US: Manufacturing bounces, jobs still being shed

A strong ISM survey suggests manufacturing is finding its feet, but renewed shutdowns amid rising Covid-19 cases means firms remain cautious. Jobs continue to be lost in the sector, reinforcing our sense that Friday's all important payrolls number could disappoint

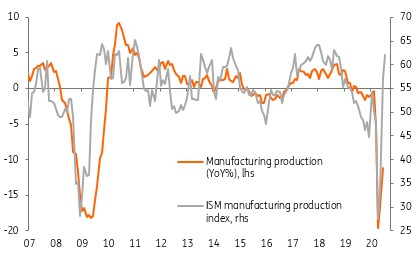

The July reading of the ISM manufacturing index is a very decent 54.2, well above the 50 break-even level which determines expansion/contraction in the sector. The consensus was looking for 53.2, so it is yet another upside surprise for the official data. It is also the strongest headline reading since March 2019 and while the new orders component is at its highest level since September 2018, production is at its highest since August 2018.

The report suggests that manufacturing is finding its feet after output plunged in the wake of Covid-19 lockdowns, but we must remember is that it is an index of the relative share of firms experiencing expansion/contraction. It doesn't tell us anything about magnitude, merely the breadth. After the scale of shutdowns we really should be seeing a large proportion of firms saying they are experiencing rising output.

ISM points to recovery in output

The one disappointment is in the employment component, which while improving, remains below the break-even 50 level at 44.3. This tells us jobs continue to be lost in the sector, but at a slower rate than in June. With the number of Covid-19 cases picking up businesses are likely to remain cautious, fearing the economic effects of re-instigated containment measures. As such we see the employment component continuing to struggle, particularly with profitability having been severely hit and firms reluctant to expand capacity given the lingering Covid-19 uncertainty.

In this regard, we are far more cautious that the market on Friday’s US jobs report, forecasting employment growth of 750,000 versus the consensus forecast of 1.5 million. In fact, the data from Homebase and the Census Bureau’s Household Pulse survey pointing to the risk of an outright decline. So, while the economy has bounced since early May on re-openings, making further significant gains through 2H20 will be much tougher.