Briefing Romania

Bank levy amendments released

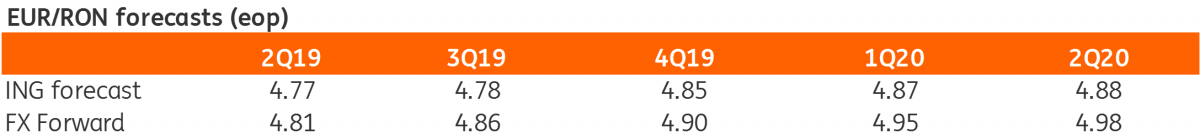

EUR/RON

A subdued day in the EUR/RON market with sideways trading around 4.7550 and below-average turnover. The 4.7500-4.7600 range looks again a likely scenario for today.

Government bonds

With no primary market auctions left for this month, Romanian government bonds were better offered yesterday, closing 3-4 basis points higher. The Ministry of Finance published the draft for amending the emergency decree which introduced the bank tax. As expected, Romanian government bonds will be excluded (among others) from the taxable base. The market didn’t seem to react to the news as these changes were widely expected. The levy was reduced from 1.2% to 0.4% per year for large banks (with above 1% market share), to 0.2% for smaller ones. There are lots of exemptions, including government bonds, state guaranteed loans, money with NBR and inter-bank transactions. The level can be reduced by 50% if banks meet one of the following requirements: increase loan book by 8%, cut net interest margin (NIM) by 8% or have NIM below 4%. The link between the bank tax and ROBOR was cut.

Money Market

With the monthly budget payments behind us, liquidity conditions have become a bit clearer for the banks and implied yields dropped in the front end to around 4.00%. We believe there is still some room for normalization but overall we expect tighter funding conditions for the current reserve period than in the previous one.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap