UK inflation casts further doubt over near-term hike

Today’s sub-consensus inflation data will continue to test the patience of Bank of England hawks

July was another disappointing month for UK inflation. Both headline and core CPI remained unchanged in YoY terms as the impact of the pound's fall failed to offset a 1.3% decline in petrol prices.

It's hard to pinpoint the weakness to any one-off quirks, but sizable declines in the prices of clothing, footwear and household goods may potentially suggest that retailers have again had to cut prices to get shoppers buying their summer wares.

| 2.6% |

Headline CPI (YoY%)(Previously 2.6%) |

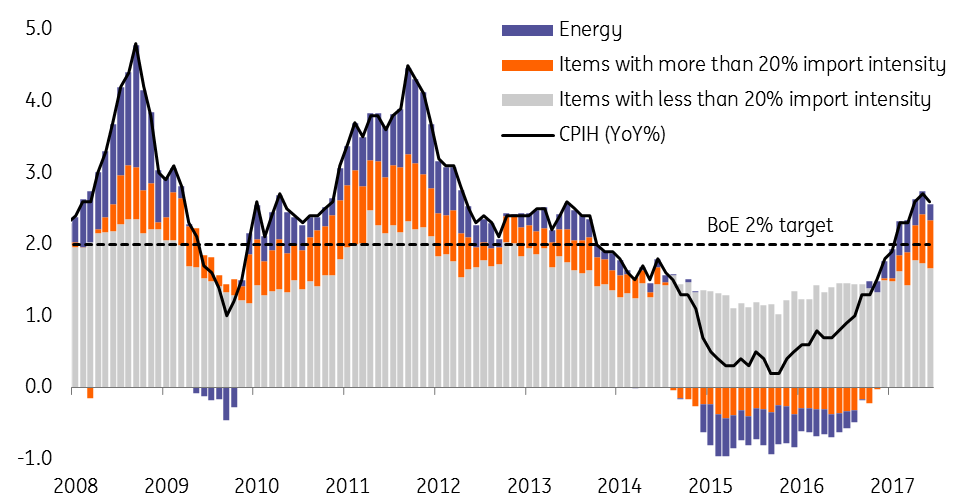

Whatever the reason though, we still think headline inflation looks set to inch closer to 3% towards the end of this year as the full extent of sterling's near-20% fall since November 2015 comes through. But the big question for policymakers is where inflation would be if this currency effect is stripped out. One way of looking at this, by excluding goods with a high import-intensity (see chart below), suggests inflation would be slightly below 2% if the pound's fluctuations were removed.

But what matters for the Bank of England is wage growth. We expect this to hold steady at 2% tomorrow, and in fact, for most of the year too. The combination of slowing economic momentum, political uncertainty and rising import costs means firms are likely to have limited incentive to accelerate pay increases.

While today's data will continue to test the patience of some BoE hawks, we expect the committee as a whole to continue 'looking through' inflation spikes in favour of slower growth. We don't expect a rate hike this year.

Import intensity is the proportion of a particular good that is based on imports

Splitting CPI by import intensity suggests inflation below 2% when GBP fall removed

Download

Download snap