US manufacturing in solid shape

The ISM manufacturing survey suggests the sector is rebounding quickly from the Covid-related lockdowns with new orders surging higher. Employment continues to look subdued and hints at some caution in the sector surrounding the longer-term outlook. Construction is also weaker than hoped, but in general, it all paints a positive picture for 3Q GDP growth

August's ISM manufacturing index has risen more than expected to stand at 56.0 well above the 50 break-even level which determines expansion/contraction in the sector. The consensus was looking for 54.8 versus July’s reading of 54.2.

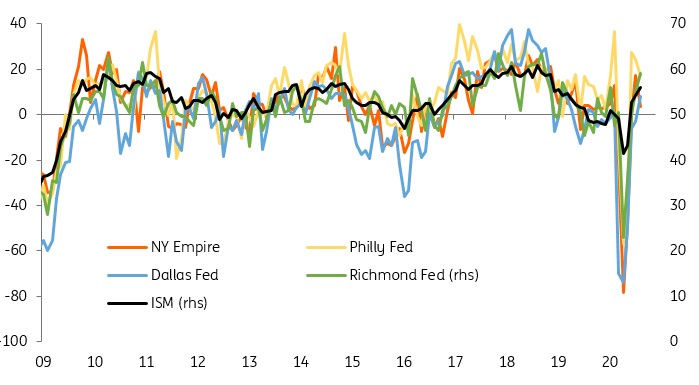

It is the strongest headline reading since November 2018 and appears consistent with development in the regional business surveys, as you can see in the chart below. As for the components, production rose to 63.3 from 62.1 while the new orders component has surged to its highest level since 2004. This suggests good durability for the recovery process through the rest of the year. Employment remains in contraction territory though at 46.4 versus 44.3. The fact that it is edging closer to the break-even 50 level suggests a slower pace of lay-offs than last month.

Headline ISM versus regional surveys

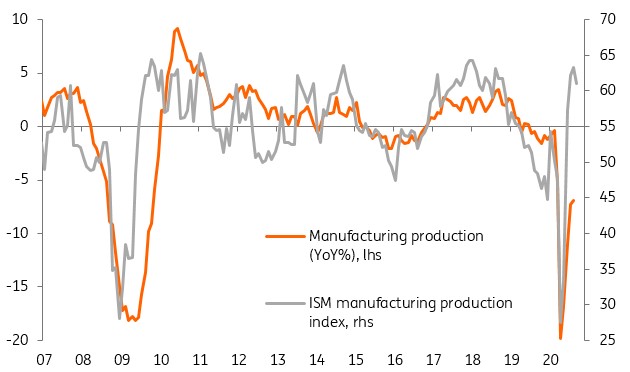

This is all very positive and suggests that manufacturing is finding its feet after output plunged in the wake of Covid-19 lockdowns, but we must remember is that it is an index of the relative share of firms experiencing expansion/contraction. Firms are asked the question 'are things getting better, staying the same or getting worse?'. Coming out from complete lockdown we should be expecting things to be "getting better", but we have no idea of the magnitude of how much better they are. We don't know if orders have risen 0.1% or 1000%, just that more companies are reporting rising orders. Nonetheless, the historical relationship in the chart below offers clear hope that the sector is moving in the right direction

ISM production component versus official manufacturing output growth

Offsetting that positive story, we have a modest disappointment in that construction spending seems to have stalled at a low level. Rather than rising 1% as expected, it came in at just a 0.1%MoM gain following four consecutive months of declines that totalled -5.4%. Residential construction is doing well given strong mortgage application and housing numbers, but non-residential is having a tougher time. Companies are not queuing up to lease shiny new office buildings given the home working situation looks to be long-lasting while manufacturing firms (despite the healthy figures) remain wary about expanding production facilities.

Public-sector construction is also weak given state and local governments budget are clearly under pressure due to extra Covid related expenditure and a loss of tax revenue. Construction is therefore likely to continue to underperform given it is roughly split 60:40 in favour of non-residential.

Download

Download snap