UK inflation jumps ahead of likely above-target spike later this year

Pandemic-related base effects and a 9% hike in household energy prices lifted the rate of inflation in April, and will likely push headline CPI above the Bank of England's target later this year. But will this last? With wage pressures likely to remain fairly unexciting, we think inflation is more likely to dip below 2% from spring 2022

Like just about every country, the UK’s inflation rate jumped in April on pandemic-related base effects. The increase in headline CPI to 1.5% from 0.7% is predominantly because we’re now comparing prices to the depth of the Covid-19 crisis last year, while energy prices also received a lift last month when the regulator lifted the household electricity/gas cap by 9%.

All of this, of course, has been well telegraphed, as is the anticipated rise in inflation above target later this year. We expect inflation to edge higher again next month, and reach 2% for the first time over the summer, before remaining there through the fourth quarter and first quarter of next year.

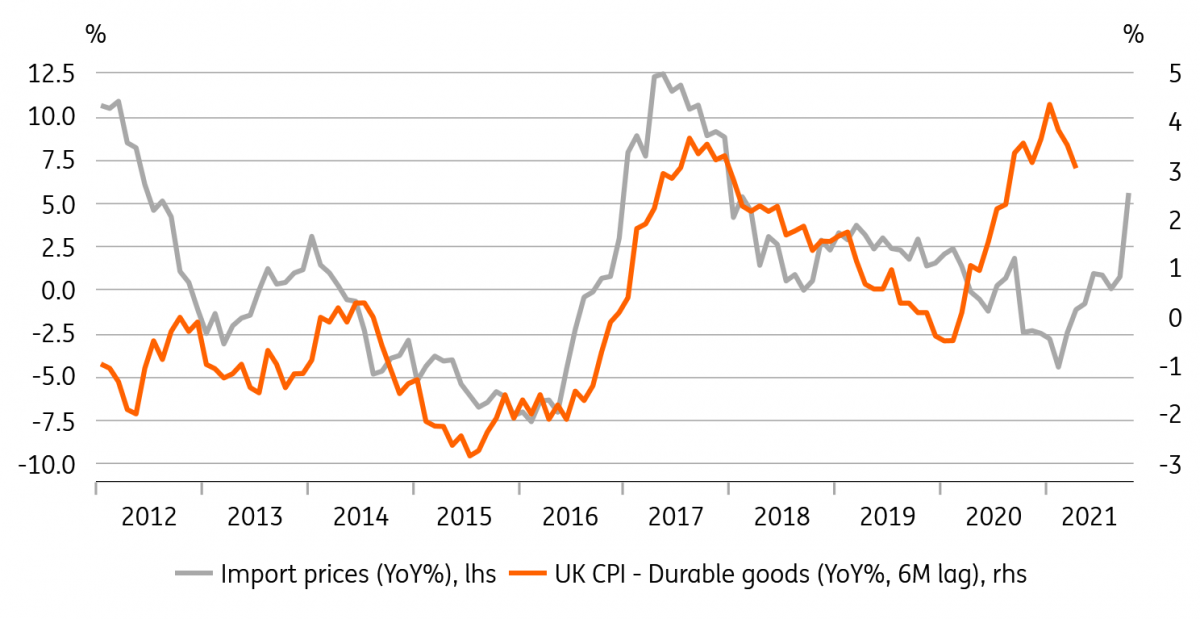

This is mainly an energy story, but is also likely to be linked to some reopening-related spikes, as well as the lagged impact of global shipping issues. Durable goods prices are already rising at a faster annual rate than after the 2016 Brexit referendum, though this time without a depreciation in the pound.

Durables goods inflation has already been taking off

Ultimately though, what matters for the Bank of England is what happens to inflation in 2022 and beyond, and there aren’t many clues in this latest data. But at this stage we think headline CPI will most likely dip back below target from around April next year. Much will depend on wage pressures, which despite the green shoots appearing in the jobs market, we think will most likely be fairly benign (though with signs of skill shortages in certain sectors emerging, this is likely to vary between industries).

The upshot is that the Bank of England is unlikely to be under any immediate pressure to begin a tightening cycle, particularly given that its QE expansion is already slated to stop at the end of this year. We expect the first rate hike in 2023.

Download

Download snap