US confidence under renewed pressure

While the Conference Board measure of consumer sentiment fell marginally, there was a bigger decline in the more important expectations series, particularly in key Presidential election swing states. This does not bode well for Donald Trump's chances of re-election and with incomes being squeezed and Covid-19 cases on the rise, neither for the economy

A softening outlook for spending

The October reading of the Conference Board measure of consumer confidence was a touch weaker than expected, falling to 100.9 from 101.3 (consensus 102.0), but the breakdown is more concerning. While the current conditions index actually rose nicely to 104.6 from 98.9 (a lagged response to job gains in all likelihood), the expectations series, which is more important for future spending, fell from 102.9 to 98.4.

Expectations tend to be driven more by the equity market while rising Covid-19 cases and election uncertainty also probably weighed here too. The details show that there were 2-4 percentage point increases in the share of the surveyed population that think business conditions and the number of jobs available will worsen over the next six months. Income expectations didn’t change much, but the proportion of people planning to buy a car or a major appliance dropped noticeably.

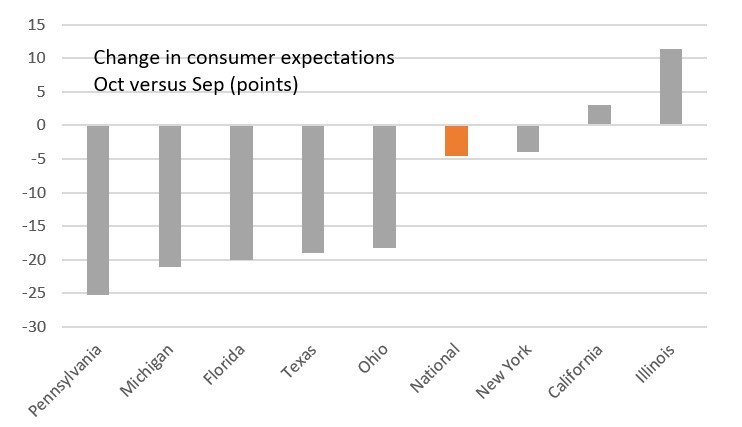

Changes in sentiment by state

Swing state sentiment a worry for president Trump

There were some interesting moves on the individual state data that could potentially have a bearing on next week’s election. The numbers can be choppy, but a 20 point drop in Florida, a 21 point fall in Michigan and a 25 point fall in Pennsylvania – key swing states that will determine the outcome of the Presidential election – offer little encouragement for Donald Trump.

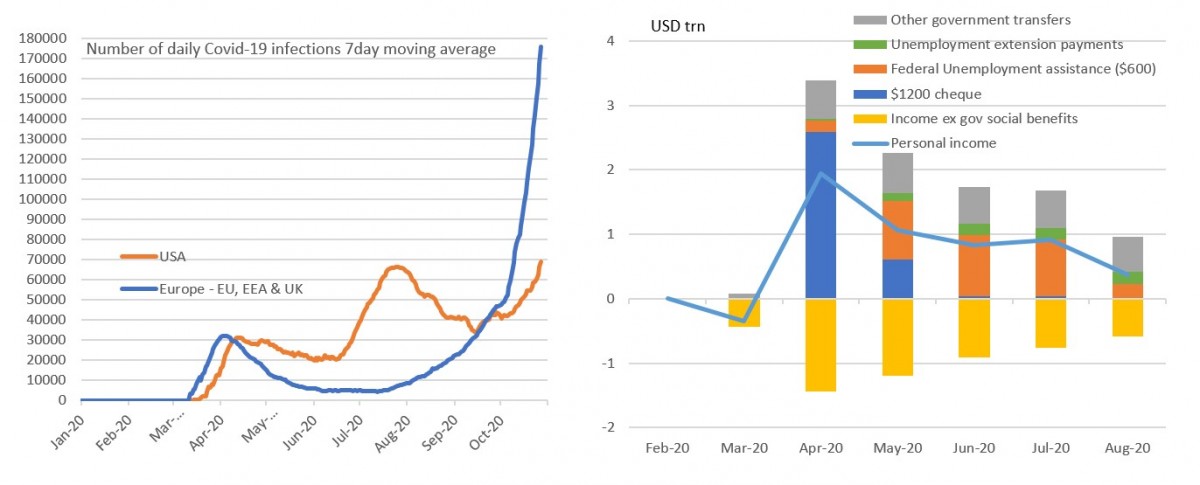

Covid cases and an income squeeze will not help sentiment recover quickly

Challenges for sentiment and spending

The overall decline in expectations suggests that the strong momentum in consumer spending in the wake of the re-openings is starting to fade. With Federal unemployment benefits being tapered and millions of people having seen their 26 weeks of state benefits expire it adds to our sense of caution on consumer spending for November/December. The concern would intensify should we get a contested election, which could add to a sense of unease, while the spike in Covid-19 cases and the potential for some containment measures to be re-introduced would further weaken the outlook for both sentiment and spending. That said, news on a vaccine and a new fiscal stimulus would swiftly turn this situation around.

Download

Download snap