US ISM manufacturing highlights upsides for growth

Another strong reading shows US manufacturing hasn't been negatively impacted by bad weather, adding to the case for more Fed hikes

| 59.1 |

ISM manufacturing reading for JanuaryConsensus was 58.6 |

| Better than expected | |

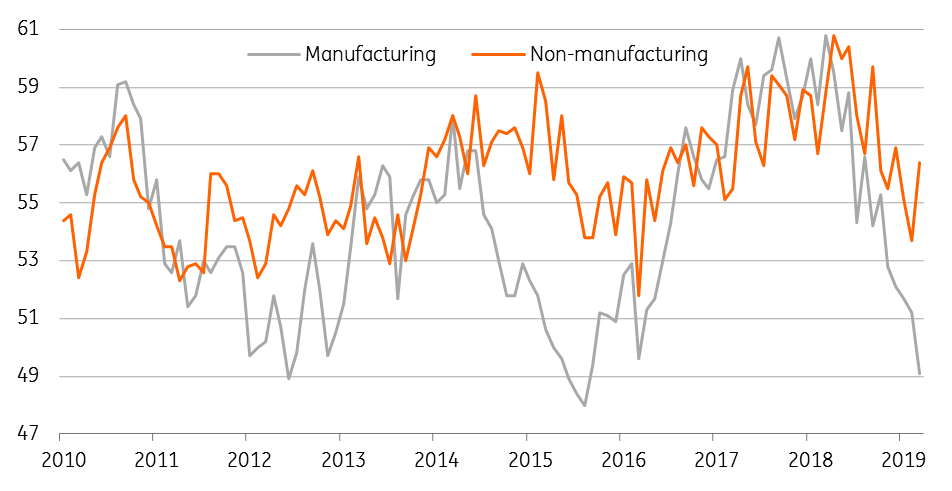

The US ISM manufacturing report for January shows the headline balance coming in slightly above expectations at 59.1 versus the 58.6 consensus. It is down modestly from December but remains very close to the strongest reading since 2004.

The components are pretty good with new orders dipping slightly to 65.4 while production was at 64.5 – remember the breakeven reading is 50 so these are really strong figures. Employment was a bit softer at 54.2 versus 58.1 previously, but this is still indicative of healthy jobs growth. Export orders continue to benefit from the combination of the weaker dollar and stronger global demand – they are at their highest level since April 2011. Note also that price pressures are intensifying with the prices paid component hitting 72.7 from 68.3 – the highest reading since May 2011 with every single industry surveyed reporting higher prices.

| 72.7 |

Highest manufacturing inflation figure since May 2011 |

ISM points to upside for GDP

We expect to see ongoing strength in manufacturing data. The 4Q GDP report showed a sharp run-down in inventories, which we think will be replenished in the first half of this year, while export demand will continue to grow, helped by the dollar’s declines. At the same time, tax cuts have lifted business sentiment and the sector is creating jobs in significant numbers. Today’s report also suggests that activity hasn’t been unduly impacted by bad weather at the start of the year, which will intensify expectations of Fed interest rate hikes.