US investment spending - grounded

2019 was a poor year for business investment. We hope the US-China trade agreement may provide a platform for better numbers in 2020, but today's durable goods reports signals little sign of an imminent turn

The military to the rescue

US durable goods orders rose 2.4% month on month in December, which was well ahead of expectations, but the details paint a much darker picture. Strip out defense (which rose 90.2% MoM!) and durable goods orders were down 2.5% following a 0.5% drop in November. Civilian aircraft orders fell 74.7% MoM following a 28.4% decline in November, which of course reflects the problems at Boeing. The cessation of production of the 737-Max earlier this month has meant less orders for the 600 or so different part suppliers while actual Boeing aircraft orders slumped to just 3 for December versus 63 in November.

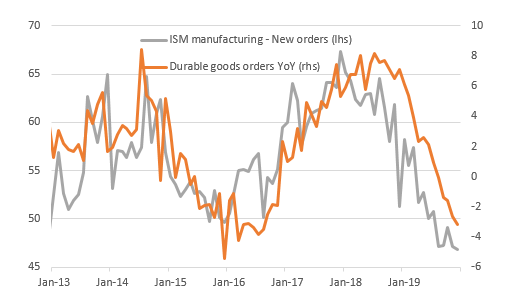

Orders continue to slide

No sign of a turn yet

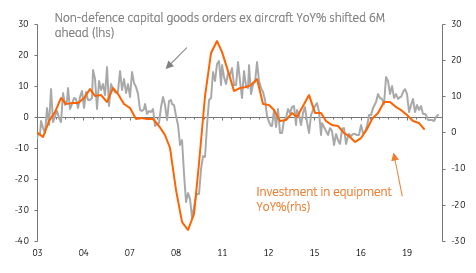

Nonetheless, it isn’t just about Boeing. Non-defence capital goods orders ex aircraft slumped 0.9% versus expectations of a 0.4% rise. This is significant because it strips out the volatile components of the report (defence and aircraft, obviously) and has a much stronger correlation with investment spending in the US. The chart below shows an uptick in the YoY rate of growth, but we would caution that it reflects a very weak reading at the same time last year (coinciding with the start of the December 2018-January 2019 government shutdown) and we, unfortunately, strongly suspect that it will be back in negative YoY growth again next month.

Investment and manufacturing orders

Investment set to remain subdued

Investment spending was disappointing through 2019. The uncertainty generated by the trade war, the weakness in global demand and the effects of a strong dollar may all have played a part in this. Now that US-China trade relations are on a better footing this could provide a platform for stronger numbers in 2020, but we don’t see it as a transformational agreement that will unleash an investment boom.

It is far too early to say if the coronavirus outbreak will have a dampening effect on business spending. However, with the recent Deloitte’s CFO survey showing 97% of respondents thinking the US is either already in a downturn or will be at some point this year, we don’t have much confidence that US business leaders are about to start spending in a meaningful way. We are also cognizant of the fact that presidential elections typically make firms wary of putting money to work given the potential for significant regulatory/taxation changes. As such, investment is unlikely to offer much upside for GDP growth and reinforces our sub-consensus outlook for US activity, inflation and interest rates this year. indeed, we continue to see a strong chance of a Fed rate cut before the summer is out.

Download

Download snap