US: Glimmers of hope in the gloom

Durable goods orders plunged in April, led by steep declines in aircraft, auto and defence orders, but other areas held up much better. This offers some hope that corporate America more broadly is proving to be relatively resilient

US durable goods orders fell 17.2% month on month in April, which was less than consensus expected, but with downward revisions to the history, the US dollar level of orders is broadly in line with expectations. The bulk of the hit was in autos and parts, which saw orders fall 52.8% – understandable given the shutdowns in production. Defence orders fell 30.8% and non-defence aircraft fell 46.9%.

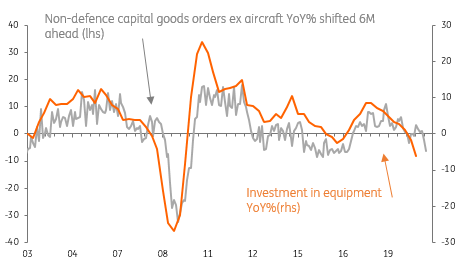

However, there is some good news in that the so called “core” figure – non-defence capital goods orders ex aircraft, which is viewed as a decent lead indicator for capital expenditure, didn’t fall quite as much as feared. It dropped by only 5.8% versus the 10% fall expected and thereby offer some optimism that firms are perhaps not retrenching particularly aggressively – especially relative to the Global Financial Crisis.

It could have been a lot worse for orders...

Nonetheless, it is early days and the hit to corporate profitability caused by the Covid-19 crisis could mean that firms remain reluctant to replace older equipment, particularly as capacity utilisation remains so low. As such there is scope for further declines over coming months. Aircraft orders are also likely to remain weak given the troubles faced by the airline industry, but we are hopeful that auto-related orders will pick up given the re-opening of car plants and evidence suggesting that car sales are recovering.

In this regard we need to recognise that just like housing, the typical new car buyer is in their late 40s and is less likely to be impacted by job losses in the leisure, retail and hospitality industries. Given the financing incentives available right now there are deals to be had that can support demand for output.

GDP revised down to -5%

We have also had 1Q 2020 GDP revisions. After initially being reported as a -4.8% annualised decline, it is now reported as -5% thanks mainly to a sizeable downward revision to residential investment (was +21%, now +18.5%) and inventories (now subtracting 1.4% from headline growth after having previously been reported as only subtracting 0.5%). Consumer spending and non-residential investment were actually revised a little higher.

As for 2Q 2020 GDP we continue to look for an annualised decline of 40%. This will be driven primarily by consumer spending and investment as lockdowns hit hard during mid-March to mid-May. We are now embarking on the re-opening phase and look for slight improvements in monthly indicators for May and much better numbers for June.

Unfortunately, we doubt that the US will experience a V-shaped recovery. The social distancing constraints, likely ongoing consumer caution until there is a vaccine plus the impact on aggregate demand from mass unemployment will limit the pace of the rebound. Throw in the potential for long-term structural changes (think business travel and home working as examples) and it means at best we think the lost output in 1Q and 2Q won’t be fully regained until late 2022 at the very earliest.

Contributions to GDP growth