US investment - finally some good news

Durable goods orders have plunged, but this is purely a Boeing story. Outside of transportation the story is much less negative with a key index of capex actually rising! How sustainable this is will depend on how quickly the economy re-opens given manufacturing surveys are painting a grim picture right now

Hope in the details!

US durable goods orders plunged 14.4% in March, but the details are much better. Transportation orders took a huge hit (-41% month on month), which is once again attributable to Boeing’s woes (civilian aircraft orders fell 295.7% MoM!!!). There were just 13 Boeing aircraft orders in March, but they also experienced 295 order cancellations, which are subtracted in the durable goods report – the Census Bureau uses net orders in its calculations.

Excluding this component orders fell only 0.2% – a fantastic outcome given what has happened to manufacturing surveys. Electrical equipment was up 1.5% and capital goods rose 1.3%.

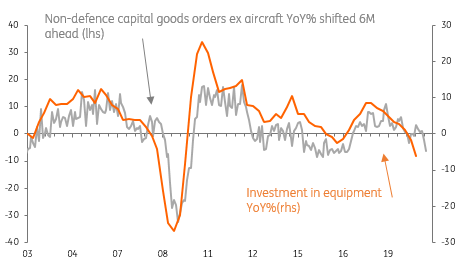

The Fed is known to follow the non-defence capital goods order ex aircraft component closely given this is typically a good lead indicator for investment in equipment and capex in general. It actually rose! Only 0.1% admittedly, but this is much, much better than the -6.7% consensus expectations and offers hope that our -6% annualised GDP estimate for next week’s 1Q GDP report may be a touch too pessimistic.

Core new orders offer hope for continued investment spending

But 2Q will be worse...

Nonetheless, we can’t be too upbeat. We still expect to see investment fall sharply through 2Q and given the long lead times, we suspect we will also see hefty falls in 3Q irrespective of whether the economy has re-opened by then.

With manufacturing surveys pointing to output contracting 20%, there is little need to increase productive capacity while the carnage in the oil industry given recent price plunges suggests this capex hungry sector is also going to be face major cut backs in expenditure.

This is just one more reason why we doubt a V-shaped recovery is possible with a base case scenario being that the economy contracts 13% peak to trough with the lost output not recovered until mid-2022.