Nothing in UK wage data that screams the need for another rate hike

Momentum in UK wage growth appears to have eased since 2022, and together with signs that the heat is coming out of the jobs market, there's nothing in the latest report that screams a need to keep hiking rates. But there's still plenty of data due before the next Bank of England meeting in June

Last month’s surprisingly strong UK wage growth figure was almost certainly a key driver behind last week’s Bank of England decision to raise interest rates further. This month though, the story appears more benign.

The headline rate of regular pay growth, which compares the past three months to the same period last year, notched up to 6.7%. But the level of average weekly pay (ex bonuses) increased by only £2 in the past month, a slower pace than we saw through much of 2022 and indeed in the previous month (which now looks like an aberration).

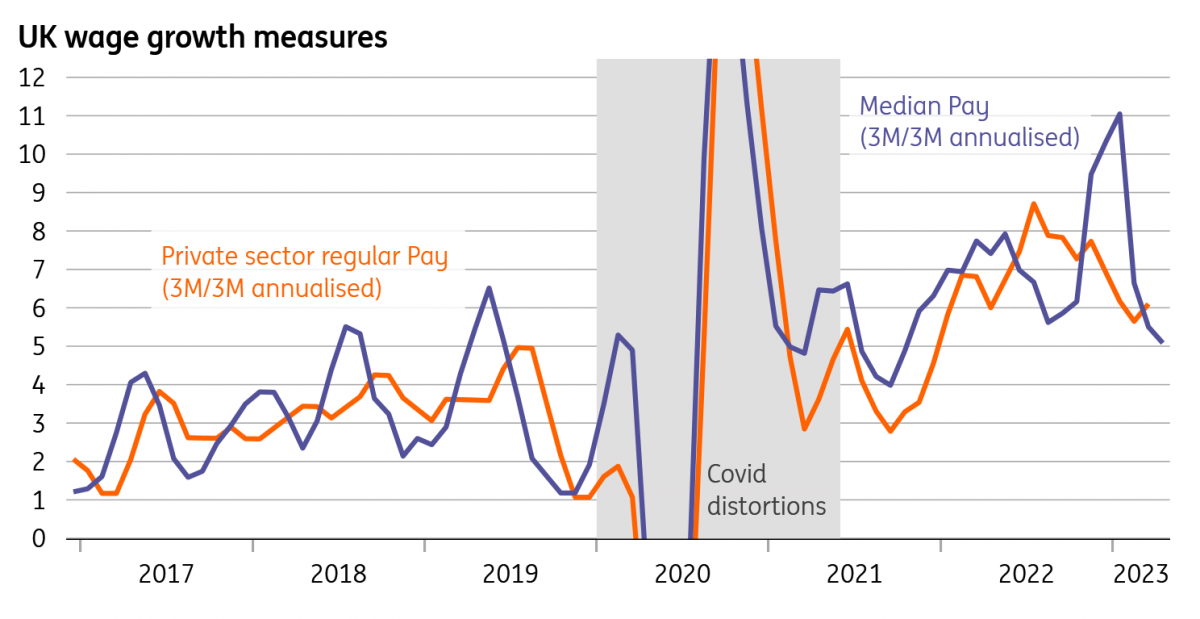

Smoothing out recent volatility and comparing the most recent three months to the three months before, the rate of private sector wage growth has clearly slowed since 2022. That trend is also supported by the BoE’s own survey of businesses, which indicates that both price and pay pressures beginning to ebb.

UK wage momentum has been slowing

Elsewhere there are further signs that the heat is coming out of the UK jobs market, albeit steadily. The unemployment rate inched up to 3.9%, while we saw the first monthly fall in employment since early 2021, at least according to the experimental payrolled employees measure.

The Bank of England will also be pleased that economic inactivity – people neither employed nor actively seeking work – has continued to fall, albeit not because of a decline in long-term sickness rates. There was also a healthy increase in the number of non-UK nationals employed in the UK, including a 5% rise in EU nationals during the first quarter. All of this, on paper, points to an improvement in worker supply – something that’s corroborated by the BoE’s surveys which have pointed to a less acute shortage of employees in recent months.

Numbers of non-UK nationals employed in the UK increased in Q1

In practice, we still suspect it’s going to take time for wage growth to slow and that hiring issues will remain a medium-term economic challenge. But from the BoE’s perspective, today’s report was the first big data test ahead of the June meeting, and there’s nothing here that screams a need for further hikes. Our base case is a pause next month, though by its own admission, the Bank of England is data-dependent now, and there’s still another jobs report and two CPI releases before next month’s meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap