US inflation keeps grinding higher

US inflation is on the verge of 3% and with a tight jobs market and strong economic growth, the Federal Reserve will continue to raise interest rates, despite the worries on trade

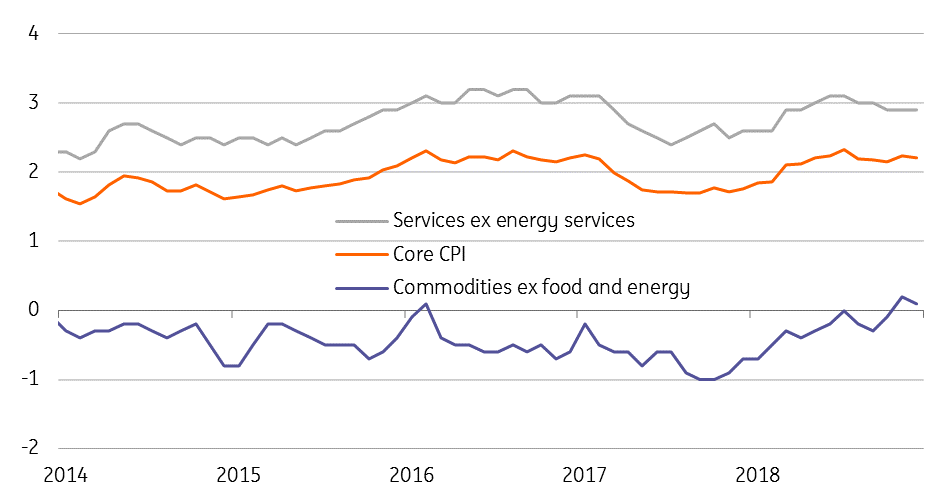

US consumer price inflation for June has come in showing a 0.1% MoM increase, which pushes the annual rate of inflation up to 2.9% - the highest since December 2011. Excluding the volatile food and energy components, core CPI rose 0.2% MoM, resulting in an annual inflation rate of 2.3% - the highest since August 2016.

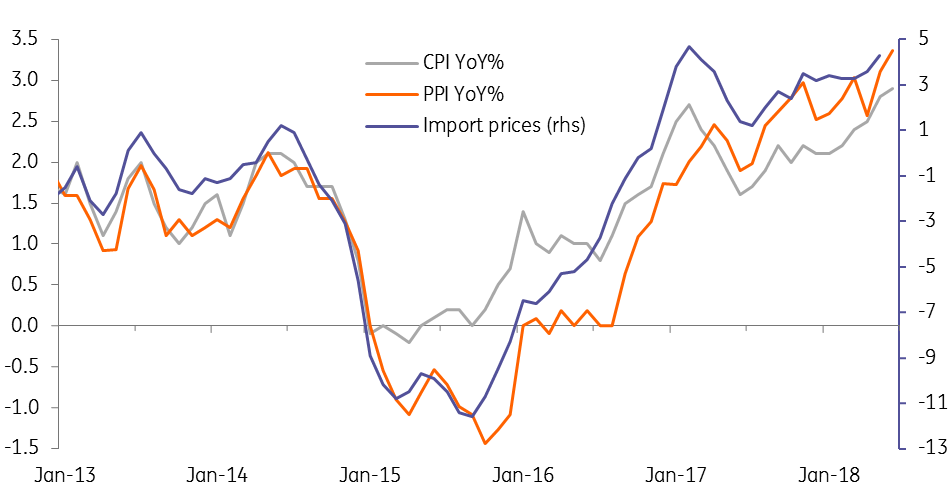

Pipeline price pressures are still on the rise with import and producer price inflation also hitting new highs. As such there is a strong chance consumer price inflation continues heading up in the months ahead.

Pipeline price pressures continue to build

Energy was weaker than expected, falling 0.3% MoM, which was why the headline MoM increase was below the 0.2% consensus forecast. There was also weakness in apparel (-0.9% MoM) while tobacco prices fell 0.4%. Most other components were well behaved, although medical care costs up 0.4% MoM were relatively strong. Given the tight jobs market, rising tariffs and general capacity issues within the economy, we think inflation will continue to rise. In fact, we are likely to be up at 3% for headline CPI next month with core CPI set to breach the 2.5% level soon afterwards. With the headline and core personal consumer expenditure deflators also having increased, all of the inflation measures the Federal Reserve looks at are at or above the 2% medium-term target.

All major inflation readings are at or above the Fed's 2% target

So the US has an economy that probably grew 4% in the second quarter, has an inflation rate rapidly heading to 3% at the same time as arguably experiencing the strongest labour market for 50 years. This suggests that even with the uncertainty generated by trade protectionism the Federal Reserve should continue tightening monetary policy “gradually”. This is certainly the line that we expect the Federal Reserve’s semi-annual monetary policy report to take on Friday. We continue to look for two further rate rises this year – one in 3Q and one in 4Q18.