainly break above 20%.

Download

Download snap