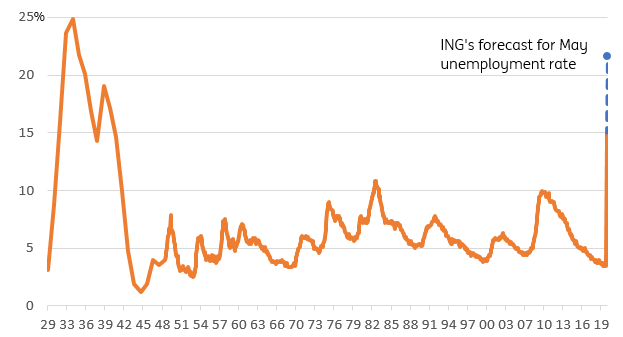

US: Highest unemployment rate since 1940

Today’s jobs report is horrible with the unemployment rate up at 14.7% and 20.5 million jobs lost in April, but the data will continue to deteriorate. Social distancing, consumer angst, travel restrictions and the legacy of up to 40 million jobs lost mean there is zero prospect of a V-shaped recovery

| 14.7% |

US unemployment rate |

20.5 million jobs lost broadly across sectors

As widely expected, based on intitial jobless claims data, we see that US non-farm payrolls fell 20.5 million in April with the unemployment rate reaching 14.7%. A truly terrible outcome resulting from Covid-19 containment measures.

The details show job losses were broader than we had expected – it clearly isn’t just retail and hospitality that were impacted in the first wave. 7.7 million jobs gone in leisure and hospitality, 2.1m in business services, 2.1m in retail, 2.5m in health/education, 1.3m in manufacturing, 1 million in construction and 1 million in state and local government.

US payrolls monthly changes and total payrolls

Unemployment surges with just 51.3% of working age employed

Unemployment, as measured by the household survey, didn’t rise as much as implied by the payrolls plunge (it was up 15.9 million), most likely due to self-classification issues and the fact that some of those impacted may have lost more than one job. For example, someone who works in a shop in the daytime and as a cleaner in the evening would only count once in the household survey if they lost both jobs, but twice in the payrolls report. Alternatively, a student who has just lost a part-time bar job, may not classify themselves as unemployed as they are a student and therefore outside of the labour force (instead they are contributing to a drop in the participation rate to 60.2%).

This means the unemployment rate is now the highest since 1940 – see chart below. We can only get annual data back to 1929 on this. Another terrible statistic is that just 51.3% of people of working age now have a job – it will be below 50% next month.

As expected, we also saw an outsized jump in average hourly earnings of 4.7%. With 20 million people towards the lower end of the income spectrum dropping out of the calculation for “average” hourly earnings we automatically got a big skew to higher “average” hourly earnings for those still in work. Ignore it – no-one is getting a pay rise in the US.

US unemployment rate 1929-2020 with ING forecast for May 2020

The outlook for the May report and beyond

As for the May jobs report, to be published on 5 June, we expect to see a payrolls drop of around 12 million. Remember that the data is collected in the week of the 12th of each month so if we assume weekly initial claims comes in at 3 million next week that would give a four-week total of around 14.5 million on the debit side of the ledger – those job losses will increasingly be in manufacturing and business services. However, with more and more states opening-up there is going to be increased hiring in the economy after virtually nothing in April.

Hiring will be tentative at first as retailers and restaurants start to open their doors. Social distancing restrictions will be in place such as with Texas restaurants only allowing 25% of maximum occupancy and Georgia allowing 10 customers per 500 square foot. We also must consider whether consumers remain somewhat anxious about returning to normal life given the health concerns, while the legacy of 30-40 million unemployed people means that there will naturally be less demand as many households are forced to retrench.

Most businesses won’t need as many staff as they had before the pandemic hit while many businesses may simply take the view that it isn’t economically viable for them to open at this stage and they remain closed. Regular retail will be having to do similar calculations on what is worthwhile opening.

With social distancing, consumer angst, travel restrictions and the depressing effects of mass unemployment mean that economic activity and employment will certainly not be exhibiting a V-shaped recovery. If we can get unemployment back down to 8-10% by year-end that would likely be a “good” outcome.