Russia: Strong current account in April, but little relief for the ruble

The Russian current account surplus widened to an impressive US$11 billion in April, defying seasonality, thanks to strong oil exports and restrained foreign travel. But the weakness in other components of the balance of payments explain why the ruble couldn't benefit much. We continue to see RUB appreciation in May as temporary

Current account strong thanks to oil exports and lack of foreign travel, but other BoP items remain a concern

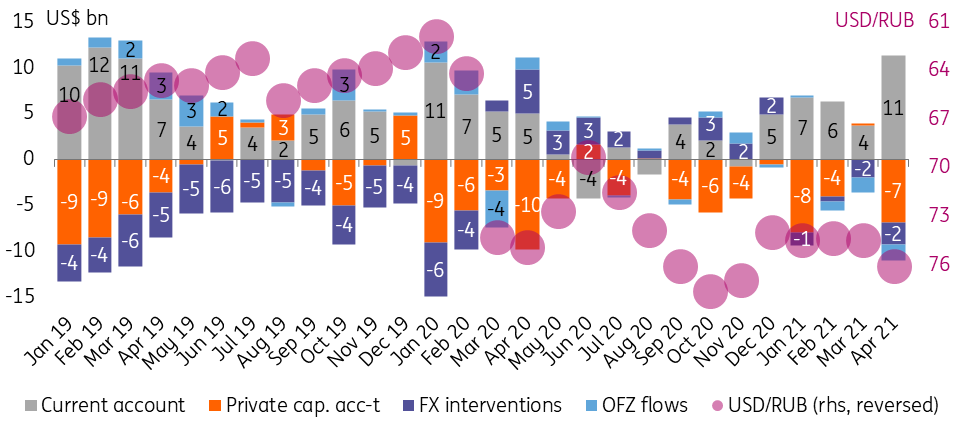

Bank of Russia (CBR) released preliminary balance of payments statistics for January-April 2021, according to which the current account surplus widened from US$16.8bn in 1Q21 to US$11.3bn in April alone, the highest monthly figure since early 2019. However, the other components of the balance of payments did not provide much support to the ruble, with net private capital outflow increasing from US$11.8bn in 1Q21 to US$6.9bn in April, reflecting continued accumulation of international assets by the non-financial sector, according to the CBR commentary. Combined with US$2.4bn FX purchases as per the budget rule, and US$1.7bn net portfolio outflow from the ruble-denominated public debt market (OFZ), the capital account weakness was the key driver behind the ruble's depreciation last month (Figure 1).

- A strong current account this April is in line with our expectations. As we mentioned earlier, while the current account surplus usually starts to decline in May, subsequently falling to or below zero in June, this year the seasonal factors behind those moves are not as strong. This is thanks to the travel ban on outward tourism to Turkey, recently extended till 30 June, and to Egypt. Also, the 24% year-on-year drop in 2020 corporate profits (according to Russian accounting standards) may suggest smaller pressure from dividend outflows this year relative to the US$10bn accrued in June last year. As a result, the April current account, which also benefits from the recovery in oil output and strong commodity price environment, is in line with our expectations of the 2Q21 current surplus remaining in the US$10-15bn range, close to the US$17bn reported in 1Q21.

- Persistently high net private capital outflow is the primary reason why the ruble fails to benefit from the strong current account. While partially the widening capital account deficit is technical and explained by delayed repatriation of export proceeds, we still take the number as elevated and indicative of low local investment demand.

- The FX purchases, as we predicted, are not large enough to upset the overall situation, and the May decline in the interventions should provide a temporary boost to the ruble.

- The portfolio outflow from OFZ, on the positive side, managed to reverse at the very end of April, after the foreign policy tensions eased, and since the beginning of May there have been inflows of around US$0.4bn. On the negative side, the inflow is still quite small relative to the local capital outflow, and is subject to volatility related to core markets and Russia-specific foreign policy issues.

Figure 1: Ruble weakened in April despite the stronger current account

Still constructive on RUB in May, but further prospects might be less bright

For the near term we remain constructive on the ruble, as it should be supported by the strong commodity price environment, extended outward travel restrictions to the most popular tourist destinations, and benign foreign policy newsflow. We continue to see USDRUB 73 as a realistic target level to be achieved in May. However, for the summer months we would not exclude some retracement back to the upper border of the USDRUB70-75 range on seasonal dividend payout (albeit probably smaller than last year's) to foreign shareholders, continued private capital outflow, and expected pressure on the current account from accelerating imports. Global risk sentiment is also a factor of uncertainty in the medium term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap