US: Inflation reflects Covid unwind

Inflation has surprised on the upside, but we see this more as an an unwinding of the strains caused by Covid-19 shutdowns rather than a signal there is a meaningful pick-up in medium-term price pressures

Inflation surprises on the upside

US consumer price inflation came in higher than expected in July, posting 0.6% month-on-month gains for both headline and core CPI versus 0.3% and 0.2% respective consensus expectations. This leaves the respective year-on-year inflation rates at 1% and 1.6%.

After yesterday’s firmer-than-anticipated PPI report there was going to be some upside threat, but the scale of the rise in the core measure is quite a surprise. However, we see this more as an an unwinding of the strains caused by Covid-19 shutdowns rather than a signal there is a meaningful pick-up in medium-term price pressures.

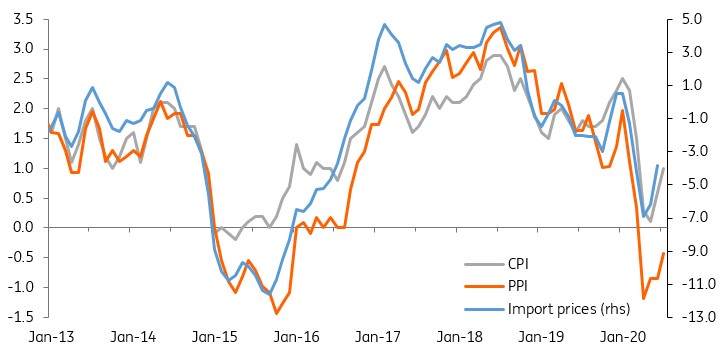

US inflation measures moving in tandem

Near-term yield curve steepening to continue

For example, apparel rose another 1.1% after the aggressive discounting of April and May concluded when retailers were desperate for cash. Likewise, transport jumped 2.9% and lodging away from home rose 1.2% (hotels) as people start to move around the country more and firms have a bit more pricing power. Meanwhile gasoline rose 5.6% MoM, reflecting higher pump prices as a lagged response to the recovery in the oil price and car prices picked up 0.8% MoM.

With the US Treasury seeking to sell $38bn of 10Y treasuries today and $26bn of 30Y tomorrow, these higher inflation numbers and the recent softer tone to the US dollar supports our debt strategy team's view that we see more curve steepening in the near term. However, we are not fearful of a meaningful rise in inflation over the medium term.

Little medium-term inflation threat

The US is a service sector orientated economy and so inflation is predominantly driven by service sector factors. The biggest input to service sector prices is labour and when you have more that 30 million people claiming unemployment benefits there is likely to be a glut for quite a while. This will keep wage pressure subdued, thus limiting the upside for service sector inflation.

We also have to remember that the economy is 10% smaller than it was in December so there is a huge output gap that will limit the upside for broader inflation pressures, even if the dollar weakening trend continues. Today’s inflation figure is a corrective move, but in our view the threat of prolonged higher inflation is limited.

Download

Download snap