UK data backs rate hike, pity about the politics

Decent UK data suggests an August rate hike looks a good bet, but the politics could add a twist

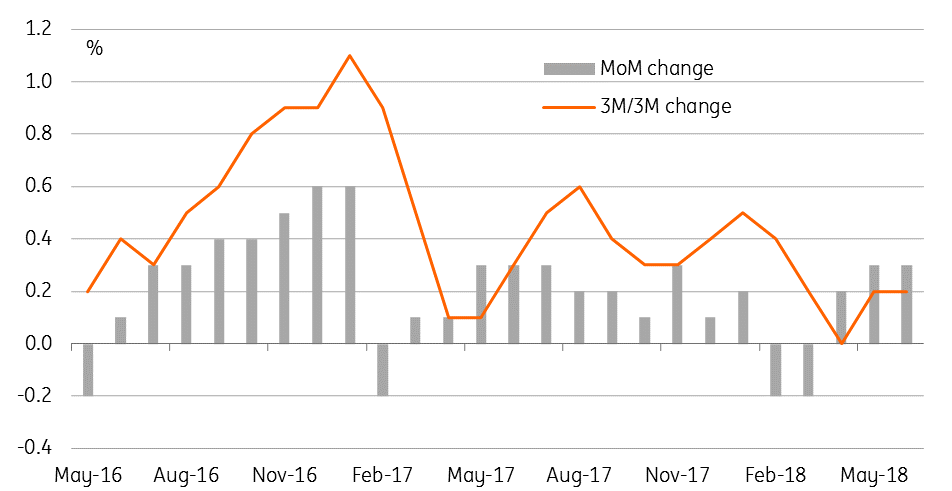

The first release of the UK’s new monthly GDP series shows the economy expanding 0.3%MoM in May after a 0.2% increase in April. After a very poor 1Q18 this is good news with activity seemingly buoyed by better weather. The 3M on 3M change is at 0.2% versus the 0% figure seen in April. Within the report construction was the standout, growing 2.9%MoM while services were up 0.3%MoM. Industrial production fell 0.4% though.

Overnight data from the British Retail Consortium and Barclaycard suggest this positive momentum continued into June with retail activity given an additional boost by the football World Cup. Spending on entertainment, TVs and food have seen a noticeable improvement. There was even some good news on trade finally with a significant £2bn downward revision to the deficit figure for April while May’s trade deficit narrowed further.

As such the economic news is supporting the idea of an August interest rate rise from the Bank of England. The problem is the politics and the uncertainty triggered by yesterday’s resignations of David Davis and Boris Johnson could yet come into play.

For now, the focus is very much on the World Cup and a couple more wins for England and a summer recess in parliament could see talk of a leadership challenge fade. Bookmakers pricing currently suggest it is a 50-50 call whether PM May does face a challenge to her leadership while the Paddypower website currently prices it at 2/1 that Theresa May will still be Prime Minister on 1 April 2019 – but then again it is only 3/1 that the UK applies to rejoin the EU by 2027...

UK monthly GDP series