Disappointing activity data in China suggests more fiscal support is needed

The Chinese economy has been hit by weak exports. The central government needs to speed up investments in technology and green energy to support the manufacturing sector

| 0.12%MoM |

Industrial production |

| Worse than expected | |

Very disappointing activity data

This set of activity data should disappoint the market a lot.

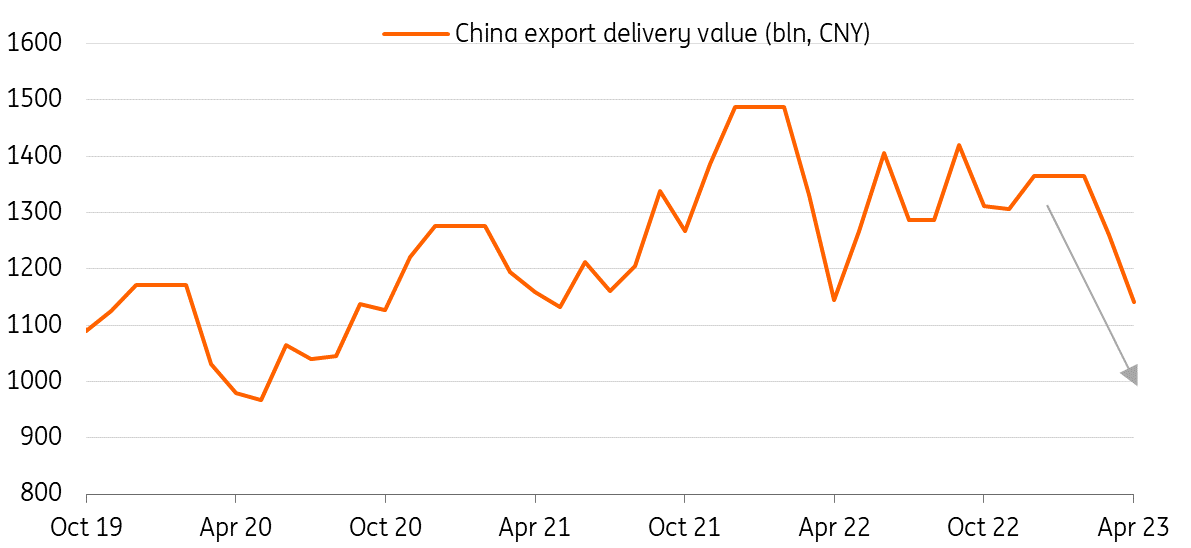

The biggest disappointment comes from industrial production staying at 0.12% month-on-month in April (5.6% year-on-year vs 10.9%YoY consensus and 3.9%YoY in March), which indicates a weak start to the export season. Export delivery values in April increased only 0.7%YoY in the month. This describes a bad month of exports as the base was low from last year. Even without logistic problems like last year, exports grew very slowly, pointing to weak external demand.

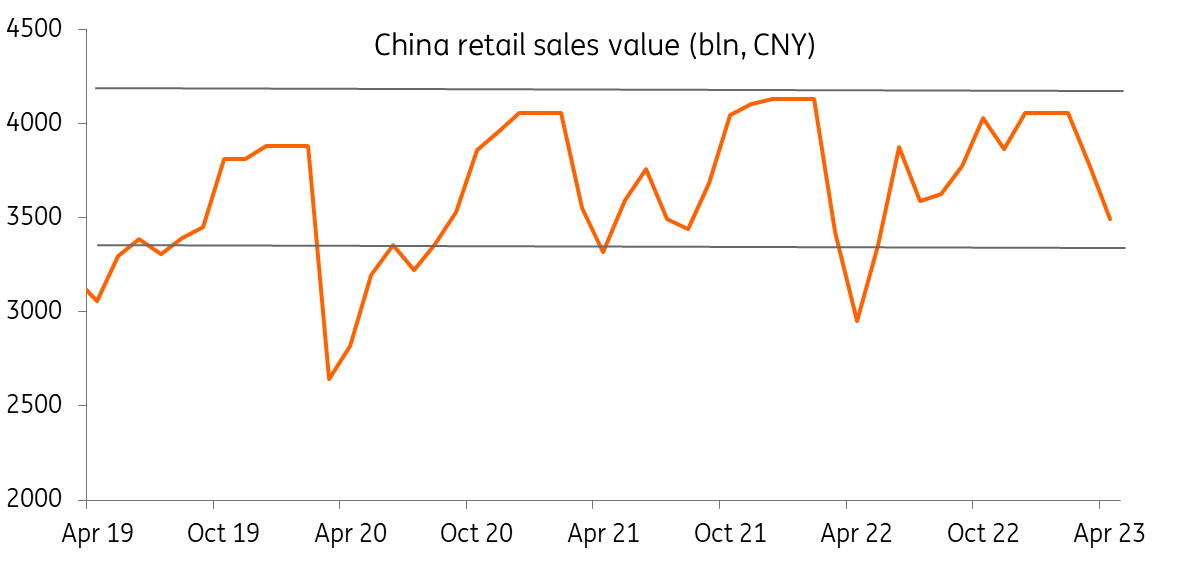

There was also slower than expected retail sales growth in April at 0.49%MoM from 0.78%MoM in March (18.4%YoY vs 21.9%YoY consensus and 10.9%YoY in March). This suggests consumers were saving money in April for spending on the holidays in May. Consumers are cautious when they spend. Another reason for the slower-than-consensus growth was due to reductions in spending on home decoration. Spending on home decoration contracted by 11.2%YoY in April after an 11.7%YoY contraction in the same month last year.

China export delivery value falling

Retail sales recovering, but only gradually

Investment slowed

We find that investments slowed to CNY4 trillion in April from more than CNY5.3 trillion in March. Private entities' investment moved very slowly at 0.4%YoY year-to-date in April, with most investments made by state-owned enterprises, at 9.7%YoY YTD. This is a barometer of how private companies perceive investment prospects in China.

There is some upbeat data

Two bits of data are more positive.

One is home sales which grew by 11.8%YoY YTD in April from 7.1%YoY YTD in March, indicating quite some bottom fishing activities in the home buying market.

The second is that the surveyed jobless rate reduced to 5.2% from 5.3%, but this data seems to be lagging behind most activity data.

These two sets of data are not enough to convince us that the economy can avoid the weakness of external demand passing on to the domestic economy.

The Chinese economy needs faster fiscal support

Even though we believe the long holiday in May should give a boost to the economy, the domestic economy is at risk from lower wages in the export-related manufacturing sector.

The central government needs to push for infrastructure investments. China needs technology research and development and new energy infrastructure. These could provide future growth potential.

But local governments may not be able to pick up these investments as they do not have enough revenue due to poor land sales. The investments should largely come from the central government budget. If the central government delays infrastructure investment, weak exports and related manufacturing activities would hit the labour market which could in turn hit consumption. Another way is to induce private investments in these long-term projects.

Without long-term investments in technology and new energy, China's economic growth might not last after a brief rebound in the second and third quarters of the year.

Our GDP forecast is 5.7% for 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap