The Commodities Feed: Zinc spreads tighten

Your daily roundup of commodity news and ING views

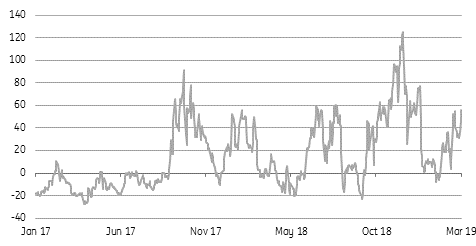

LME Zinc cash/3M spread strengthens (US$/t)

Energy

US crude oil inventories: The EIA reported yesterday that US crude oil inventories increased by 2.8MMbbls over the last week- which was more than the 1.93MMbbls that the API reported the previous day, and quite different from market expectations for a 2.5MMbbls drawdown. Refinery utilisation fell over the week by 2.3 percentage points to 86.6% over the week, which saw crude oil inputs over the week decline by 367Mbbls/d. On trade, both imports and exports of crude oil saw declines over the week- although net crude oil imports increased over the period, which added further to the stock build.

On the refined products side, both gasoline and distillate fuel oil saw stock drawdowns, which shouldn’t come as too much of a surprise given the fall in refinery utilisation over the week. Gasoline and distillate fuel oil stocks fell by 2.88MMbbls and 2.08MMbbls, respectively. Overall this week’s report was fairly uneventful but next week the report should reflect more disruptions from the Houston Ship Channel.

Nigerian oil production: Nigerian oil output averaged 1.8MMbbls/d over the month of February, increasing from 1.66MMbbls/d the month before, according to government numbers. This suggests that Nigeria failed to comply with the OPEC+ production cut deal over the month. Under the deal, Nigeria is meant to produce 1.69MMbbls/d. Meanwhile, total crude and condensate production averaged 2.12MMbbls/d over the month, compared to 2MMbbls/d in the prior month.

Metals

LME zinc backwardation: The LME zinc cash/3M spread strengthened further yesterday, trading to US$56/t- levels not seen since early January. The spot physical market remains tight, and LME zinc inventories continue to decline- almost 10kt has been withdrawn since the start of the month and nearly 74kt since the start of the year. LME stocks currently sit at just 55kt- the lowest in over two decades. Increased mine supply is expected to improve the supply picture moving forward, however for now the market remains tight, which should prove supportive for both flat price and spreads.

Weaker economic data from China: NBS data shows that China’s Industrial profits fell 14% YoY over the first two months of 2019, the worst start to a year since the financial crisis, amid slowing production. China will be releasing its latest manufacturing PMI numbers on Sunday, which have been below 50 (in contraction territory) for the past three months and a similar trend would likely weigh on the base metals complex in the immediate term.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap