US manufacturing madness

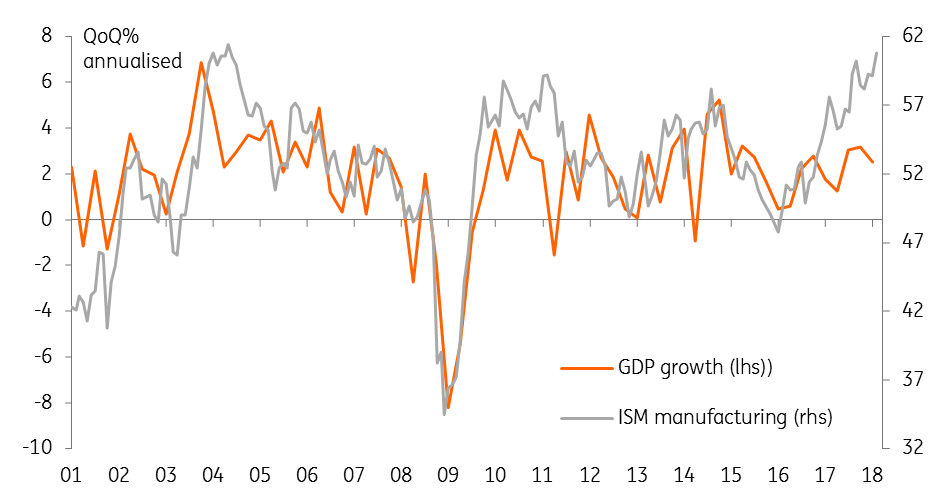

The ISM manufacturing index has confounded market expectations and pushed back above the 60 level - a number that in the past has been consistent with 6% real GDP growth

| 60.8 |

Manufacturing ISM indexHighest reading since May 2004 |

| Better than expected | |

The February reading of the manufacturing ISM index has easily beaten market expectations, rising to 60.8 from 59.1 whereas the consensus was looking for a dip to 58.7. The details show a massive rebound in employment to 59.7 from 54.2 while there is a growing backlog of orders (59.8 from 56.2). The dollar’s weakness and a strengthening global economy mean that new export orders have recorded a higher reading on just two occasions in the past 30 years.

Given orders and production are also well above the 60 level – remember that a reading of 50 notionally means stable output - the report suggests that the manufacturing sector will continue to contribute significantly to economic activity in coming months. However, inflation pressures are also clearly building with prices paid the highest since 2011. As such, this report supports our predictions that the US economy will expand 3% this year and that headline inflation could hit 3% in the summer. With new Fed Chair Jay Powell seemingly backing the case for further policy tightening, we look for a March 21st rate hike with three more to follow later this year.