US consumers lose momentum as inflation undershoots Fed’s predictions

Consumer spending slowed sharply through the fourth quarter and we will need to see a rapid turnaround to prevent a contraction in the first quarter of this year. Meanwhile, the Fed's favoured measure of inflation is already undershooting the Fed's forecasts from last month, adding to a sense that the peak is close for interest rates

Consumer slowdown intensifies...

The US December personal income and spending report contains a few interesting bits and pieces that build on yesterday's fourth quarter GDP report. It confirms that consumer spending slowed rapidly through the quarter with month-on-month real spending growth of +0.4% in October followed by -0.2% in November and -0.3% in December. This loss of momentum is not helpful for generating a decent first quarter consumer spending number. To highlight this, if we get 0 growth in each month (January-March) we will get a negative first quarter consumer spending number of -1% annualised. To get a positive number we obviously need to see a robust rebound in those MoM numbers, which we are not confident about.

... as inflation pressures continue to ease

Meanwhile the Federal Reserve's favoured measure of inflation, the core personal consumer expenditure deflator, rose 0.3%MoM/4.4%YoY, in line with expectations, but below what the Fed was projecting at its December Federal Open Market Committee meeting – the summary of economic projections had the fourth quarter average at 4.8%, but it is actually 4.7%.

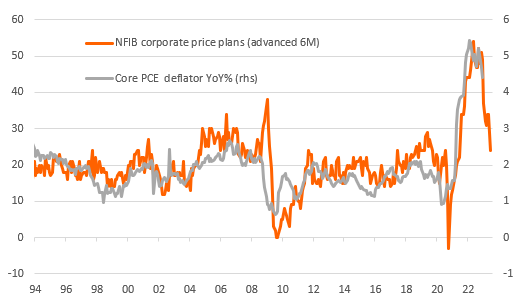

Core PCE deflator set to slow as corporate pricing power weakens

In terms of the outlook we expect to see this measure of inflation falling sharply through the second and third quarters. It won’t be as rapid as the core CPI declines given the different weighting of shelter costs and vehicle prices, but we still see it in a 2-2.5% range by year-end. As the chart above shows, corporate pricing power is apparently weakening rapidly with the National Federation of Independent Businesses reporting a steep drop in the proportion of businesses expecting to be able to raise their prices in the months ahead. If the relationship with the core PCE deflator continues to hold and recessionary forces continue to intensify then the Fed will be cutting rates in the second half of the year.

Download

Download snap