US: Still going strong

After recording 4.2% annualised GDP growth, the ISM manufacturing index suggests the US economy is gaining momentum rather than losing it, reinforcing the case for two more rate hikes from the Federal Reserve this year

The ISM index for August has jumped from 58.1 to 61.3, its highest reading since May 2004. This is significantly better than the market consensus of 57.6 and suggests that while companies may be concerned about Trump’s protectionist policies, the underlying strength of demand remains fantastically robust.

New orders jumped to 65.1 from 60.2 while production increased to 63.3 from 58.5. Given a reading of 50 is the break-even level, these are incredibly strong levels. Even the new export orders figures are good – dipping ever so marginally to 55.2 from 55.3, while employment increased to 58.5 from 56.5. The rise in the backlog of orders adds further upside potential for output in 3Q and 4Q.

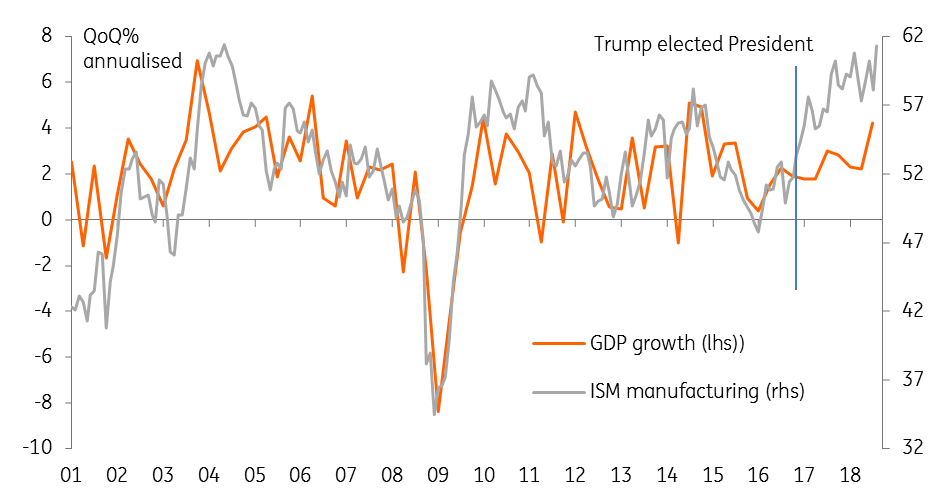

With profits accelerating and durable goods orders growth indicating a firm contribution to GDP from investment in 3Q18, the corporate sector is in great shape. Moreover, the ISM is at levels historically consistent with GDP growth of around 8%. However, as the chart below shows, the relationship between the two series has broken down since President Trump’s election. Nonetheless, it suggests that US business is weathering the protectionist storm for now, reinforcing our view that the Fed will hike rates again in both September and December.

ISM Manufacturing Survey vs GDP growth

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap